When India’s new Labour Code finally takes effect, the impact will not just be felt in HR departments or corporate balance sheets. It will directly hit employees’ monthly bank accounts.

For lakhs of salaried individuals, especially those whose basic pay makes up less than half of their cost-to-company (CTC), the shift could mean a reduced take-home salary, even though their overall compensation remains unchanged.

For years, employers have relied on a familiar formula of keeping basic pay around 25–40 percent of CTC. This structure served a very specific purpose. It inflated the special allowance portions of a salary, which helped employees receive a larger in-hand amount every month.

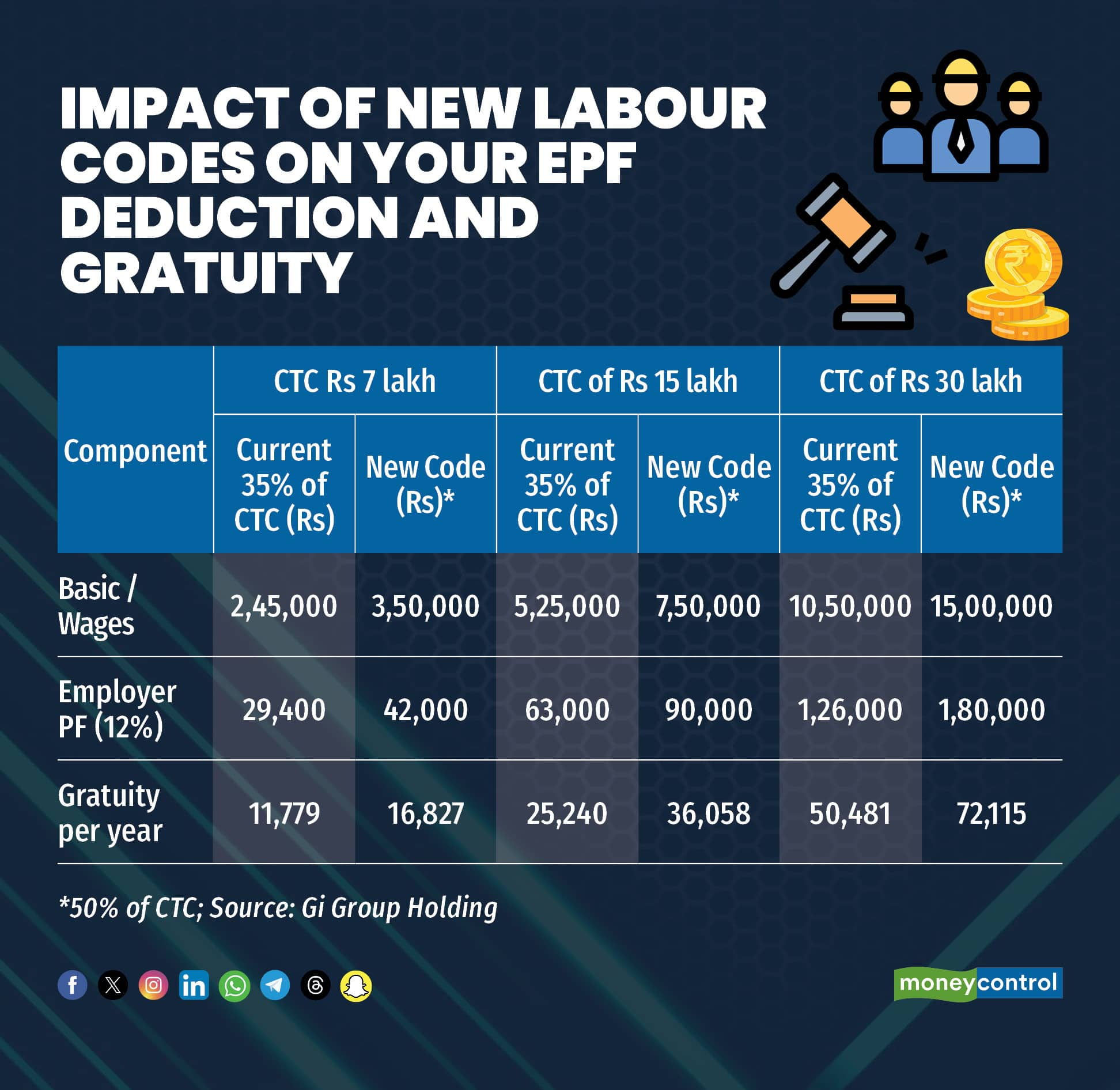

But the new Labour Code rewrites this playbook. By defining wages far more narrowly, the code mandates that at least 50 percent of an employee’s CTC must be counted as wages. "The new code is set to change how organisations calculate PF and gratuity. Today, most organisations keep basic salary on the lower side, usually around 25-40 percent of the total CTC. This helps them manage PF and gratuity costs in a predictable way," said Kuljeet Singh, Director- Finance and Administration (Head of Finance, Legal & Compliance) at Gi Group Holding.

The new code takes a different approach by defining ‘wages’ more strictly and requiring that at least half of an employee’s pay be counted under this category," added Singh.

The ripple effect of this higher wage base is immediate. As wages rise, the amount subjected to PF, both employer contribution and employee deduction, also rises. Gratuity, which is computed on the last drawn basic salary, climbs too. And while these statutory contributions strengthen an employee’s long-term financial cushion, they also reduce the take-home salary in the present.

“Now, 50 percent of the CTC will be considered for calculating the 12 percent EPF deduction from an employee’s salary,” said Balasubramanian A, Senior Vice President, TeamLease Services. “If your CTC doesn’t change, your Employees' Provident Fund (EPF) contribution will increase, and your take-home pay may dip slightly.”

Currently, EPF deduction is based on basic salary plus dearness allowance. Both the employee and the employer contribute 12 percent of this amount. However, this will likely not impact those who are currently contributing the minimum EPF of Rs 1,800 per month. “If you contribute only the minimum EPF today, you won’t see any change,” Balasubramanian said.

This adjustment has a direct impact on CTC levels . Wages are now standardised to include basic pay, dearness allowance and other allowances unless specifically exempted while the Code on Social Security also gives exclusions such as House Rent Allownace, conveyance allowance and commission.

Since a larger share of the salary will now fall under wages, the amounts used for EPF and gratuity calculations increase. Employers will see a higher statutory payout, while employees will build a stronger retirement benefit over time. EPF contributions may go up in cases where the earlier pay structure relied on a smaller basic component, explained Singh.

"Variable pay and bonuses payable under any law will to be included and discretionary ones will be excluded. Companies may need to realign their salary structures, once the rules are officially implemented," added Singh.

Gratuity, which depends on the last-drawn basic pay, also rises in line with the revised wage base. Fixed-term employees now become eligible for gratuity after just one year of continuous service. Currently, employees are paid gratuity, if they have completed five years of continuous service at the time of leaving the company.

"The new code extends gratuity to fixed-term employees, irrespective of the duration of their service -- a significant departure from the five-year requirement. Organisations relying heavily on short-term contractual or project-based staff will have to make earlier and more frequent gratuity payouts," said Rashmi Pradeep, Partner (head - southern region), Cyril Amarchand Mangaldas.

For employees, this translates to a double-edged outcome. Their monthly take-home shrinks because the employee contribution to PF increases alongside the employer’s share. The extent of the reduction depends on the current salary structure, but those with a lean basic will feel the most visible dip.

Yet, to view the change purely through the lens of take-home pay would be incomplete. A larger PF contribution means a stronger retirement corpus. A higher basic salary also results in a significantly healthier gratuity payout at the end of employment benefits that many employees undervalue in the present moment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.