Lovaii Navlakhi

Everyone who has grown up or worked in India before going overseas has a connection with India. And if there is a family in India, this connect becomes emotional. Hence the attraction to investing in India for non-residents.

However, making money and emotions are two different things. For non-residents, apart from the market return, the currency movement can throw a spanner in the works, or give their dollar returns an extra kicker. Suddenly, rational thinking goes out of the window.

The current year is no exception. The sharp depreciation of the INR is the headline conversation my non-resident clients are having with me.

“Now that the rupee is depreciating, when will it cross Rs 75 to the USD, and when Rs 80.”

“I made the blunder of transferring funds when it was Rs 65; I feel I should stop further planned transfers though I will get 10% extra now.”

Some of these conversations are without logic, but then emotion does play a crucial role in investor's decision-making.

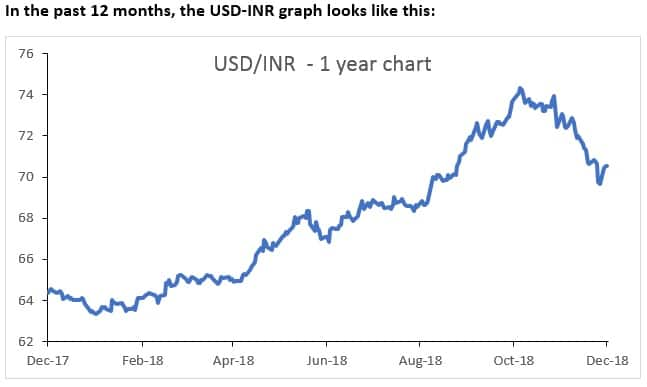

After holding below Rs 64 to the USD in the first two months of 2018, the depreciation was one way till the end of October, and the rupee had lost over 15% at one time, before making a U-turn, and bouncing back 5% in the past few weeks. The recency bias almost makes one believe that this trend of 10% depreciation will occur year after year.

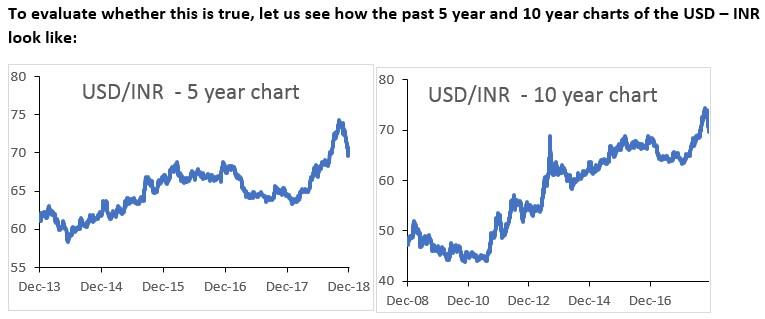

The shapes look strikingly similar to the one-year graph. And a few learnings are apparent.

1. The trend is that the INR depreciates vs the USD. But the movement is not one-way all the time. Why does this depreciation happen? Let us try and understand it with an example. If I am in the US and can borrow money at 3% pa, convert the USD to INR and earn 8% pa, what is to prevent everyone to do this and make the 5% pa extra. To correct this anomaly, the INR must depreciate by 5% pa to ensure parity – not make the US investor better or worse off than the Indian investor. Of course, this is an oversimplified explanation. This also equates to the difference in inflation rates between the two countries.

2. The slope of the trend line is smooth and not vertical, indicating lack of sharpness in long term movements. However, shorter-term movements are sharper. This means that the currency risks are reduced or smoothened over longer periods as compared to shorter tenures.

It is also important to understand what really has been the depreciation of the INR vs the USD. From a level of sub Rs 50 in end 2008 to a level of Rs 70 now, the depreciation is at a CAGR (compounded annual growth rate) of 3.6% pa. Similarly, in the of end 2013, the INR was under Rs. 62 and for the past five years, the INR has depreciated at a lower CAGR of 2.7%. Of course, this includes the current year depreciation of 10%+. The numbers then tell us a more subdued rate of depreciation than what we have imagined.

Despite these numbers, there are currency risks that the investors should keep in mind. Then how does one work on reducing the currency risk for non-residents while investing in India?

Here are some thoughts:

1. Just as we apply rupee cost averaging to reduce the risks of investing at the wrong time in equity markets, make sure that you convert your USD to INR in tranches. This must be clinically done, while you take into account the cost of transfers including bank charges. This could be your strategic currency conversion strategy.

2. Keep aside some dollars to be converted based on tactical calls, once again in tranches. Some of these transfers could be made just before/ after US Fed meetings/ RBI committee meetings so that event-based risks are reduced.

3. Keeping in mind short term volatility in exchange rates, do not transfer to India funds that you might need in the short-term (periods lesser than three to five years).

The most important ingredient that is essential in good investing is not the selection of the product, nor the timing of your entry.

Focusing on the risk of the investment is crucial, but not the most important.

Then what is important?

Without doubt, it is discipline. The rigour of planning is as important as the followthrough of execution. The whole of idea of staggered investments is to get the advantage of rupee cost averaging – averages only work if there is more than one investment.

Trying to play a zero-sum game – either being fully in or fully out presupposes that you have a prescient mindset, which is practically impossible. The advisor’s role in ensuring you do not get into an emotional freeze on investing is underrated. Talk to one to overcome your fear of exchange rate fluctuations.

The author is the Managing Director & CEO of International Money Matters. Views are personal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.