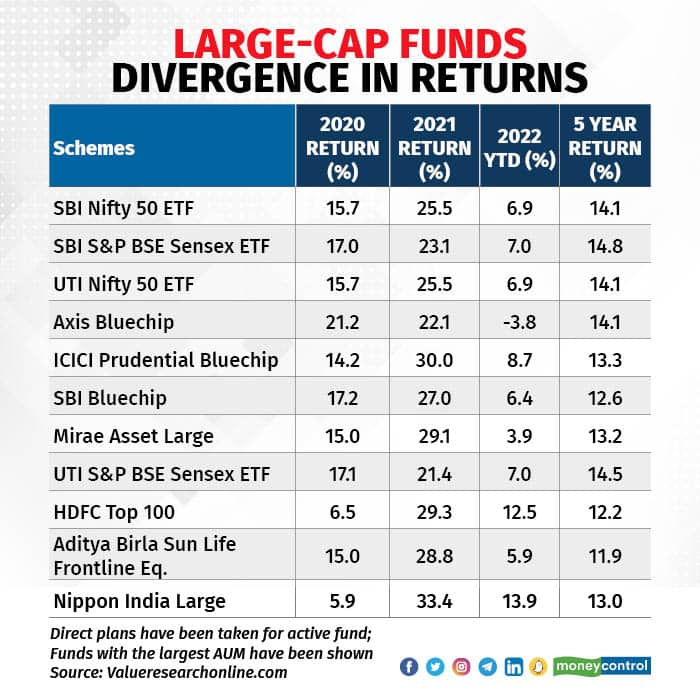

The category average returns for equity mutual funds in 2022 are misleading. Sample this: the large-cap equity fund category average for year-to-date (YTD) returns is at around 5.40%. However, the highest return by a fund is 13.9 percent and the lowest return is -13.7%. When the highs and lows are at such extremes, the average category return clearly doesn’t mean much.

Interestingly, the average category return is very close to the benchmark index Nifty 50’s YTD return of around 5.5%.The outcomes in the mid- and small-cap equity fund categories are similarly extreme.

There are two matters to unpack here. First, what caused such extreme outcomes, especially in the large-cap equity space, where fund managers have a total stock selection universe of just 100 stocks, with little room for differentiation?

Secondly, if you are stuck holding a fund that has underperformed its peer set by a large margin, what should you do?

Conventional wisdom suggests that one year is too short a period to judge an equity fund’s performance or to take any action based on this kind of analysis. This is accurate given that investing in equity stocks is largely about buying companies with the potential to grow and deliver returns over several years. The stock price movement in the short term, over a year or two, could be driven by unrelated variables or just unfavorable demand and supply dynamics.

Also read | Check out Moneycontrol’s curated list of 30 investment-worthy mutual fund schemesNevertheless, when you see that your fund has delivered a negative return in 2022 — as many hitherto top-rated large-cap schemes have done — while some other similar funds have delivered YTD returns in the range of 5%-13%, it is hard to stop yourself from taking some action.

What happened in the restrained large-cap universe?“There is a style tilt towards high-growth businesses that worked well till 2021. Valuations could have been excessive, but the market was more focused towards growth stocks. In 2022, a lot of value stocks, which had so far underperformed, started to perform well,” said Vishal Dhawan, founder and chief executive officer, Plan Ahead Wealth Advisors.

The market rally in 2022 has been far from broad based. While sectors such as banking, financial services and oil and gas delivered double-digit gains ranging from 10% to 18%, IT and healthcare delivered a heavy blow with negative returns of -23% and -10.5%, respectively. Even within the sectors that have done well, a select few stocks carried the bulk of the weight.

If you were to compare the two actively managed large-cap funds on the extreme ends of the return scale — Nippon India Large Cap fund with 13.9% YTD and Axis Bluechip Fund with -3.77% — you’ll see the basic difference is not just in portfolio concentration but also stock selection. While the gaining fund is a lot more diversified with 59 stocks against Axis’s 37 stocks, the latter also has a lower allocation to bluechip stocks such as Reliance and SBI, which have delivered strong returns during this period.

Ultimately, in 2022, the equity market shifted its loyalty away from growth stocks to those that were so far undervalued and unwanted. This shift, too, is one of the contributors to the divergent performance across schemes. In such times, individual stock allocations make a big difference. The historical five-year return for both funds mentioned above, at 12.96% and 14.13% (both annualised), respectively, does not display the divergence we are seeing today.

What should you do?A severe underperformance in one year can temporarily unravel some of the good performance over the previous 2-3 years. This doesn’t show up well in individual portfolios that hold funds that are currently underperforming. So, what’s your recourse if you hold such underperforming schemes? Should you hold on for a few more years and hope the scheme catches up or switch to the current top performing fund?

Chasing the annual top performers can cost a lot in taxes (capital gains tax may kick in each time you sell a fund to buy a new one) and peace of mind, weighing down your overall equity portfolio returns. Plus, there is no guarantee that yesterday’s winners will be tomorrow’s achievers as well.

Experts suggest sticking to consistency; it’s okay to miss some return in a single calendar year, if you know that the fund is a consistent long-term performer. This attribute can be judged by analysing its historical performance across market cycles, both downcycles and uptrends. Consistency in return is not random, it comes from consistency in the fund management style and investment process underlying the scheme. Evaluating portfolio quality, both current and historical, is also important.

According to Deepak Chhabria, chief executive officer, Axiom Financial Services Pvt Ltd, “Fund managers follow various styles. Some may have a very aggressive growth style of investing, buying stocks for high growth regardless of price. Others have a higher conviction in buying stocks only at a reasonable price. Over the last year or so there has been a shift in which style the market rewards, from being inclined to growth stocks the market has moved to the undervalued segment. In this shift, funds that stick to the former (growth) for stock selection got left behind as far as short-term performance is concerned.”

Not all styles will work at all times. Recency bias among investors can also have an impact. Many investors would have bought into well performing growth funds over the previous 3-4 years, inducing the fund manager to keep on buying relatively expensive stocks, thus, driving the price higher thanks to demand. Thus, a change in market trend could lead to a sharp fall in the prices of such stocks.

“For investors, it is better to have a mix of different types of fund managers and investing styles by diversifying across schemes. Having fund managers with distinct styles can work even for SIP investors across market cycles.” Says Chhabria.

Unless the underperformance can be attributed to fundamental reasons, such as a change in the fund manager or in the investment process, or a buyout of the asset management company, or some shift in the portfolio construction strategy, or frequent portfolio changes, it’s best to ride out the interim underperformance and stay invested.

According to Dhawan, “Looking at rolling returns rather than performance just at one point in time is more accurate. Diversification across asset managers, allocation to passive funds that deliver basic market returns and a sharper focus on cost versus return for efficient alpha generation are some aspects that investors should keep in mind, going forward.”

Understandably, running this kind of analysis by yourself can be difficult and you may not even know where to begin. Outsourcing some of this to a trusted advisor is worth considering for the success of your long-term investment portfolio.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.