The DSP World Gold Fund’s (DWGF’s) net asset value (NAV) has fallen by 26 percent over the past one year (as per Value Research data). Curiously, DSP Mutual Fund has released a note saying that this is a good time to invest in the scheme. Buying low and selling high may be a sound strategy, but there is a twist in the tale. Gold prices have fallen by just about 10 percent over the past year. Is DWGF still a good bet?

Patchy performance

International gold prices have been under pressure. But DWGF doesn’t buy gold the way gold exchange-traded funds (ETFs) do. It buys equity shares in companies that mine gold. DWGF invests its entire corpus in BlackRock’s Fund – World Gold Fund (BWGF). DWGF’s size was Rs 851 crore as of August 2021.

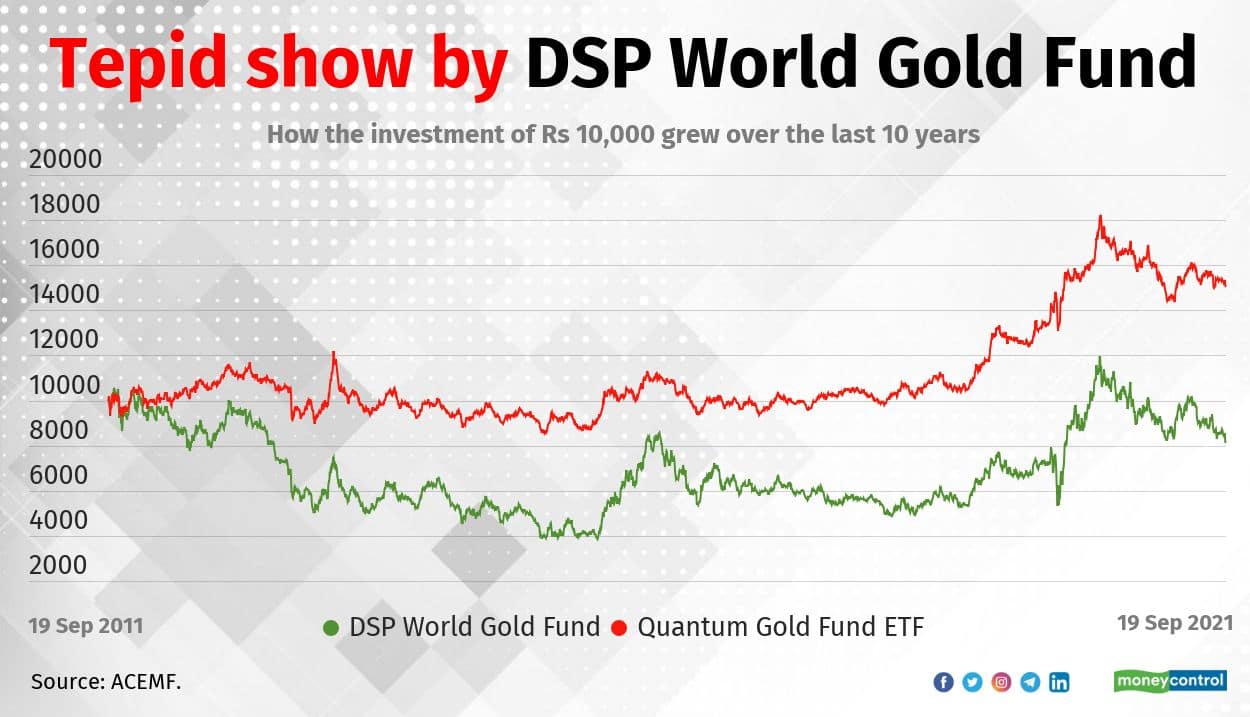

Its performance has been patchy. The scheme has delivered 2.41 percent over the past five years, as per Value Research. It has declined in value during seven out of 12 calendar years.

Fund house’s sales call

A correction in prices is often a good time to buy gold, says the fund house in its note. “The current crack in gold prices can appear to be a correction in a longer bull market over the next few years and may move towards $2500-$2800 over time.”

The update note also pointed out factors such as higher-than-normal levels of inflation, central bank gold purchases and investment demand that should be supportive of gold prices.

Improved economic outlook, prospects of central bank tightening will prove to be headwinds. But uncertainty on growth, inflation and other risks to the economic cycle will support gold investment. Investors can buy on dips.

Also read: Opinion: Why should investors buy gold on dips, in 2021?

The update further points out that the parent fund – BWGF’ portfolio companies are available at record dividend yields while the profitability is the best in last three decades and balance sheets are also in healthy shape. Price to earnings multiple stands at 13 compared to long-term average of 18, the note adds.

Gold or gold mining companies?

The demand for bullion gold and jewellery has been subdued. As COVID-19 recedes, households are expected to gradually build their savings and, may be later, buy gold.

“India and China are the largest consumers of gold. If we see a strong economic recovery in these two countries, then it can propel the consumption demand for gold and thereby gold prices,” says Shyam Sekhar, Chief Ideator, ithought Advisory.

If the gold prices rise, then gold miners’ profits increase. Valuations may expand and attract investors.

Sahil Kapoor, Head of Products and Market Strategist, DSP Mutual Fund says, “An investment in this scheme can be considered with a two to three years’ view. Investors should ideally stagger their investments to reduce timing risk.”

Over the past 10-year period, DWGF has actually lost two percent. But gold prices have fallen by 4 percent. In the last three years, gold prices rose 14 percent and Quantum Gold ETF’s NAV increased about 14 percent. But DWGF outperformed and was up 17 percent.

Even if you are bullish on the gold prices, you should keep in mind that investing in gold and gold miners are two different things. Gold mining funds also carry risks associated with equity markets. “Shares of gold mining companies move with the equity markets more than the gold prices, especially in the short run,” says a fund manager who did not wish to be named.

Consider DWGF only after you are well-diversified. But if you wish to use gold as a hedge, stick to sovereign gold bonds if you are okay with the lock-in period. Opt for a gold ETF or gold savings fund, if you want the flexibility to withdraw at any time.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.