Ruchi AgrawalMoneycontrol Research

Chemical manufacturer PI Industries (PIND) (CMP: Rs 1,495, Mcap: Rs 18,910 crore) has a healthy second quarter to talk about, with exports steering the growth show.

The domestic business continued to be pressured by erratic and delayed monsoon and softer offtake. Commercialisation of new products has shown continued traction. The management commentary indicates strong momentum in business and we expect the healthy growth to continue in coming years.

Key results highlights

The strong 25 percent year-on-year (YoY) growth in September quarter revenue came on the back of continued traction in exports (up 52 percent), which made up for a weak show in the domestic business (down 12 percent). Delayed arrival of monsoon and erratic rainfall in the domestic markets led to softer offtake and higher inventory.

The quarter saw slight weakness in gross margin. According to the management, this is attributable to the product mix and price volatility in raw material sourced from China. However, gross margin remained at the high end of the industry average.

Despite softness in the domestic performance and the ramp-up cost, the company posted a healthy 257 basis points of growth in EBITDA margin.

The company has launched several products over the past few quarters that are contributing to a healthy top line growth. As more enquiries stream in, the management plans to launch 2-3 molecules in H2 FY20.

Other comments

The process of closing of Isagro acquisition is progressing as planned and is expected to be completed in Q3 FY20. This will add to additional manufacturing capacities to meet growing demand of global customers and strengthen the company’s position in domestic markets by leveraging complementary product portfolio and distribution channel.

Outlook

The company has reported a strong quarter with a volume surge in exports. It sees growth pacing up, given improved monsoon performance and the line-up of new products.

The exports business has shown strength and so do order book inflows. We expect this to continue, too. With increased enquiries and higher translation into firm orders, we also expect the growth in exports to sustain. The company has an aggressive line-up of new molecules with which it aims to scale up volumes in this segment.

Ramp-up in sales of recent product launches, along with new molecules lined up for a launch, suggests that volumes are expected to improve.

With a robust exports order book, presence in early stage molecules in agrochemicals, diversification in specialty chemicals, foray in pharma intermediates, a sound balance sheet with a net cash position and a strong pipeline of new molecules, we remain positive on the future performance of the company.

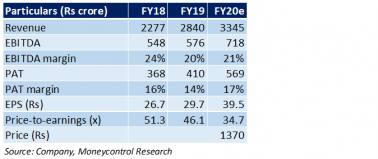

The stock has had a steady run over the past months. At current prices, it is trading close to its 52-week high, valuing the company at 35x FY20e earnings, which seems a tad at the higher end. With a strong future order book and normalisation in the domestic business during Rabi season, we expect the strong show to continue.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.