Jitendra Kumar Gupta Moneycontrol Research

Which set of stocks give you healthy cash levels, attractive valuations, good dividend yields, decent return ratios, significant competitive advantages and the absence of promoter risks? If you answered PSU stocks, that’s correct.

PSU scrips have typically attracted those seeking value. Despite their huge appeal, they have often turned out to be wealth destroyers. Total returns from 44 listed non-bank PSU stocks were a mere 3 percent annual growth over the last five years. While the metrics may seem attractive, the returns call for caution.

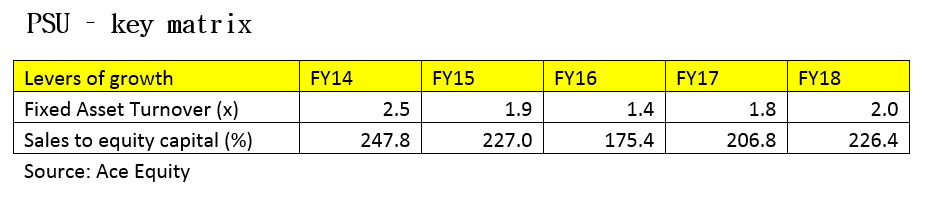

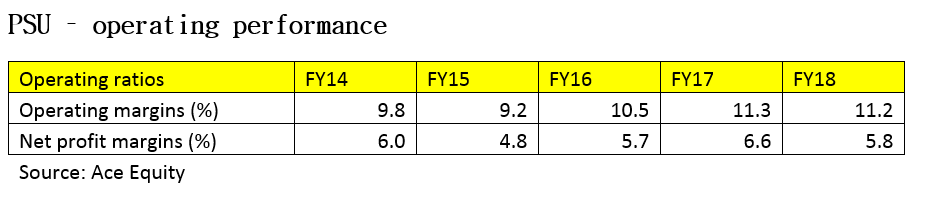

There are good reasons for their shares underperforming. Between fiscal 2014 and 2018, the companies in this study delivered a mere 1.5 percent revenue growth and 0.7 percent net profit growth annually.

The value mirage

That’s why investors should get not carried away by low valuations. For instance, Steel Authority of India or SAIL in March 2014 was at around Rs 56 a share, available at 0.6 times its book value against its historical average of 1-1.2 times. That may have been inviting. But today, even at 0.6 times its book value, SAIL remains cheap at Rs 51 a share. A buyer in 2014 would be sitting on losses even today.

SAIL is not alone; several PSUs including Coal India, BHEL, GAIL India, HPCL, BPCL and many others where investors got attracted to valuations have actually turned out to be so-called value traps in the absence of earnings growth.

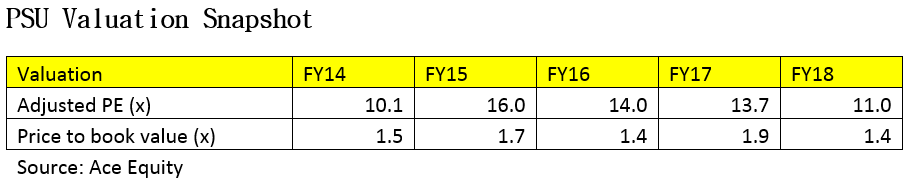

On paper, PSU stocks have turned cheap. The PSUs studied are trading at an average of 11 times their earnings in FY18 against 16 times in FY15. Their price to book value of 1.4 times is 30 basis points lower than their FY15 levels. They can, at best be valued based on dividends. Investors who take the plunge do so, based on other factors such as a potential recovery in earnings and cash flows and often end up regretting it.

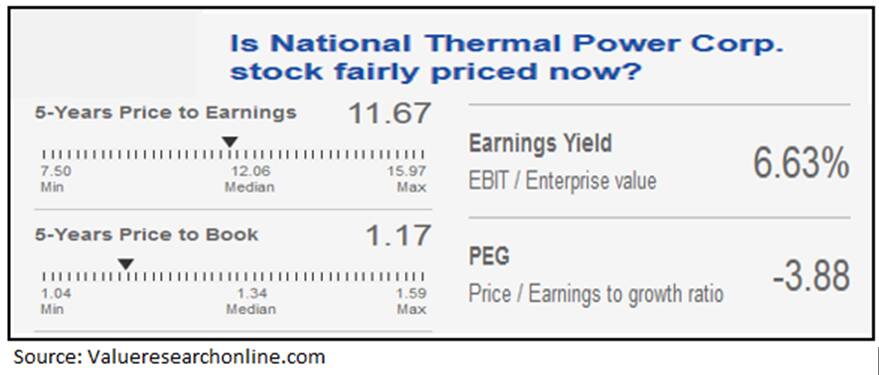

An interesting case is that of NTPC, which is struggling to grow earnings. Since returns are regulated, investors prefer to value it based on dividends. During fiscal 2014-18, it reported 2.5 percent annual revenue growth whereas profit declined by 3 percent annually. Investors who had applied earnings-based valuation methods, thinking someday these stocks will be valued as growth stocks, made a mistake. Even today, despite attractive valuations, it continues to offer a 3.8 percent dividend yield.

Slow growth trajectory

A chief cause of wealth destruction in PSU stocks is growth; or the lack of it. Of the 44 listed PSUs covered here, half reported a decline in revenues over the past four fiscals. These companies dragged down overall annual revenue growth on an aggregate basis to merely 1.5 percent. What about the remaining half that saw revenues grow? Their aggregate sales rose by 8.8 percent annually on average in the past four fiscals.

Consider the performance of three leading PSU miners NMDC, MOIL and Coal India. Despite a monopoly position and good demand from user industries, miners reported a decline in profits led by reasons such as higher employee cost and inability to scale business.

Scalability is a big constraint due to delays in decision making and inadequate planning. For instance, NMDC decided it will also make steel in addition to mining iron ore, which fuelled investor expectation. But delays and a change in plans has now resulted in the company deciding to exit this project.

In 2013, SAIL had plans to double its 13-million-tonne capacity in two to three years. In fiscal 2014, out of Rs 60,000 crore fixed capital employed in the business, Rs 33,000 crore was tied to these expansion projects shown as capital work in progress. Because of the huge delays in the expansion, it not only weakened its balance sheet but allowed others such as Tata Steel and JSW Steel to increase their market share.

Companies with a monopoly find their profits are protected even if they cannot scale up. Once the market opens up, as was seen in the case of BHEL and MTNL, competition erodes their market position and share valuations.

Managerial ability is underwhelming

Often growth and scalability have suffered because of the ability of management. To put in perspective, between FY14 and FY18, BHEL’s net profit declined 30 percent annually and net worth by close to a percent annually as a result of drying market opportunities in the power equipment market accounted for close to 80 percent of its revenue. While peers survive, BHEL lost on strategic thinking and initiatives. In one of the reports prepared by Comptroller and Auditor General of India (CAG) last year titled, 'Competitiveness of BHEL in emerging markets', it cited reasons such as lack of timely diversification for the poor financial performance.

Ignoring the tenets of wealth creation

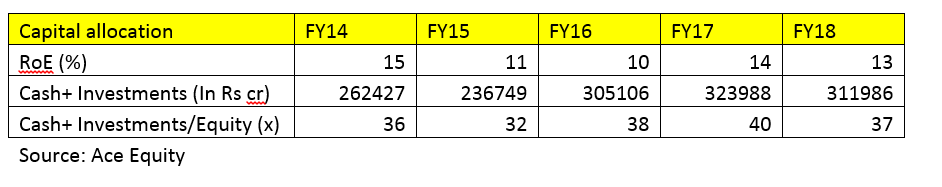

Poor capital allocation and reluctance to return surplus cash to shareholders has also marred the prospects of PSUs. Companies in our study have consistently kept cash and investments to the tune of 32-40 percent of the equity capital invested in the business which is quite high resulting in low return ratios and eroding capital.

While companies during fiscal 2014-18 delivered 1.5 percent annual revenue growth, their other income has risen by 7.5 percent annually. Thus, profit growth to an extent has been helped by growth in other income.

Still, funds in the bank yield less than returns generated in their core business. Investors also fear misallocation of funds such as in the case of Coal India investing surplus cash for operating power generation plants.

In sum, public sector shares may seem like low hanging fruits but they are likely to leave a bitter aftertaste.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.