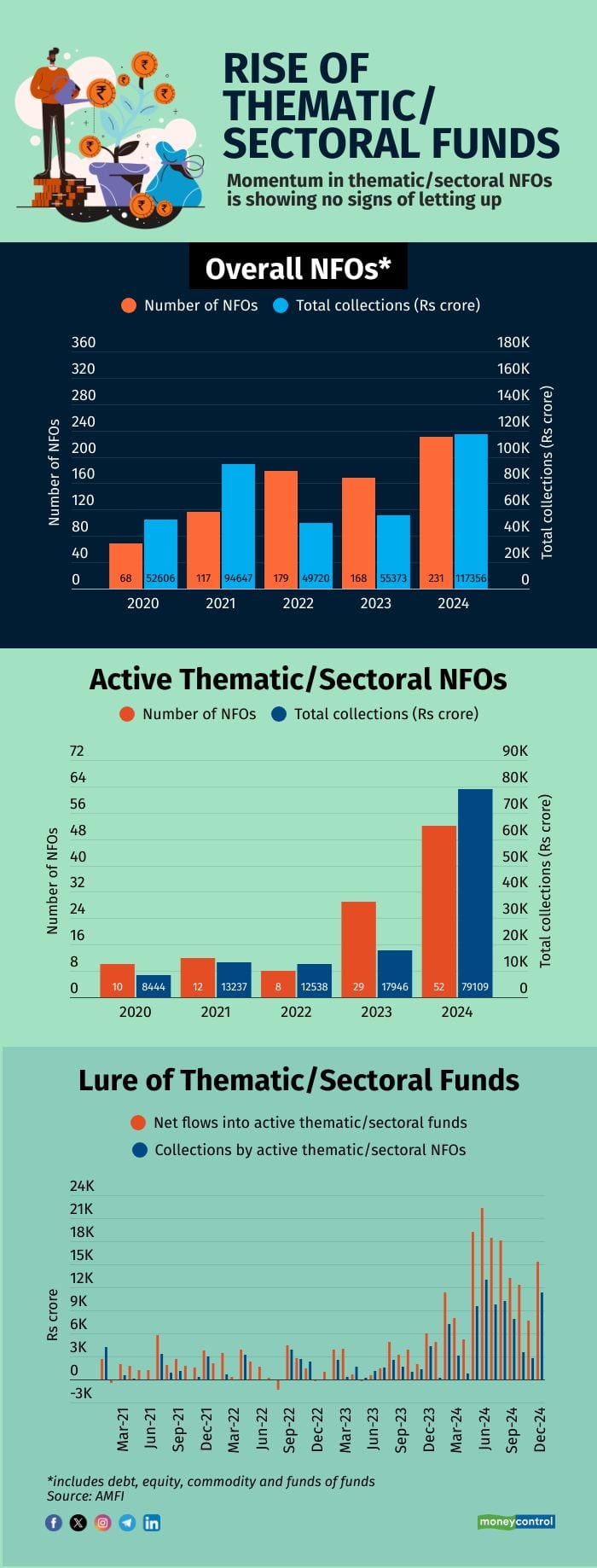

The number of mutual fund schemes entering the market has been on a steady rise with each of the last four years recording more than 100 new fund offers (NFO). Within this, new thematic or sectoral funds have grabbed the spotlight.

In 2024, Indian asset management companies (AMCs) mopped up a record Rs 1,17,356 crore through an unprecedented number of 231 new schemes. Some 52 active thematic or sectoral NFOs collected Rs 79,109 crore during the year, again scaling a never-seen-before high.

Data available with the Association of Mutual Funds in India (AMFI) showed that thematic or sectoral schemes have become the top choice of the mutual fund industry.

Also read | Why setting up a family trust scores over making a will in estate planning

“Thematic funds are on two wings on the backdrop of interesting themes through new fund offers. Themes such as India opportunity, manufacturing, and digital have gained a lot of traction. We feel the trend will continue in the coming year as well, with a lot of innovation and differentiation across funds,” said Akhil Chaturvedi, executive director and chief business officer at Motilal Oswal AMC.

Why thematic/sectoral NFOs?

The share of thematic or sectoral NFOs is growing steadily in the overall NFO launches. From just 4 percent in 2022, these funds now make up 23 percent of the pie.

In 2022, eight new funds were active thematic/sectoral funds out of 179 overall launches. This increased to 52 new active thematic/sectoral funds out of 231 new fund launches in 2024.

Dhirendra Kumar, chief executive officer at Value Research, believes that thematic funds or sectoral funds are the way to go for AMCs.

“For some new fund management companies, who are in the business of selling stories rather than performance, this is the route to take. Also, the regulatory framework has changed over the years. You can't have five multicap or midcap funds, for example. However, you can have an infinite number of thematic funds. If good time prevails, there will be more such funds,” Kumar said.

A bump in the road

Thanks to investor interest in the high-risk equity offerings and collections through NFOs, the active thematic/sectoral fund category recorded the highest-ever inflow of Rs 1,55,743 crore in 2024.

Since May 2024, the thematic/sectoral fund category saw at least Rs 10,000 crore inflow every month. However, with markets coming under pressure during October and November, the funds flow slowed down.

With the equity market continuing to be strained, will the new floats in the category take a hit?

According to Rushabh Desai, founder of Rupee With Rushabh Investment Services, AMCs take a strategic call during bull markets to launch NFOs, as liquidity is usually high during this period.

Also read | Equity fund inflows jump 15% to Rs 41,156 cr in Dec, SIP book tops Rs 26,000 cr mark: AMFI

“In 2024, during the first eight months, a lot of flows went into thematic/sectoral funds. During the last few months with the lower GDP revision, earnings and market weakness, flows took a dip,” he pointed out.

Desai feels that going ahead, when expectations from markets are not that high, new funds in this category are expected to slow down at least in the first six months of 2025. “Launches may pick up in the second half of the year, depending on the market mood,” he said.

Back to age-old bets?

In terms of performance, it was a mixed year for thematic or sectoral funds.

Among the new themes launched during the year were tourism, export opportunities, rural consumption, defence and electric vehicle & new-age automotive.

Most of the schemes launched when the market was on a rise, according to the data, started to underperform as the corrections set in.

Kalpesh N Ashar, a Sebi-registered investment advisor and founder of Full Circle Financial Planners and Advisors, thinks there isn’t going to be any genuine excitement for NFOs pertaining to thematic or sectoral in nature in the new year.

“Whatever the excitement or euphoria was, all that has been factored in. Since the markets have come down, most of these themes riding on the euphoria, have taken a knock. From now, whichever way the market moves, people are expected to stick with more conventional investing themes like diversified funds such as flexicap, and multi asset allocation funds or hybrid funds, rather than getting into too aggressive funds,” Ashar said.

Also read | Budget 2025: Why tax relief for debt funds tops wish list of mutual fund industry

Value Research’s Kumar also believes that most investors' needs are fulfilled by diversification, and at most a little bit of concentration of capitalisation. “The very reason you buy a mutual fund is to diversify, and thematic or sectoral funds are the exact opposite of that,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.