Nitin Agrawal Moneycontrol Research

Despite oil prices softening, automobile majors continue to post a weak set of volumes due to muted consumer sentiment caused by liquidity crunch, non-availability of retail finance and moderate festive season.

Commercial vehicle (CV) segment, which had continued to remain resilient until October, has also started showing signs of weakness, due to liquidity and financing challenges. Tractor segment witnessed robust traction in November on strong rural demand this festive season and robust reservoir levels after the monsoon.

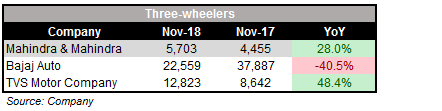

Three-wheeler (3W) sales were mixed on the back of last year's high base and government’s decision to end Permit Raj and no permit regime for alternate fuelled 3Ws. Two-wheeler (2W) volumes were also mixed for players in this space.

Passenger vehicle (PV) sales continue to disappoint because of higher cost of ownership, high base of last year and adverse macro factors.

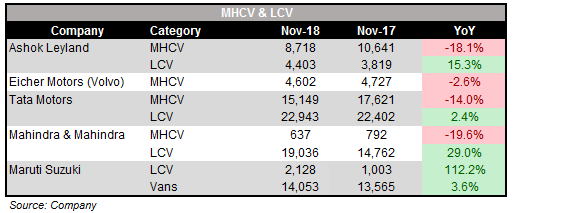

CVs showing initial sign of weakness CV segment volumes were impacted negatively due to lower consumer sentiment, led by liquidity and financing issues, rising interest rate and higher fuel cost. The outlook continues to remain positive on the back of increased demand from construction, focus on infrastructure, increase in mining activity and growth in industrial productivity (IIP).

FMCG and e-commerce sectors and increasing demand from container and refrigerated trucks have led to strong growth in the light commercial vehicle (LCV) segment.

Tata Motors' CV volumes declined 4.8 percent year-on-year (YoY).

The same for medium & heavy commercial vehicles (M&HCV) declined 14 percent on the back of subdued sentiments, which was partially offset by 2.4 percent growth in the LCV segment. Eicher Volvo and Ashok Leyland witnessed monthly volumes of 2.6 percent and 9 percent, respectively.

Mahindra & Mahindra (M&M), however, posted a healthy (26 percent) growth in the CV segment on the back of strong demand accruing from the LCV segment (significant contribution to total CV volumes) led by the newly launched Maha Bolero Pik-up.

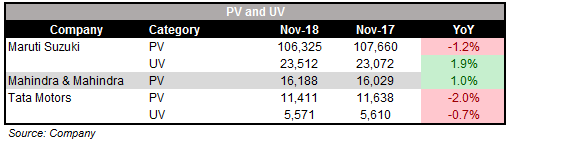

Adverse macros impacting car segment Amid higher ownership costs on rising interest rate, mandatory long term insurance and ongoing liquidity crunch, all companies posted a muted/decline in PV volumes for November.

Market leader, Maruti Suzuki, posted a 1 percent volume decline for the month. Tata Motors’ PV volumes declined 2 percent YoY. M&M, however, could post a 1 percent growth on the back of Marazzo launch.

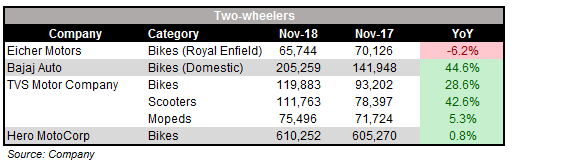

2W segment: Bajaj Auto and TVS Motor continue to shine In the 2W space, Bajaj Auto leads the pack with a strong (44.6 percent) growth in November, followed by TVS Motor Company, which grew 26 percent YoY. TVS posted a strong volumes on growth accruing from bikes (28.6 percent) and scooters (42.6 percent). Hero MotoCorp, the leader in the space, also posted a muted (0.8 percent) volume growth. Eicher too saw volumes dip 6.2 percent.

Steller showing by 3Ws The 3W market continues to remain robust. TVS and M&M saw their 3W volumes grow 48.4 percent and 28 percent, respectively. Bajaj Auto, the leader in this space, posted a 40.5 percent volume decline due to a very high base of last year.

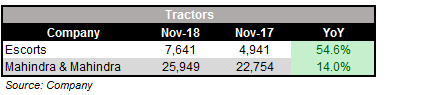

Tractors gain on positive rural sentiment Festive season and adequate reservoir levels boosted tractor volumes in November. Volumes for Escorts and M&M grew 54.6 percent and 14 percent, respectively.

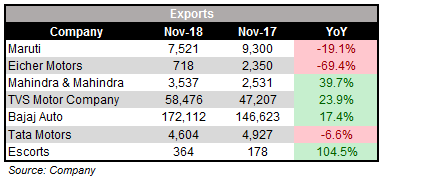

Exports: Strong momentum Export markets were mixed for companies. Maruti, Eicher and Tata Motors saw their volumes decline, while the same for M&M, Bajaj Auto, TVS and Escorts grew in November.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!