It is time for Budget 2021. Over this past month, Moneycontrol spoke to a cross-section of industry experts for their take on the much-needed measures that would benefit individual taxpayers immensely. Like every year, reducing the tax rates tops the wish list of tax payers. But this year, people have suffered income loss and job losses as well due to the onset of the COVID-19 pandemic.

New tax regime: Very few takers

In fact, last year, finance minister Nirmala Sitharaman had introduced the new income-tax slabs. The existing income-tax regime continues, but for those willing to give up on several tax deduction benefits can shift to the new income-tax slabs. But the new income-tax structure found few takers. Four experts that Moneycontrol spoke to suggested that the new income-tax slabs must be made more robust, either by reducing the rates further or by allowing a few more tax deductions.

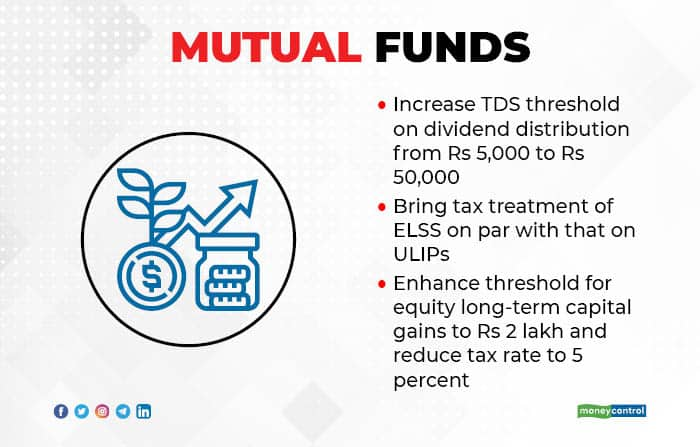

The Association of Mutual Funds of India too sent its wish lists. Among other suggestions, AMFI wants to increase the threshold of dividend distribution tax and bring about tax parity between unit-linked insurance plans and mutual funds. At present, if you get dividends from mutual funds in excess of Rs 5,000 a year, mutual funds deduct 7.5 percent TDS. This was earlier 10 percent, but was brought down as part of COVID-19 related relief measures that the government announced last year. AMFI wants this threshold to be increased to Rs 50,000 a year. Homi Mistry, Partner, Deloitte India says that Budget 2021 should also reduce long-term capital gains tax to 5 percent and increase the threshold limit to Rs 2 lakh.

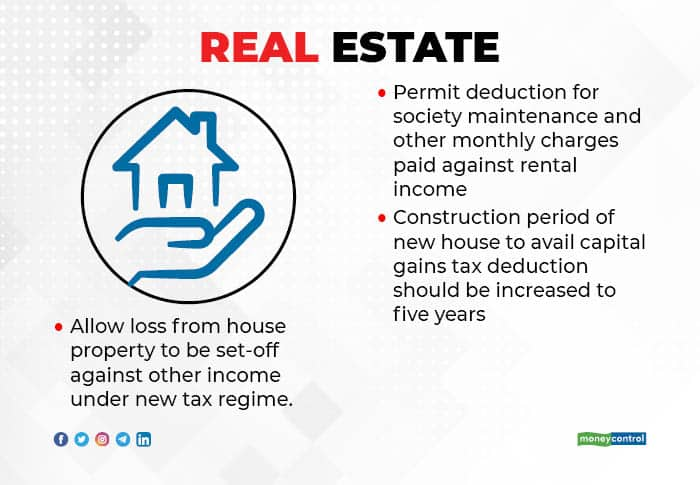

The real-estate sector has also expressed its wishlist, as this section is one of the most keenly watched in every Budget speech. Experts have suggested that deductions of society maintenance charges be allowed in rental income. Experts who Moneycontrol spoke with on affordable housing stressed that the definition of an affordable home (Rs 50 lakh) must be enhanced because it’s virtually impossible to buy a house in this budget in big cities such as Mumbai and Delhi.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.