Sachin PalMoneycontrol Research

The transportation and logistics market has remained a laggard, having moved at a snail’s pace over the past few years. However, the sector seems to be getting the much needed investor attention in light of a number of key developments. One such development which has immense potential to change the fortunes of the sector as well as other allied industries is the Dedicated Freight Corridor (DFC) project, which is a broad gauge freight corridor being constructed by the Indian Railways.

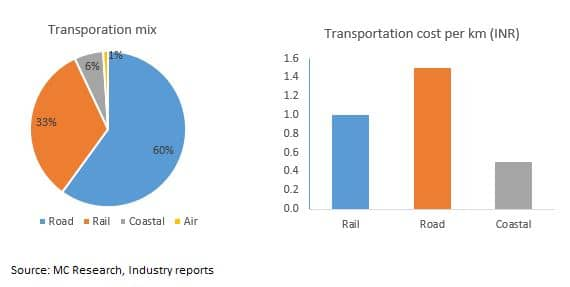

India has traditionally remained dependant on roads to meet a large part of its logistics needs. Around 60% transportation in India takes place through road despite it remaining expensive. Lack of available rail capacity forces industry players to be dependent on road to meet their transportation requirements.

The Dedicated Freight Corridor project aims to resolve this issue by providing an efficient and reliable transportation system through construction of six freight corridors traversing the entire country. Work on the Eastern Freight Corridor from Punjab to Kolkata and Western Freight Corridor from Delhi to Mumbai have already begun and is expected to be completed by 2019.

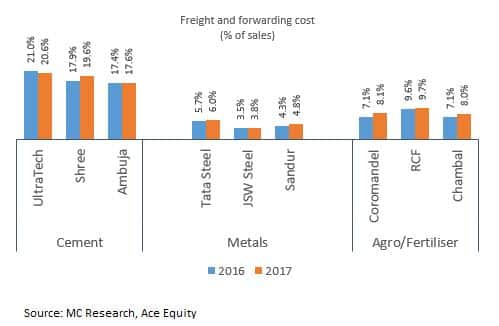

Rail transportation has been favoured by low value-high volume industries such as cement, steel, metals and fertilisers. Cement is expected to be the biggest beneficiary of this project among all sectors as freights costs constitute 17-20 percent of total sales. Select fertiliser and metal companies such as Coromandel International, Rashtriya Chemicals & Fertilizers (RCF) and Tata Steel also incur huge costs on transportation.

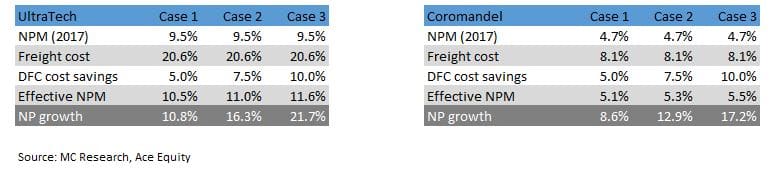

Assuming 5-10 percent savings on freight costs through effective use of DFC could potentially result in net profit margin improvement by 1-2 percent for UltraTech. The savings for companies would be quite significant. For instance, UltraTech operates at a net profit margin of 9-10 percent which could potentially head to 11-12 percent, resulting in a high double-digit profit growth of up to 20 percent purely from cost savings. Similarly, Coromandel’s net profit margins stands to gain up to one percent from 10% freight savings. The impact, however, cannot be generalised as it may vary across companies and industries.

Apart from direct cost savings which will directly flow to net profits, there would be additional benefits on the balance sheet front.

A long working capital cycle is one of the biggest pain points for a large number of industries. DFC would enable an efficient procurement of supplies and transportation of finished products, thereby reducing working capital requirements. This would release some of the locked-in capital which could be put to effective use in business expansion or other investment activities.

A higher net profit margin (NPM) and lower working capital requirement stands to improve return ratios and facilitate potential re-rating of the earnings multiple.

While the tangible benefits appear relatively straight forward, the intangible benefits arising out of this are difficult to quantify. On the intangible side, the industry stands to gain from brand development and strengthening of relationships with customers via an uninterrupted delivery of goods and services.

With a large number of positives expected to accrue from the DFC project, there is a lot at stake from an industry perspective. Although project execution is still in early stages, the first set of beneficiaries would be companies having proximity to the Eastern and Western Freight Corridor.

All in all, it is set to be a gamechanger for the country and stakeholders (industries along with investors) who would keep a close watch on the phased commisioning of this project starting next year.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.