Highlights:- - Jewellery sales declined due to steep gold prices - Watches continue to grow at a healthy pace - Launches are being undertaken in eyewear - Lifestyle segments appear promising - The stock remains a good long-term pick

--------------------------------------------------

In its latest filing to the exchange, Titan’s management shed some light on what investors can look forward to in terms of the company’s Q2 FY20 performance.

Here are the segment-wise highlights.

JewellerySales declined sharply in July. This was attributable to the following headwinds:-

- Gold ornaments, constituting close to 50-60 percent of this segment’s top-line, became costlier due to a steady increase in gold prices

- Liquidity crunch

- The consumption sentiment in most parts of India remains subdued, thus resulting in lower discretionary spends on high-value products

- No festive push

Nevertheless, some green shoots were visible in August and September. During these months, retail (secondary) sales grew 15 percent year-on-year (YoY) due to increased impetus towards advertising. On the flip side, this would impact margins.

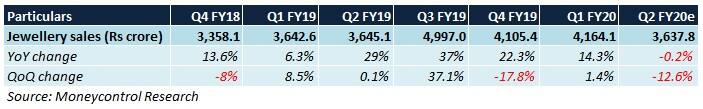

For Q2 FY20 on the whole, retail sales growth was 7 percent YoY. However, from the consolidated financials perspective, jewellery revenue was down due to the adverse impact of hedges maturing during the quarter. This happens to be among the weakest growth figures in Q2 in recent fiscals, as seen below.

Besides adding 21 new Tanishq outlets (with a retail space addition of 67,000 square feet), product launches were undertaken in Q2. Network augmentation is slated to accelerate further in Q3 and Q4 to maximise market share gains during the wedding season.

Titan increased its shareholding in Caratlane (its subsidiary) from 69.5 percent to 72.3 percent during the quarter. Despite softness in the market, Caratlane sales grew by 75 percent YoY and the store count was 70 as on 30th September, 2019.

WatchesMBOs (multi-brand outlets) grew at a faster pace vis-a-vis EBOs (exclusive brand outlets) since a wider product/brand range is available under the same roof. E-commerce sales were healthy too.

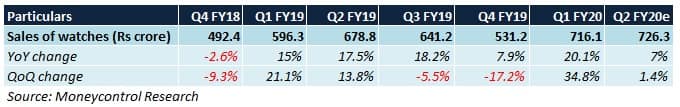

On account of weak demand sentiment, sales growth moderated to 7 percent YoY in Q2 FY20.

Unlike jewellery, where a de-growth is clearly visible, this segment has managed to grow at a decent clip in spite of the consumption headwinds.

To promote personalised and convenience shopping, an omnichannel (blend of online and offline retailing) platform has been introduced by the company. By virtue of this initiative, consumers can avail either of the following 3 options:-

- Order online and collect from store

- Reserve online and try on in-store

- Get the product shipped from the nearest store

Being a nascent step, it’ll take a few more quarters for this strategy to gather pace. In the long run, omnichannel could, undoubtedly, be among the key revenue drivers.

Focused digital campaigns were launched during festivals like Ganeshotsav and Durga Puja. The total reach (i.e. views) garnered through these was over 5 million.

To cash in on the company’s strong recall, ‘Titan Clocks’ were exclusively sold on Flipkart. This was well received by the buyers.

Furthermore, new products were introduced for under ‘Fastrack’, ‘Sonata’, water resistant and women categories.

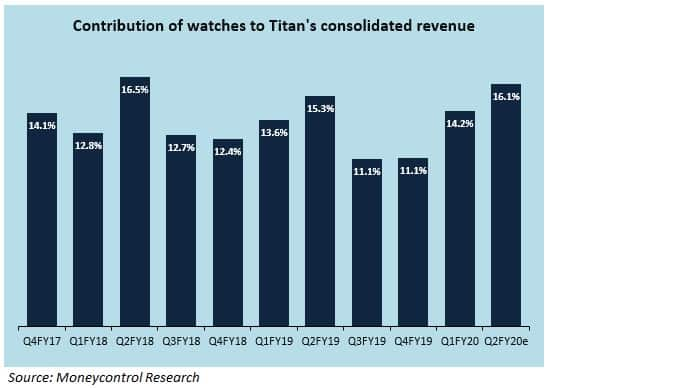

A combination of new outlets, brand extensions, differentiated products and robust marketing measures should augur well in terms of revenue accretion. From Titan’s point of view, the improving performance trajectory becomes important for the following two reasons:-

- It reduces the risks associated with high seasonality in jewellery sales.

- The contribution of watches to consolidated revenue is increasing.

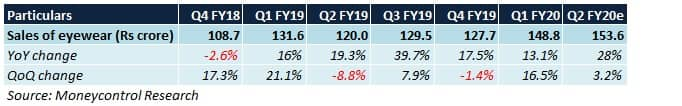

In Q2, top-line grew at 28 percent YoY. This was predominantly aided by increased participation in Essilor’s ‘Buy One, Get One’ offers.

Though the uptick in revenue is worth taking note of, it remains to be seen if the emphasis on volume growth helps achieve break-even levels.

Net retail space addition (after some store closures) during the quarter was approximately 16,000 square feet.

Titan came up with new product variants under eyewear (both ‘Titan’ and ‘Fastrack’ brands), sunglasses and frames.

SKINN perfumesEfforts to widen the distribution reach are underway. The offtake has been good in large format stores. Premium deodorant sales are also picking up. The outlook for this segment remains upbeat and positive.

Taneira sareesPresently, 7 stores are operational in 4 Indian metro cities. A month-long customer activation programme and a new festive series of sarees helped this segment’s revenue grow.

Should you invest?In the consumer-centric space, Titan remains one of our top picks because of the following:

- Good corporate governance standards

- Healthy financials

- The ability to consistently outperform its peers in jewellery sales

- Store expansion strategies

- A well-recognised brand image across all segments

Titan, in all likelihood, may have difficulties in delivering any noticeable YoY revenue growth by FY20-end. This will be predominantly on account of weakness in jewellery sales, which constitute nearly 80 percent of the company’s annual revenue. The consequent lack of operating leverage from this segment, coupled with and losses from eyewear, will limit overall margin improvement.

The stock, valued at 49.4 times its FY21 estimated earnings, will continue to command a premium valuation going ahead too. While the challenges in the short-term may result in the stock not re-rating substantially anytime soon, we don’t foresee a major downside either. Those looking to build a portfolio for the long haul may consider investing in the backdrop of the management’s weak Q2 commentary and possible stock reaction on the same.

Follow @krishnakarwa152For more research articles, visit our Moneycontrol Research pageDisclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed hereDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.