India’s longest festival season of the year is underway, starting with Ganesh Chaturthi, followed by Navratri and Deepavali celebrations, and culminating in Christmas.

Through these months, you find Indians buying gold, largely in the form of jewellery. In India, no festival is complete unless the women of the house are decked up in gold. It is a sign of prosperity and a harbinger of good times.

Buying festival gold differently

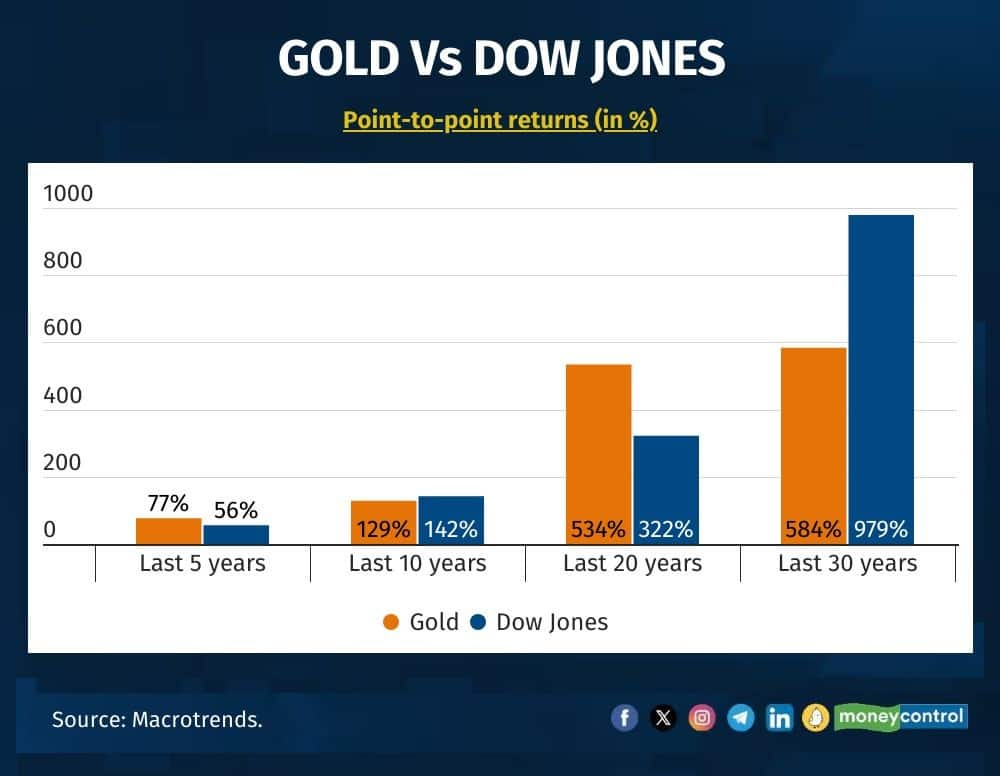

In India, there is a sentiment attached to gold. Ask your grandmother, why gold, and her justification would be that it never loses value and can be passed on to coming generations. She is not wrong. Over the last 30 years, gold has done well.

Also see: How to invest in gold wisely during the festive season

Over the last 5 years and 20 years; gold has done better, while equities did better over the last 10 years and 30 years. We have considered DJIA as gold is denominated in dollars. The moral of the story is that there is merit in including gold in your portfolio. There are two questions; how much gold to include and how to do it?

How much gold to include in the portfolio?

There is no benchmark but remember that gold is a commodity and equity index is a representation. In equities, you have large-cap funds, mid-cap funds, small-cap funds, sectoral funds, thematic funds, etc, that can outperform indices. There is not much choice in gold. However, gold returns have the potential to diverge from equity returns; making it a good hedge when added to the portfolio. An exposure of 10 percent to 15 percent of the portfolio to gold is the ideal mix. We are not talking about personal jewellery. This is the gold that you invest in as an asset class. And, here is how you can start making small investments each festive season.

Also see: Why buying Sovereign Gold Bonds in secondary markets may not be a good idea

How to invest in gold and what it means?

If you are buying gold as an investment, it can be purchased in physical or non-physical forms, which you can decide based on your convenience. The most popular mode in recent times has been sovereign gold bonds (SGB). Apart from returns being pegged to the price of 24-carat gold, there are 2 more merits. SGBs pay 2.5 percent annual interest with a sovereign guarantee on interest and the principal amount in grams of gold. Secondly, if held for the full tenure of 8 years, it is exempt from capital gains. Apparently, the government plans to discontinue the SGB scheme due to its high costs. In that case, the secondary markets may be the only place to buy SGBs.

The second way to invest in gold this festive season is through gold ETFs. These exchange traded funds (ETFs) are pegged to the local gold price and are traded on the stock exchange. They can be bought with your regular trading account and the gold ETFs can be held in a demat account. These gold ETFs are very liquid with low bid-ask spreads; so, entry and exit are not an issue.

Read here: Why timeless gold is timely now as a safe haven asset?

The third popular method is via gold coins/bars/biscuits. These are assayed gold blocks issued by the major commercial banks in India. You can redeem these coins/bars with the bank at the market price of gold and there is no loss of value, unlike jewellery. It is not as convenient as holding gold in a certificate or demat form.

If you want to avoid using the trading or demat account, you can also opt for gold FOFs (fund of funds). However, here the costs are relatively higher, compared to ETFs, and that eats away at your gold fund NAV.

Also read | Israel-Iran war: Should you invest in gold funds to hedge your portfolio?

There are two more ways to buy gold during this festive season. You can opt for one of the many gold schemes offered by jewellers or through digital gold (e-Gold) offered by various fintech platforms. However, it may be noted that both these exist in a regulatory grey area, so it is best to be conscious of the risks. Otherwise, festivals are the time to whet your gold appetite and also add a hedge to your portfolio.

The author is the co-founder and CEO, Finnovate

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.