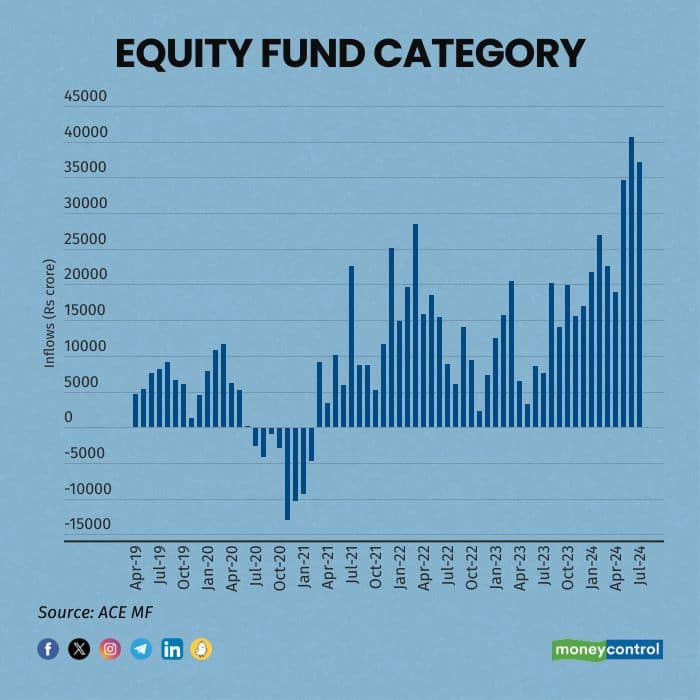

Open-ended equity mutual fund inflows slipped 8.61 percent to Rs 37,113.39 crore during July on a fall in investments in large-cap and mid-cap funds, according to the data released by the Association of Mutual Funds of India (AMFI), the industry trade body for mutual funds on August 9.

Earlier, inflows into equity mutual funds had surged by 17 percent to Rs 40,608.19 crore in June, a record high.

As per AMFI data, monthly gross systematic investment plan (SIP) inflows hit a fresh record high of Rs 23,332 crore during July against Rs 21,262 crore in June.

Meanwhile, inflows into open-ended equity funds have remained in the positive zone for the 41st month in a row.

Further, The SIP AUM was highest ever at Rs 13,09,385.46 crore for July 2024 compared to Rs 12,43,791.71 crore in June.

Venkat Chalasani, Chief Executive, AMFI said, “The mutual fund industry has demonstrated positive growth with retail investors consistently embracing mutual funds as a reliable investment avenue. It’s evident that mutual funds have become an integral part of retail investors' financial strategies.”

Equity funds

Continuous investments in sectoral or thematic funds fuelled inflows into equity mutual funds. In July, the category saw net inflows of Rs 18,386.35 crore.

Also read | Will limit on overseas investments by MFs be enhanced, now that RBI Guv is happy with forex reserves?

To be sure, there were nine new fund offers (NFOs) in the Sectoral/Thematic Fund category, via which schemes garnered a total of Rs 12,974 crore during the month.

“Net equity flows were a tad lower compared to June. The inflow could be attributed to NFO listing and SIP inflows. Most of the lump sum purchases seem to be through the NFO route,” said Manish Mehta, National Head - Sales, Marketing & Digital Business, Kotak Mahindra AMC.

In the equity fund category, inflows into large-cap funds slumped 31 percent to Rs 670.12 crore, while mid-cap and small-cap also saw a slowing of fresh flows during the month.

Despite this, small-cap funds saw net inflows of Rs 2,109.20 crore and mid-cap funds saw Rs 1,644.22 crore fresh investments during the month.

On the other hand, multi-cap funds, which invest at least 25 percent each in large-cap, mid-cap and small-cap stocks, witnessed 50 percent higher inflows at Rs 7,084.61 crore.

“Surprisingly, large-cap funds haven't seen higher inflows compared to June 2024, but dividend yield funds, which are large-cap oriented, recorded comparatively higher inflows at ₹630 crore against Rs 520 crore last month,” said Feroze Azeez, Deputy CEO, Anand Rathi Wealth.

Debt funds

In the fixed-income category, debt mutual funds saw net inflows of Rs 1,19,587.60 crore during the month. During June 2024, debt funds saw net outflows of Rs 1,07,357.62 crore.

In July, short-term liquid funds category saw net inflows of Rs 70,060.88 crore, while money market funds witnessed fresh investments of Rs 28,738.03 crore.

Also read | Down but not out: MFs hold on to these small-cap stocks despite fall

On the other hand, Medium Duration Fund, Credit Risk Fund and Gilt Fund with 10-year constant duration categories saw minor selling.

The liquid fund category, which bore the brunt of the outflows in June with a significant net outflow of Rs 80,354.03 crore, saw the highest inflows in July, amounting to Rs 70,060.88 crore. This reversal can be attributed to corporates and businesses redeploying their excess short-term assets into these funds.

“Other categories with a maturity profile of less than a year also experienced net inflows, likely reflecting a preference for safety in debt allocation among investors. Moreover, broadly the uncertainty surrounding the commencement of the interest rate cut cycle continues. This has prompted investors to focus on investing in categories having maturity profile of less than a year, as well as categories such short duration and corporate bond funds,” said Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Research.

The hybrid category, which invests in more than one asset such as commodities, equity and debt, saw net inflows of Rs 17,436.09 crore during July.

Overall, open-ended mutual funds saw net inflows of Rs 1,89,141.39 crore during the month.

During July, BSE benchmark Sensex gained 3.43 percent, while NSE Nifty was up 3.92 percent.

“We feel retail investors are now understanding that volatility is part of the long-term wealth creation journey. The share of financial assets has been increasing rapidly and within financial assets, mutual fund market share is relatively high,” said Hitesh Thakkar, Acting CEO, ITI Mutual Fund.

Also read | Invest in long debt mutual funds, as RBI holds rates, say experts

Net assets under management (AUM) of the mutual fund industry rose to hit Rs 64,96,653.14 lakh crore in July, data showed. The industry net AUM has risen past the Rs 60 lakh crore level for the first time in June.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.