Krishna Karwa

Moneycontrol Research

Highlights:

- Post-correction, the stock offers value

- Revenue growth will be driven by network expansion

- Product mix would influence profitability

- FDI regulations may lead to restrictions on sales

----------------------------------------------------

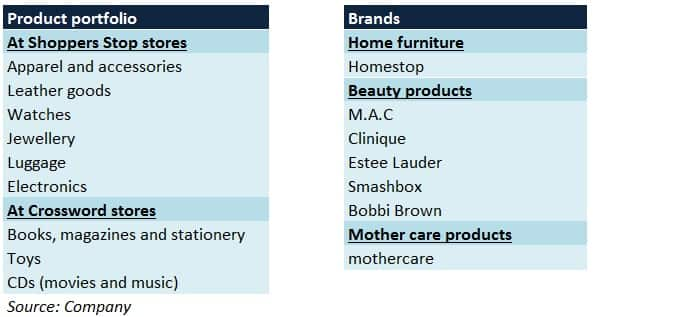

Shoppers Stop, one of India's largest departmental store chains, reported a strong set of numbers in Q3. Going forward, the company is banking on network expansion and impetus towards high-margin products to bolster its performance.

After a sharp 26.6 percent dip from its 52-week high, the stock, despite being an expensive proposition, has the potential to re-rate.

Shoppers Stop is a part of the K Raheja Group. It operates 295 departmental stores, spanning 4.4 million square feet, in 38 cities across India. Its ‘First Citizen Loyalty Programme’ covers nearly 5.9 million members.

Q3 analysis

Positives

- 8.9 percent like-to-like growth in sales YoY (year-on-year) because of wedding and festive demand. This is the highest in the last 5 quarters

- Top-line traction seen across all segments

- Noticeable improvement in margins because private label sales grew by 29 percent YoY

- Financing costs declined substantially

- Improvement in key parameters

Negatives

- Sales growth appears optically lower (3.7 percent YoY) due to accounting and GST adjustments

Observations

Revenue drivers

- Shoppers Stop outlets (4) and beauty stores (4) are likely to be added in Q4 FY19

- Number of members under the customer loyalty programme are steadily growing

- Personal shopper services will be made available in more stores in due course

- Click-and-collect services (currently offered in 50 Shoppers Stop stores) will gain scale

- Omnichannel sales (through shoppersstop.com, amazon.in) should gain momentum as convenience shopping picks up pace

- Kiosks/experience centres will be set up in stores other than Mumbai and Bengaluru

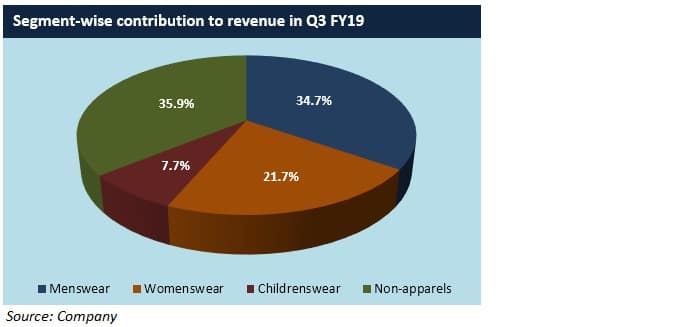

- Women's ethnic wear is a fast-growing segment

Margin drivers

- The contribution of private labels to sales is expected to increase gradually

- Branded beauty products, which fetch better margins than apparel, are meaningfully contributing to the top-line since the past few quarters

- The share of non-apparel products to sales is slated to increase. This will help diversify challenges associated with seasonality in apparel (H2 of a fiscal year tends to be better than H1)

- Long-term debt has been pared from the proceeds of stake sale to Amazon and sale of Hypercity to Future Retail in FY18

- To rationalise rentals, most of the new stores (to be opened in tier 2/3 regions) will be small or mid-sized

Outlook- The recently announced FDI regulations may restrict Amazon or Shoppers Stop’s scope for discounting, warehousing and marketing of products (particularly the private label ones). One needs to keep a close eye on how developments on this front unfold

- The stock is trading at 26.8 times its FY21 projected earnings

- Price/time correction during the course of the past year/last 3 months, respectively, provides a good buying opportunity

For more research articles, visit our Moneycontrol Research Page.

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.