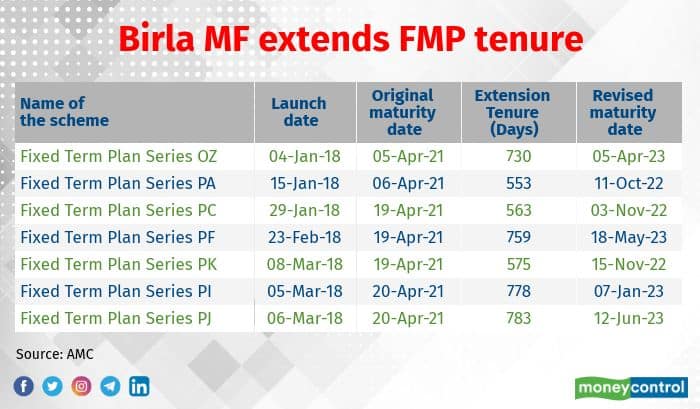

Aditya Birla Sun Life Mutual Fund (MF) has reset the maturity date of seven of its fixed term plans, known as fixed maturity plans or FMPs earlier. Investors in these schemes <see table> can either redeem at maturity, which is between April 5-20 this year, or choose to stay invested for another 18-24 months depending on the scheme.

Low interest rates

Interest rates have fallen throughout 2020 on the back of the central bank making it easier for borrowers to borrow, to ease difficulties endured during the Covid-19 pandemic. As a result, “interest rates are quite low now. A two-year extension is the perfect way out as they (seven FTPs) would get a five-year timeframe. So, investors would get double indexation benefit,” says A Balasubramanian, managing director and CEO, Aditya Birla Sun Life MF.

The fund house in its communication to investors wrote that it would be prudent to continue to stay invested in these schemes, for now.

Also read: What to do if your fixed maturity scheme rolls over

How do FMPs work?

FMPs are close-ended schemes that come with a specified tenure. Simply put, your money is locked in and can be liquidated only on maturity. FMPs take your money and invest in securities that mature around just before the FMP itself matures.

Since FMPs usually buy and hold them till maturity, there is a high chance of earning the returns indicated at the start. Hence, if held till maturity, FMPs are less susceptible to interest rate risks. Plus, they offer indexation benefits too.

But, by that logic, if the fund house would have earned its targeted return by now, why is it rolling over these FMPs? Experts say that investors benefit by staying invested because typically the fund house would have the option of rolling over its underlying instruments, as well, and at better than market rates. “If you redeem now, you would redeploy it at only lower interest rates,” says Amit Bivalkar, Director, Sapient Wealth. He says that if you choose to redeem and reinvest, then you would need to wait for another three years to get indexation benefits. To be sure, indexation benefits are available only on long-term capital gains on debt funds, for which you need to stay invested for atleast three years. “But, if they choose to stay on in these schemes, then the wait time is only for another year and half to two,” he says.

Also read: Are target maturity funds well-suited for investors during rising yields?

What should investors do?

Financial planners like Bivalkar say it’s best for investors to roll over and stay invested, given low interest rates elsewhere.

“Rollover would be a better option as investors would also get the benefit of higher returns accumulated in the past three years,” says Rupesh Nagda, founder, Family First Capital. “If you do not require the money, go for the rollover as the returns would be much better on an overall basis,” says Suresh Parthasarathy, a certified financial planner and founder, myassetsconsolidation.com. “The tax outgo would also be lower,” say advisors.

The average one-year returns from the seven FTPs that have a rollover option stands at 7.2%-7.9%. The best yearly performance of the FTPs was between September 2018 and 2019 when they clocked returns in excess of 11%. The worst was in the past one year when returns have averaged by only about 6%.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.