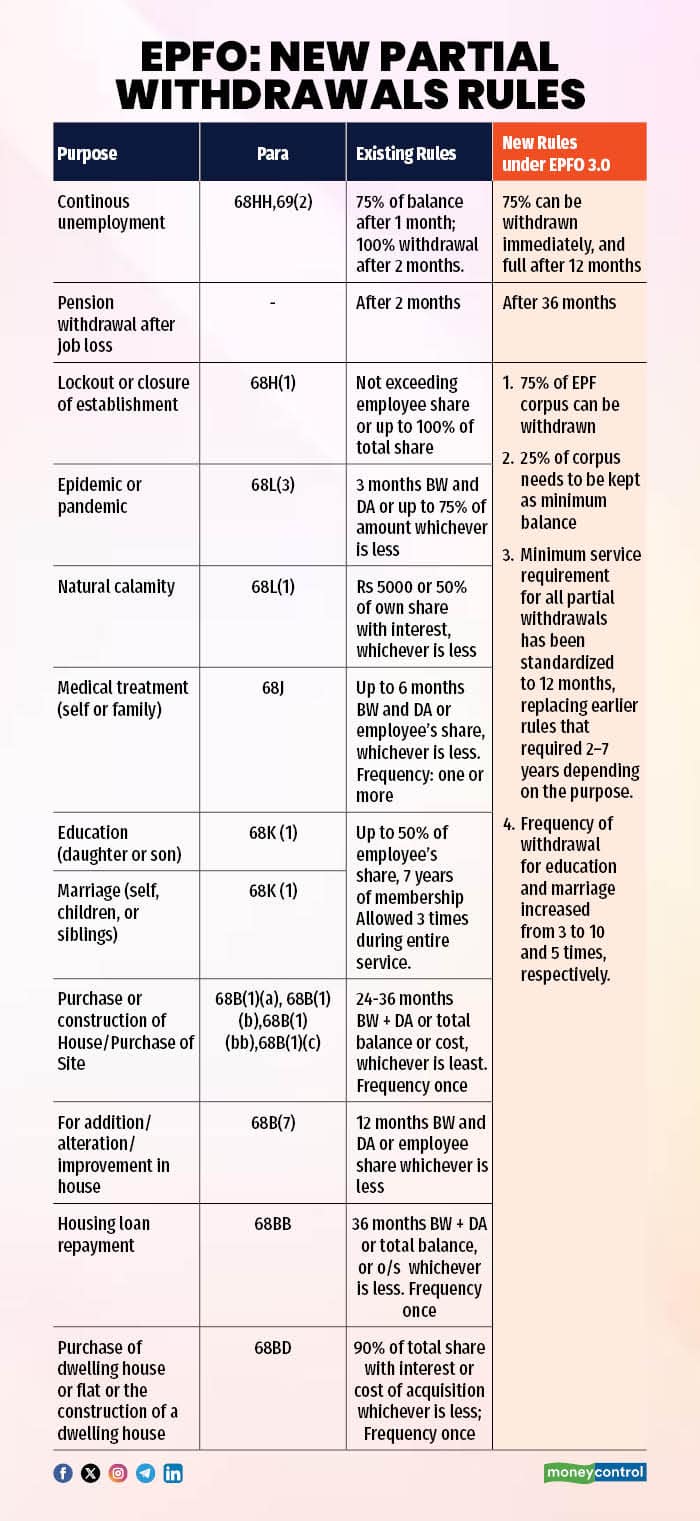

The Employees’ Provident Fund Organisation (EPFO) on Monday announced new guidelines simplifying the rules for partial withdrawals from provident fund accounts. The move, aimed at reducing claim rejections and improving accessibility, consolidates 13 complex withdrawal categories into just three broad and uniform ones consisting of essential needs, housing needs, and special circumstances.

The EPFO has also introduced a minimum balance requirement, under which at least 25 percent of the EPF balance must remain in the account. In other words, members can now withdraw up to 75 percent of their EPF corpus while maintaining the mandatory minimum balance. Additionally, in the event of job loss, the timeline for premature final settlement has been extended from two months to 12 months.

Following the announcement, several concerns have surfaced regarding the availability of EPF funds after job loss and the revised rules for partial withdrawals. Here’s a quick look at the myths and facts surrounding the new EPFO guidelines:

Myth: There are concerns on social media that no withdrawals will be allowed after leaving the job and that even after one year only 75 percent can be withdrawn.

Fact: 75 percent of the amount can be withdrawn immediately after leaving the job, and the full amount can be withdrawn after being unemployed for one year, said a government official on the condition of anonymity.

Currently, a member who has been unemployed for at least one month can withdraw up to 75 percent of the EPF balance in their account. Under Paragraph 69(2) of the EPF Scheme, a member who remains unemployed for two consecutive months is allowed to withdraw the entire EPF balance.

Frequent withdrawals earlier caused breaks in service, leading to the rejection of many pension cases. At the time of final settlement, employees were left with very little money. The new provisions will ensure continuity of service, a better final PF settlement amount, and greater financial security for employees and their families, added the official.

EPFO data shows that 50 percent of members had less than Rs 20,000 at final settlement, 75 percent had less than Rs 50,000, and 87 percent had less than Rs 1 lakh. Worse, three out of four pension withdrawals occurred within just four years of joining, suggesting that most members were exhausting their savings far too early.

Also Read: EPFO 3.0 Explained: What the new PF withdrawal rules mean for 30 crore members

Myth: 25% of the employee’s money has been locked and withdrawals have been restricted

Fact: Earlier, there were 13 different categories with numerous conditions under which money used to get locked. These have now been simplified into one uniform provision, making it much easier to withdraw money without any documentation.

"In almost all cases, the withdrawal limits have only been increased whether in terms of amount or frequency. Earlier, withdrawals for marriage or house purchase were allowed only after five to seven years; now they can be made after just one year," said the official.

Withdrawal limits for education or illness have also been made more flexible. Additionally, in any special circumstances or emergencies, the full eligible amount can be withdrawn up to twice a year without any questions asked.

Special Circumstances categoryalso allows members to withdraw without providing any specific reason. Earlier, withdrawals under this head required documentary proof, such as for natural calamities, unemployment, or other emergencies. This change is expected to significantly reduce procedural delays and claim rejection.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.