Krishna KarwaMoneycontrol Research

Page Industries has the exclusive right to manufacture, distribute and market innerwear cum leisurewear products under the ‘Jockey’ brand in India, Sri Lanka, Maldives, Bangladesh, Nepal and UAE. It is also a licensed retailer of ‘Speedo’ swimwear products and accessories in India.

Q2 review

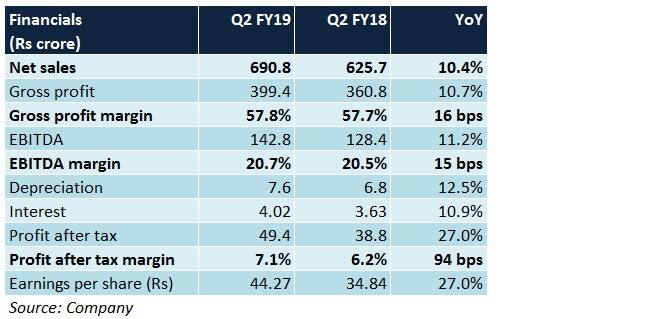

Top-line growth was sluggish in terms of volumes because of a high base. In FY19, Diwali was celebrated in November, as against October in FY18. Consequently, pre-festive sales traction, that saw an uptick in the concluding days of Q2 in FY18, was delayed to the early days of Q3 in FY19.

Weakness in revenue growth had a resultant impact on margins, which remained flat.

The path ahead

Exclusive brand outlets (EBO)

For Page, EBOs have always been the preferred store format in terms of network expansion since they enhance brand visibility and provide product cross-selling opportunities. Given Jockey’s strong recall and robust demand, the company, despite investing around Rs 30-40 crore annually in fixed assets, has been successful in deriving high asset turns consistently over the years.

The management is working towards doubling the EBO count from 470 (as on March 2018) to over 1,000 by FY20-end. Additionally, presence across other retail formats (multi-brand outlets, large format stores) will be scaled up gradually.

Brand extension

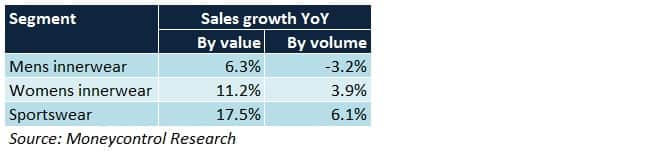

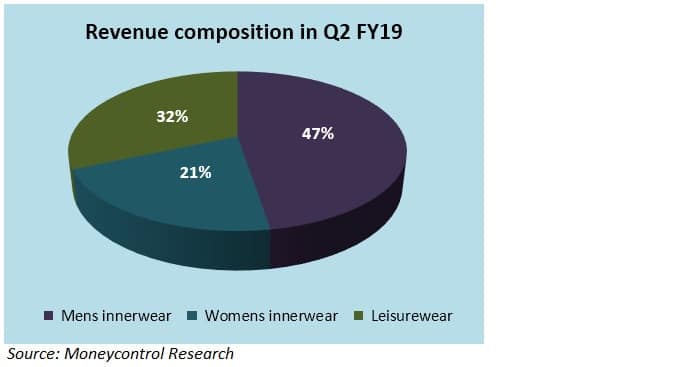

Historically, men's innerwear has been the dominant contributor to Page’s top-line. In the past few years, the company has been introducing products for women and children in a bid to diversify its portfolio and widen the buyer base. Since sales traction in the sportswear segment (comprising athleisure and activewear) is anticipated to be robust, more variants will be launched on this front too.

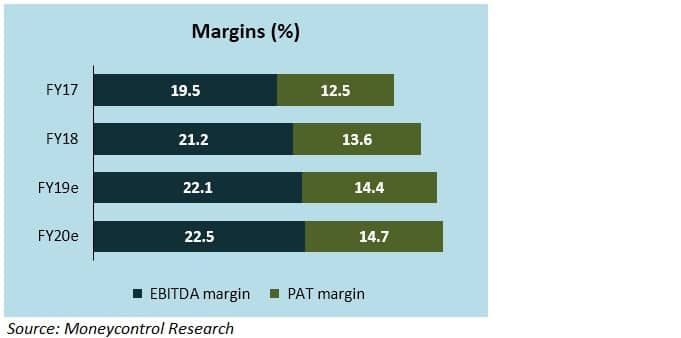

Margin stability

Being a popular brand, Jockey commands a pricing advantage vis-à-vis most others. This makes it easier for Page to pass on any increase in cost (raw material ones in particular) to the buyers. Furthermore, the company rarely resorts to any discounting or ‘end-of-season-sale’ days to clear inventories. Owing to these measures, margins aren’t subject to a high degree of volatility.

Outsourcing

To keep the business model asset-light, Page is outsourcing a bigger chunk of its manufacturing operations to third parties. By March 2020, nearly 40 percent of such activities will be undertaken by external suppliers, in comparison to the 20-25 percent mark in FY18. In the long run, the management intends to focus primarily on branding and retailing.

Online

Digitisation and convenience shopping has been picking up pretty rapidly across India. To cash in on this advantage, Page has been investing heavily in building its own online store, besides ensuring that its products are available on all leading e-commerce portals of the country.

Major risks

International innerwear and leisurewear brands have been expanding at a brisk pace, either by themselves or through tie-ups with leading retailers.

In a business like this, investments in brand building and product design/innovation have to be made at periodic intervals. An inability to achieve revenue targets because of such outflows could dent margins.

The company is facing resistance from distributors as it looks to realign its distribution structure.

Should you invest?

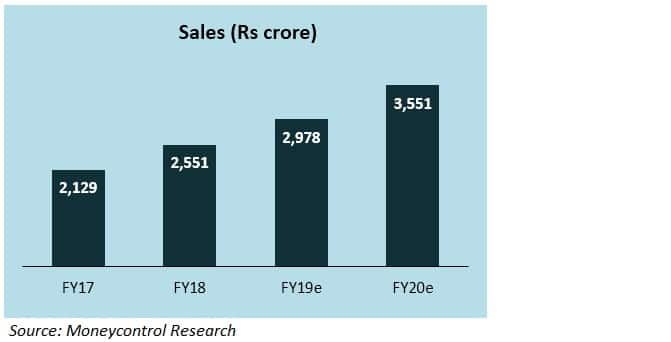

Being one of India's best-performing companies, Page, unsurprisingly, continues to command superlative valuations. This is predominantly because of the company's ability to not only deliver a sustained financial performance but also outperform its peers consistently over the years, in spite of a growing base.

In case of a sharp miss (as was seen post Q2 results) versus the Street’s expectations, such stocks bear the brunt of selling orders and de-rate. Nonetheless, we expect Q3 to be significantly better on a sequential basis (ie. vis-a-vis Q2) for Page on the back of revival in sale volumes, which, in turn, would be attributable to festive season sales.

Page's future prospects already seem to be more than comprehensively captured in the price (at 59 times FY20e earnings), and this trend will persist going forward. Though it remains an expensive proposition, investors may consider taking advantage of the stock’s steep correction of 24 percent from its 52-week high of Rs 36,335.95 (as on August 28, 2018).

Another factor worth considering is that Page has announced a dividend of Rs 192 per share in H1 FY19 (Rs 41 in Q1 + Rs 41 in Q2 + Rs 110 special dividend in Q2), as against Rs 61 in H1 FY18. From a shareholder perspective, this could probably hint at better dividend yields in future, given the company’s free cash flow generation capabilities and adequacy of reserves.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.