By Hemen Asher

As the nation eagerly awaits the upcoming Budget 2025, all eyes are on the Modi government and Finance Minister, Nirmala Sitharaman, and the measures she proposes to introduce that will shape India’s financial and tax landscape for the year ahead.

As usual, there is a general expectation that the Budget would bring in several important reforms aimed at fostering economic growth, enhancing disposable income, and encouraging sustainable spending behaviours among citizens. We have listed some amendments impacting individual taxation which we believe should be made in the upcoming Budget.

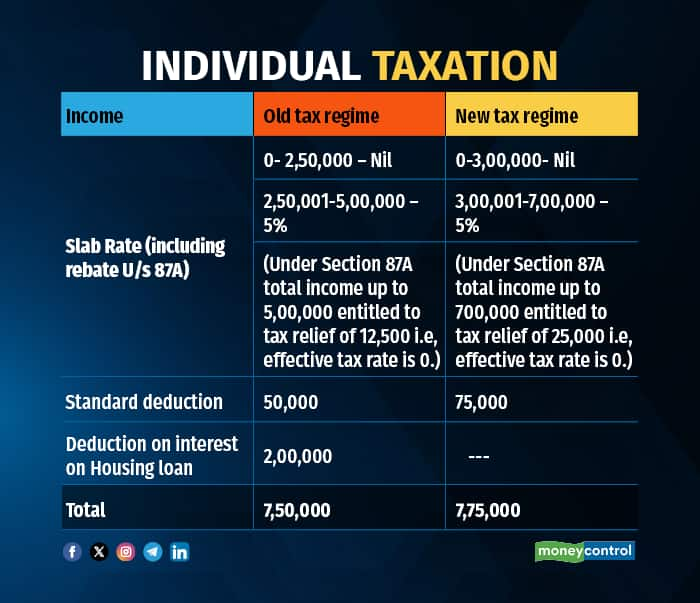

1. Current tax position

As may be seen from the table, effectively an individual is not required to pay any tax under the old/new regime under certain circumstances if his income does not exceed Rs 7,50,000/Rs 7,75,000 respectively.

Over the last 5 years, the basic exemption limit under the new regime was increased from Rs 2,50,000 to Rs 3,00,000 only.

Also read | Budget 2025: How the old and new income tax regime slabs, rates stack up

However, to promote the new scheme as the default scheme a tax rebate was introduced to make it more lucrative to taxpayers. To continue its preference of promoting the new regime the government could also tweak tax rates for subsequent slabs under the new regime.

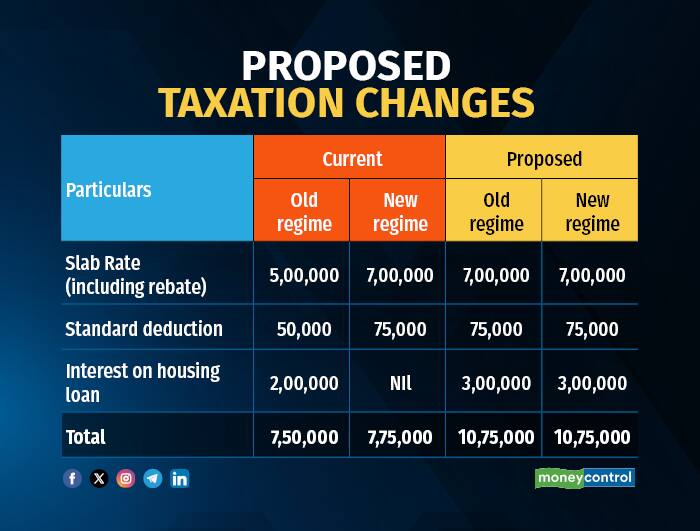

In our view, considering the above fact pattern and the limited fiscal flexibility available to the government the finance minister could consider walking a tightrope and adopt a balanced approach as listed in the table below.

As you would notice the finance minister could extend the benefit of interest on housing loans to the new regime, thereby effectively ensuring that a person earning up to Rs 10,75,000 should not be liable to pay any tax under the new regime.

With the rising cost of housing and loans, an increase in this limit could provide much-needed relief to homebuyers, making property ownership more affordable and accessible. Also, as more people enter the housing market, the real estate sector should receive a major impetus contributing significantly to economic growth and creating jobs for the unemployed.

2. Simplification of determination of residential status

Keeping in line with the stated policy of the Modi government which is simplification of tax laws and improving the ease of doing business in India, one can expect the simplification of the determination of the residential status of an individual for income tax purposes. Currently, India’s income tax system classifies individuals into three categories: Resident, Resident but Not Ordinarily Resident (RNOR), and Non-Resident. This three-tier system creates a lot of interpretation issues on the classification per se and also on which income should be taxable in India or not.

Also read | RBI ombudsman sees a surge in banking complaints. Here’s how you can resolve your grievances

To simplify matters, the government should introduce a two-tier system: Resident and Non-Resident. This change will primarily focus on the number of days spent in India during a financial year, eliminating the RNOR category and reducing ambiguity in residency determination.

This simplification promises greater clarity, easier compliance, and better alignment with global standards. Additionally, it’s expected to reduce disputes, making the tax system more efficient for both taxpayers and authorities.

3. Modifications to capital gains tax

As the interest in the stock market, mutual funds, and SIPs continues to rise, many investors are moving away from traditional bank deposits in search of higher returns. This shift has created issues for the banking sector to raise low-cost CASA deposits. The banking sector has been requesting a level playing field.

Currently, interest earned on bank deposits is taxed as regular income, which discourages long-term investments in the banking sector. The government is expected to reclassify bank deposits as capital assets. This change would treat the redemption amount paid on maturity as sale consideration, and tax the excess amount (Sale consideration minus amount invested) as capital gains. (Short term or long term depending on the period of holding)

Also read | How the next-gen of affluent families are managing their wealth

By classifying bank deposits as capital assets, the government aims to strike a balance between traditional savings and market-linked investments, encouraging more people to consider fixed deposits while providing a favourable tax environment. This reform could be extremely relevant specifically for senior citizens who do not wish to expose themselves to the volatility in the stock market.

As we look ahead to the Union Budget 2025, the focus will likely remain on continuing the momentum of economic reforms and maintaining the fiscal deficit within the prescribed norms. Expect changes in tax rates and tweaks to exemptions and deductions, aimed at reducing the financial burden on individuals while boosting general consumption and investments in sectors like real estate.

The writer is Partner at Bhuta Shah & Co LLP.

Disclaimer: The views expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!