Sachin Pal

Moneycontrol Research

TCI Express, a third-party express logistic service provider, reported stellar set of numbers in the final quarter of FY18. It reported its highest ever quarterly topline and bottomline, driven by strong performance on all parameters. It continues to gain market share from industry players after the rollout of the Goods & Service Tax (GST). We expect further earnings acceleration in coming years as the industry reforms start to yield benefits.

Strong operational performance

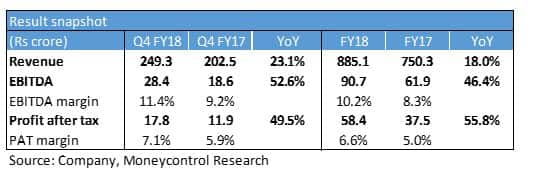

Sales for the quarter gone by increased 23 percent year-on-year to Rs 249 crore. EBITDA came in 53 percent higher than last year at Rs 28 crore. Profit after tax rose 50 percent to Rs 18 crore.

The company ended FY18 on a solid note with topline rising 18 percent (in line with the management’s guidance at the start of the year) and bottomline growth of 55 percent.

Revenue continues to grow on a quarterly basis

Revenue during the first half of FY18 was impacted by rollout of GST. However, things appear to have stabilised after that with strong demand seen for logistics services in the past two quarters.

While revenues continue to remain on an uptrend, enterprise resource planning (ERP) integration with clients has resulted in cost savings. The company has also been able to generate operating efficiencies through changes in its distribution strategy. Margins continue to grow in spite of rising fuel prices as TCIE follows fuel surcharge based pricing mechanism to counter the rise in diesel prices.

These factors along with strong operating leverage on account of an asset light business model has resulted in operating margins improving to 11.4 percent in Q4 FY18 from 9.2 percent in Q4 FY17.

Providing logistic services across industries

TCIE offers express logistics services for high value products to companies operating in the pharma, automobile spare parts, lifestyle, retail and engineering industries. These sectors are seeing robust demand as economic activity led by domestic consumption has picked up in recent months.

The company derives more than half of its revenue from small and medium enterprises (SME). These latter are engines of economic growth for India as it contributes 45-50 percent of the country’s industrial output. With its unique offering and strong business relationships, it remains well position to capture the potential in this segment.

Industry tailwinds to propel growth

The company operates in the Rs 25,000 crore express logistics market which is largely dominated by unorganised players. The demand for express logistics services is increasing given the need for time-bound delivery services. Its prospects appear promising as sectoral reforms such as GST and e-way bill should aid the shift in market share to organised players in coming years. The development of road and highways under Bharatmala will also provide it a big boost as it primarily operates in the road segment.

Expansion funded through internal accruals

The management plans to grow its business organically and has chalked out a capex plan of Rs 400 crore spread over 3-4 years to drive future growth. It plans to use this capital for owning sorting and distribution centres across locations as it gives it more control on the business and helps in generating cost efficiencies. The investment will primarily be funded through internal accruals.

Outlook and recommendation

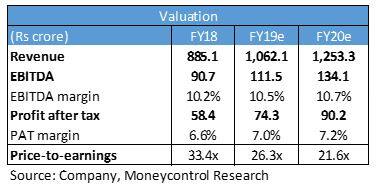

Aided by industry tailwinds and increased economic activity, the managements expects FY19 topline to increase around 20 percent.

From a valuation standpoint, the stock trades at 26 times one-year forward price-to-earnings multiple and appears to have priced in near term positives. Investors with a medium to long term view should look to accumulate TCIE on dips given its strong fundamentals, low leverage (debt-to-equity ratio of 0.1 times at the end of FY18) and market share gains from competitors.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!