December 31 - the extended due date for filing income tax returns for the assessment year 2021-22 (financial year 2020-21) - is just over a month away and the income tax return-filing process this time is vastly different from earlier years due to a host of reasons. For one, the new income tax return filing portal – which was in the news for all the wrong reasons – is now up and running. The process flow is significantly different compared to last year. Also, this is the first assessment year when you will have to indicate the tax regime you have chosen. Salaried tax-payers can switch between the two tax regimes even at the time of filing returns. That is, if you had chosen the old tax regime while submitting your investment proofs to your employer, you can shift to the new regime and vice-versa. You will also need to factor in dividend income earned through mutual funds or stocks this year.

Steps to file returnsHere’s a simple-to-use guide to filing returns for salaried tax-payers through the official e-filing portal this assessment year.

-Ensure that you keep your key documents – last year’s returns, bank account statements, Form-16 and Form 26AS – at hand before you start the process. You will have to refer to these while keying in the details

-Visit the new portal – www.incometax.gov.in – and register yourself if you haven’t already. Your PAN will act as your user ID.

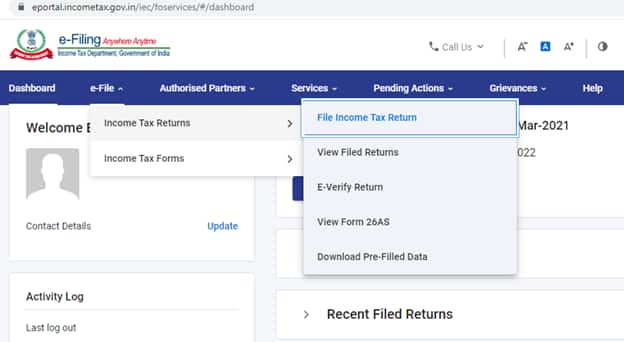

-Go to the e-file tab from the main dropdown menu and proceed to complete the process

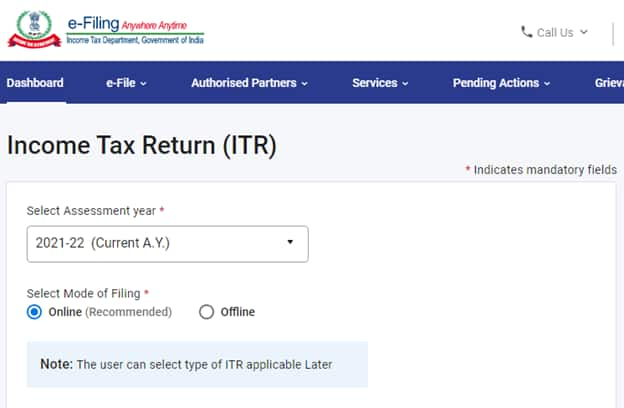

-You will have to choose between online and offline modes, and also the assessment year. Like in the case of private e-filing portals, this one, too, enables you to complete the entire process online. Earlier, this was restricted largely to ITR-1 and ITR-4S.

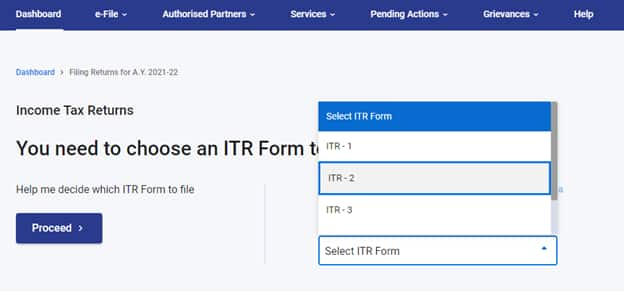

-Choose the ITR form that you ought to use. Here, we have chosen ITR-2 as many salaried tax-payers are likely to have invested in mutual funds or stocks and netted capital gains during financial year 2020-21.

Also read: Confused about which ITR form to use? Here’s help

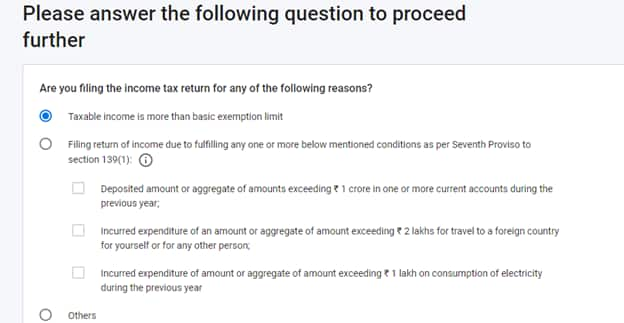

-Proceed to file the returns. You will move to the window where you need to make declarations on the specific purpose of filing returns.

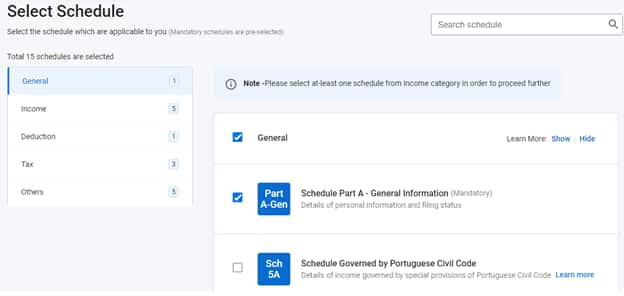

-Fill up the relevant schedules – modify or confirm the pre-filled information as required. Re-check and enter all the information and deductions in the salary schedule

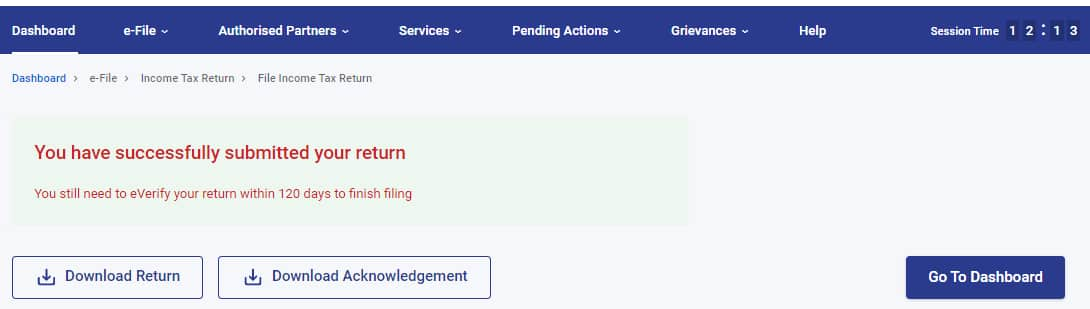

-Proceed to verify the information, particularly salary, deductions and capital gains, confirm your return summary and submit your returns. You have to choose the verification method before submission of the return.

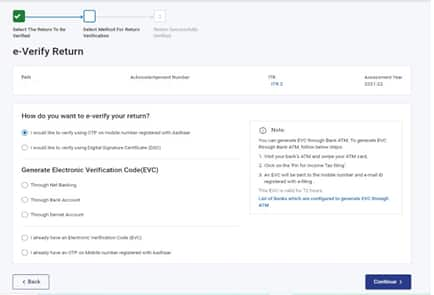

- Don’t forget to verify your returns (main menu > e-file > Income tax returns > e-verify returns) by generating an electronic verification code (EVC) through netbanking, AADHAAR-OTP, demat account or ATM. You have to complete this exercise within 120 days of having filed the return for the process to be considered complete.

Source: incometax.gov.in and Billionbasecamp

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.