Highlights

- Disappointing numbers from auto majors in all segments

- Economic slowdown, new axle load norms, tight liquidity and non-availability of finance weigh on CVs

- Passenger car segment did relatively well, three-wheelers posted strong growth- Two-wheelers continue to hit speed bumps

--------------------------------------------------

The auto sector, especially the commercial vehicle (CV) segment, continues to gasp for oxygen. There seems to be no respite due to weak macro environment and regulatory framework. Auto majors have, however, seen some recovery in passenger vehicle (PV) and three-wheeler (3W) segments.

Pre-buying ahead of BS VI implementation is a critical catalyst. Additionally, higher reservoir levels, adequate soil moisture condition and an improved MSP of Rabi crop are expected to augur well for tractor and two-wheeler (2W) demand in the next few months.

Commercial Vehicle – A big drawdown

Economic slowdown, liquidity crunch and non-availability of retail finance have all led to a significant decline in demand within the segment. This got further aggravated by the axle load norms, which increased carrying capacity in M&HCV (medium and heavy commercial vehicle) segment. However, on a month-on-month basis, there has been improvement in demand, which has led to low inventory as well. According to Tata Motors management, this is on the back of fleet owners realizing the economic benefits of replacement of their older vehicles. The management also indicated that the overall system stock is now at a multi-quarter low, which coupled with increasing enquiries, and the government's thrust on infrastructure investments, will help firm up volumes and realisations in coming months.

Company-wise, Tata Motors registered a 17 percent year-on-year (YoY) decline in CV volume led by 38.2 percent decline in M&HCV segment and 8.8 percent in LCV (light commercial vehicle) segment. Eicher Volvo also witnessed a decline of 25 percent. Ashok Leyland’s and M&M’s CV volume came off by 25 percent and 12 percent, respectively.

Cars did better

Car segment did relatively well. The leader, Maruti, posted a meagre decline of 1 percent in volume for November. M&M’s passenger car segment witnessed a decline of 9.6 percent (YoY). Tata Motors, however, disappointed with sales declining by 38.8 percent in the month.

Lacklustre demand in the space is due to increase in total cost ownership led by mandatory long-term insurance. Further, implementation of safety norms has led to increase in prices and impacted sales amid weak consumer sentiment.

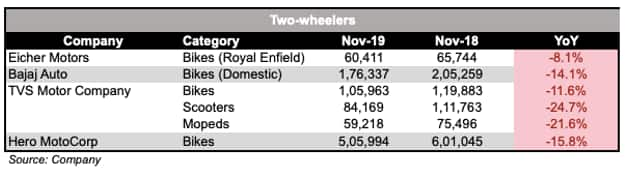

Two-wheeler (2W): Disappointment galore

Hero, the leader in the space, witnessed a sharp decline of 15.8 percent in volume. Bajaj Auto and TVS witnessed a drop of 14.1 percent and 19 percent, respectively. The figure for Eicher, the leader in premium bike segment, fell 8.1 percent.

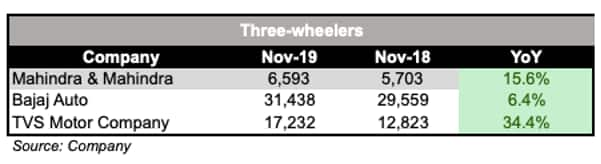

Three-wheeler (3W): Strong numbers

The overall 3W market posted strong numbers in November 2019. TVS clocked the highest growth of 34.4 percent among the three players. M&M’s grew 15.6 percent. Bajaj Auto, the leader in the space, recorded a growth of 6.4 percent.

Tractors: Muted farm sentiment hit demand

Delayed rainfall, and uneven rainfall distribution have played spoilsport for the tractor segment. Escorts logged a decline of 3.4 percent and M&M 18.9 percent. The M&M management expects that higher reservoir levels, adequate soil moisture condition and a better MSP of Rabi crop are good signs for tractor demand in the next few months.

Exports: Mixed sentiment

Export numbers are mixed for November. Eicher, TVS and Bajaj Auto notched up a growth whereas others saw a decline in monthly numbers.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.