A lack of volume growth in its core sponge business and weak domestic sponge prices continued to weigh on Tata Sponge.

In January this year, Raipur-based sponge iron prices corrected 8 percent to about Rs 21,000 a tonne.

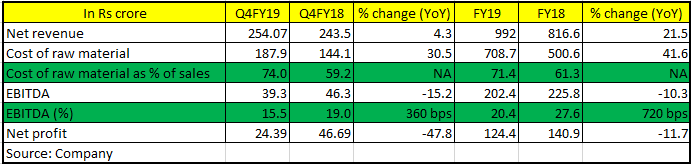

Tata Sponge, which operates at about 115 percent capacity utilisation is striving for volume growth. The company reported a 4.3 percent year-on-year (YoY) increase in sales in Q4FY19, but sequentially, sales dropped 2.65 percent to Rs 254 crore, reflecting the correction in sponge iron prices.

Key positive

Sales in FY19 grew 21.5 percent Rs 992 crore. However, this was mostly because of the low base of last year when sponge prices were relatively low. Besides, debottlenecking of existing capacity helped increase volumes in the last year in turn leading to better YoY performance.

Key negatives

Unlike sales growth, profitability has been falling both YoY and sequentially. Despite better utilisation, the company reported a 15.2 percent YoY decline in operating profits (EBITDA) to Rs 39.3 crore in March FY19 quarter. Margins, in fact, dropped by a whopping 360 basis points to 15.5 percent.

The decline in profitability was primarily a result of higher costs. Because of the tight supply of iron ore in the domestic market and an increase in coal prices, the company which partly depends on the spot market for its raw material requirements faced cost pressures. This is also the reason that the cost of material consumed as percentage of sales spiked to 73.9 percent in March quarter from 59.13 percent in the corresponding quarter last year.

Since January this year, Chinese iron ore prices spiked 24 percent in the international market to $88 a tonne. Besides, because of capacity constraints and logistics issues, the domestic iron ore premium is weighing on the domestic manufacturers. This is also a reason for the net profits falling 48 percent YoY to Rs 24.39 crore during the quarter. For the full year too, profits dropped 11.7 percent to Rs 124 crore.

Other observations

The key development that investors are watching out is the integration of recently-acquired company Usha Martin. Tata Sponge has decided to shift its corporate office to Kolkata and change its name to Tata Steel Long Products.

This also affirms our view that Tata Sponge with the help of Usha Martin will now focus on long products and partly value-added products where Tata Steel does not have much presence.

Outlook

While on the one hand, the cost pressure is increasing, on the other, customers are seeking discount on the final products. In this situation, the company has limited ability to exercise pricing power. Since the volume game is not at play because of the peak capacity utilisation, the key would be the integration of stressed Usha Martin assets and deployment of the surplus cash in the books.

Over the next six months, this should start making a positive impact and if the market stabilises here, profitability too should be better in FY20. At Rs 747 a share or nine times its FY19 earnings, the stock is valued reasonably.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.