Year 2018 was an action-packed year for the Rs 23 lakh crore Indian mutual funds (MF) industry as well as for its investors. Funds got friendlier as costs were pushed down and steps were taken to further curb misselling. Fund categories - and all schemes within - got standardised. This made it easier for investors to compare one fund with another. Perhaps the only piece of bad news was the introduction of long-term capital gains tax (LTCG) on equity funds in Budget 2018.

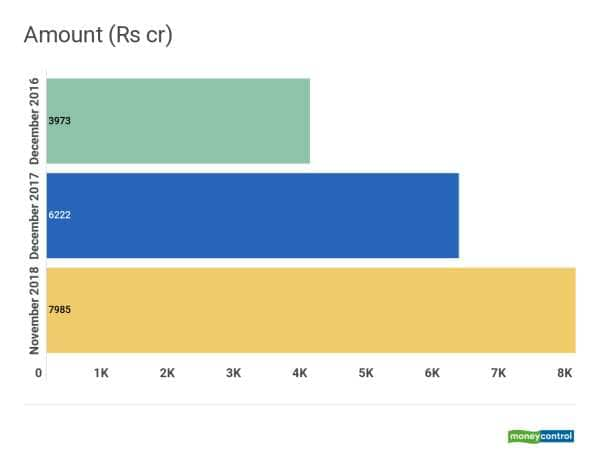

Flows remained strong through the year: in November 2018, close to Rs 8,000 crore came into MFs through systematic investment plans (SIP); compare this with December 2016 when inflows stood at under Rs 4,000 crore.

Flows were strong despite equity markets remaining volatile throughout the year. While the S&P BSE Sensex gained 5.6 percent year to date (as on December 14), equity funds disappointed.

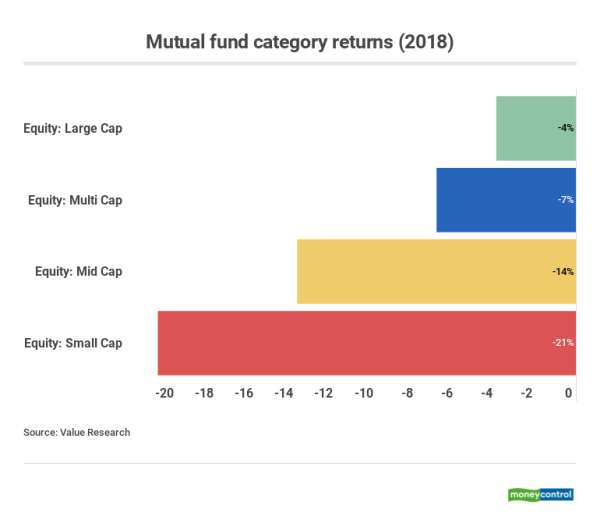

Large-cap funds fell by 4 percent on an average in 2018, mid-cap funds were down 14 percent while small-cap funds were off a steep 21 percent, as per Value Research.

Budget 2018 introduced long-term capital gains tax (at 10.4 percent, including the cess) for equity MFs and direct equities. Equities and equity MFs had been exempt from LTCG tax since 2004 when LTCG tax was abolished.

The holding period beyond which LTCG tax has been imposed, continued to remain at one year. However, all capital gains till Rs 1 lakh was made exempt from LTCG tax. All long-term gains until January 31, 2018 were also protected. Debt funds continued to be charged 20.6 percent LTCG tax after three years.

To ensure that investors do not switch to dividend plans to escape paying the tax (since dividends from equities and equity MFs were, earlier, tax-free as well), Budget 2018 also imposed an 11.648 percent dividend distribution tax. Both the LTCG and dividend distribution tax came into effect April 1, 2018.

Experts say that many investors, though, haven’t yet felt the impact of LTCG tax, mainly because of the grand-fathering clause. “Also, equity fund investors have made minimal gains this year for a variety of reasons, so they haven’t yet booked too many profits. But given the vibrant equity market, the government has to think whether LTCG is really required or not,” said A Balasubramanian, chief executive officer, Aditya Birla Sun Life Asset Management Company.

Expense ratiosThe cost that you pay to your mutual funds, as part of the total expense ratio, came down significantly in 2018 and is set to go down further as your fund’s size goes up, as per a revised Sebi formula.

Earlier, your fund house charged 30 basis points over and above the total expense ratio limits as an incentive to get inflows from beyond top 15 (B15) cities. In 2018, Sebi tightened the norm and said the extra charge can be imposed only if the fund house gets new inflows from beyond top 30 (B30) towns. Further, only retail inflows will make the MFs eligible to charge extra. One basis point is one-hundredth of a percentage point.

Chandresh Kumar Nigam, chief executive officer, Axis AMC, says: “Nearly 30 percent of last month’s SIP inflows came from B30 towns.”

Similarly, the extra 20 basis points charged earlier in lieu of the exit loads have now been brought down to five basis points. Schemes that don’t have exit loads, including closed-end schemes, cannot collect exit load charges, anymore.

Later in 2018, through a series of reforms, it mandated that fund houses will have to meet all their expenses from their respective schemes (no more dipping into their own balance sheets to dole out incentives to distributors) and ensuring that direct plan fees do not reflect any hidden distributor commission.

Downgrade in credit ratings spook debt fund investorsIn the months of August and September, Infrastructure Leasing & Financial Services Ltd (IL&FS) and some of its subsidiaries’ credit ratings were downgraded. Debt funds that had invested in these scrips got impacted. Some fund houses that had invested in these scrips took a hit as they wrote down their investments in these scrips resulting in a fall in their net asset values.

This dealt a further blow to debt funds where investors had already been leaving due to rising interest rates (when interest rates rise, bond prices- and therefore the NAVs of funds that invest in them- fall, and vice-versa). Debt funds (except liquid and money market funds) saw a net outflow (more money went out than came in) to the tune of Rs.1.62 trillion in 2018.

On 12 December, the capital market regulator, Securities and Exchange Board of India (Sebi) allowed funds to segregate their distressed assets in their portfolios that would be frozen till the time that they recover money.

Joydeep Sen, founder, wiseinvestor.in, says that Sebi’s move is good but should not be misused. “Side-pocketing (segregating bad assets) is good as a medicine, but it is not a healthy lifestyle. When a credit incident happens, if the regulator doesn’t allow side-pocketing, then it affects both the fund house as well as its investors. So it’s good to allow, but cannot be used regularly; only to be used selectively and with regulator’s approval.”

e-KYC using Aadhaar stopsJust as mutual funds were spreading out to bring in more investors online- and in a paperless way- the Supreme Court ruled in September 2018 that companies cannot use Aadhaar to validate customers. This threw a spanner in the works for mutual funds who had been using Aadhaar through e-KYC (Know Your Client) to onboard new customers by either using their biometrics (paperless) or by the One-Time Password method (online and paperless). To be sure, fund houses are also mandated to ensure that investors are alive and therefore genuine, as part of their KYC, called In-Person Verification (IPV).

The e-KYC method of using Aadhaar enabled fund houses to simultaneously do the IPV since this type of on-boarding meant that investors either give their fingerprints or enter an OTP; both are proof that investors are alive and kicking.

“Fund houses are now devising ways to allow investors shoot a small video of themselves in front of the camera either in a fund house’s app or on its website; this is also paperless but a bit more cumbersome that the Aadhaar method. The industry with Sebi’s help, would hopefully devise a better way to onboard customers online and paperless,” says the head of operations of a fund house who did not wish to be named because he is not the authorised spokesperson.

Further, fund houses had also been using Aadhaar to register a customer’s bank mandate (again, this was online, paperless and therefore quick) at the time of registering their SIPs. This too has stopped.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.