Highlights

- Below-par performance in Q3

- Low energy cost boosts margins

- Growth rode on the back of low base

- Subsidiary Rallis showing early signs of recovery- Coronavirus spread expected to impact business

--------------------------------------------------

The lacklustre December quarter for Tata Chemicals (TTCH) (CMP: Rs 734; Market cap: Rs 18,716 crore) came in below expectations, with a low single-digit revenue growth.

The jump in profit was mostly because of a low base and soft energy costs (low natural gas prices) during the quarter. Post results, the stock saw a noticeable correction.

While the performance at its subsidiary Rallis started showing early signs of recovery, we believe that the Coronavirus spread could affect the supply of input chemicals. Also, the demand for soda ash from China is likely to get hit, which may impact the company’s profits in coming quarters. That’s something to watch out for.

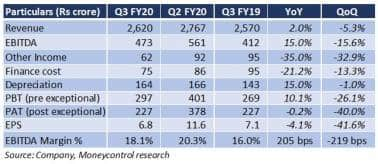

Financial performance

Results highlights

- Revenue during October-December was up 2 percent year-on-year (YoY), down 5.3 percent sequentially. The revenue from the basic chemistry business saw a 6 percent YoY growth. However, the 41 percent jump in the specialty segment, especially in Rallis, saved the day, which was mainly attributable to a low base last year.

- After consecutive quarters of softness, Rallis saw a turnaround in fortunes on the back of a healthy top line growth, positive farm sentiment, new product launches and a low base from last year. This led to a 323 percent YoY jump in profit of the specialty business of TTCH.

- The performance in the domestic market, along with Europe and North America, largely relied on margin expansion. However, supply disruption in Africa impacted its performance in the region.

- The earlier than expected start of the soda ash capacities in Turkey has created a demand-supply mismatch and left the market oversupplied.

- The salt business grew 3 percent YoY in volumes.

- With the spread of the Coronavirus flu, the demand of soda ash from China is likely to take a hit in coming quarters. This coupled with new supply additions from Turkey are playing out for the soda ash prices. The management indicated that that while there is no major impact from the China situation currently, low prices and demand could make the going tough.

Outlook

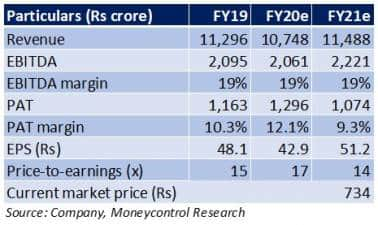

We believe that the demerger of the consumer business will help TTCH deploy resources to expand its chemical portfolio towards high-margin products. The remaining business will be a pure play chemistry-focussed entity and the company is lining up plans to expand the specialty products business.

We see the near term to be capex intensive. The management has highlighted that the entire capex to be funded through internal accruals and we do not expect any substantial debt to enter into the business in the near term. The benefits of the expansion would have some gestation period and might take some time before they start feeding positively to growth.

The stock has run up in the past few months and is trading at a 2020e PE of 17x. We expect few more value unlocking opportunities like monetizing cross-holdings in the near future.

In the medium term, we believe that the company’s plan for expanding specialty products business share to 50 percent of sales could help in re-rating. In particular, Highly Dispersible Silica (HDS) and the lithium-ion battery business are two key categories to track.

The Coronavirus impact poses a prominent risk for the company’s performance in the coming quarter. One would do well to keep an eye on the prices of soda ash and demand from China. Disruptions in supplies could also upset calculations for Rallis.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!