In November 2021, the Reserve Bank of India, through its Retail Direct Scheme, allowed retail investors to directly invest in government securities (G-Secs). The Economic Survey 2022 expects this move to diversify the investor base for G-Secs and also give more flexibility to the government’s borrowing programme.

The Economic Survey also expects the scheme to play a pivotal role in channelising the savings of middle class, small businesspersons, and senior citizens directly into the risk-free G-Secs.

“With an objective to facilitate efficient direct access of retail individual investor to the G-Sec market, which was earlier directly being accessed only by large institutional investors, this scheme will give a boost to financial inclusion and broaden the investor base,” the Survey says.

The direct access to G-Secs has opened up new investing alternatives for retail investors.

Under the scheme, retail investors can open a Retail Direct Gilt (RDG) account using an online portal. Through this, they can invest a minimum of Rs 10,000 and a maximum of Rs 2 crore per security.

Also read: RBI opens gilts to retail investors via new direct platform: Here are the details

The retail investors can not only place a non-competitive bid in primary issuance of all Central & State Government securities such as Treasury Bills and bonds but also access Secondary market through Negotiated Dealing System-Order Matching (NDS OM) - RBI’s trading system, which was previously accessible only to select financial institutions.

As of now, the bulk of the G-Sec is held by a few institutional investors like commercial banks, insurance companies, and mutual funds.

Growth of mutual fund industry

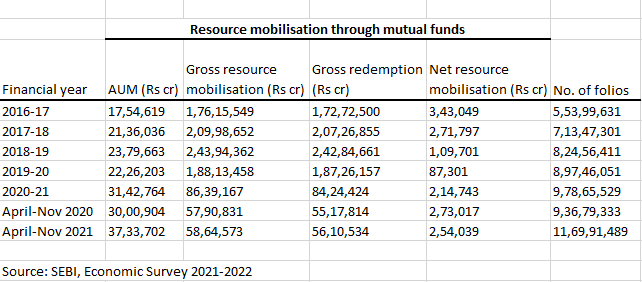

The Economic Survey 2022 also took stock of the mutual fund industry’s growth in the current financial year 2021-2022.

The net assets under management (AUM) of the mutual fund industry rose by 24.4 percent to Rs 37.3 lakh crore at the end of November 2021 from Rs 30.0 lakh crore end of November 2020.

Net resource mobilisation by mutual funds was Rs 2.54 lakh crore during April-November 2021, as compared to Rs 2.73 lakh crore during April-November 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.