Nitin Agrawal

Moneycontrol Research

Highlights:

- Leadership position in manufacturing spring for CV

- Raw material continues to be a near-term concern

- Multiple long-term growth drivers in place

- Attractive valuations --------------------------------------------------

Jamna Auto Industries (JAI), a leading spring manufacturer and supplier to commercial vehicles (CV), has a dominant position in its product market segment, robust client base and strong financial performance to back its credentials. The recent correction in stock price on the back of soft demand outlook has made the valuations attractive for long-term investors.

Leadership position

JAI is the undisputed leader in domestic CV spring segment. It is the largest spring manufacturer in India and 2nd largest manufacturer in the world. It has a domestic market share of more than 70 percent as of Q2 FY19. Further, the company supplies to the leading names in the industry.

Focus of technology

JAI continues to put lots of efforts on technology through its research and development (R&D) to keep itself ahead of others. The efforts are visible in its superior product quality and the trust it earns from its customers. JAI gets technical competence thanks to its technical association with Ridwell Corporation, USA, global leader in design and manufacturing of Air Suspensions and Lift Axles. It has also signed an agreement with Tinsley Bridge, UK, for technology transfer.

CV industry outlook – sluggish in the near term

JAI’s financial performance is directly linked to the growth in the CV segment. CV demand has been strong and is outperforming the industry growth for last couple of years.

The near-term outlook for CV demand is muted on account of multiple challenges led by slower growth, liquidity concerns and the rise in interest rates. While the long-term outlook continues to be positive on the back of expectation of strong economic growth, focus on rural economy and infrastructure.

Further, BS VI emission norms, to be implemented from April 2020, are expected to lead to pre-buying. Additionally, the government’s scrappage policy would potentially lead to the replacement of 200,000-300,000 trucks which are over 20 years old. These regulatory changes are expected to augur well for JAI.

Immune to EV

JAI is likely to remain immune to upcoming EV (electric vehicle) disruption, as its product portfolio is unaffected by adoption of EV.

Aftermarket opportunity – another leg for growth

JAI has a decent presence in domestic spring aftermarket (15-18 percent market share). Post-GST, it has been witnessing a strong demand in aftermarket led by a shift from unorganised to organised players. JAI now focusing extensively to expand its distribution network and plans to reach the target of 30-35 percent market share in next couple of years.

Adoption of parabolic leaf springs

There is an increasing adoption of parabolic leaf springs by major OEMs on the back of the need for lighter products ahead of Bharat Stage (BS) VI adoption. This augurs well for JAI as it has greater dominance there with more than 90 percent market share.

Capacity in place

In terms of capacity, JAI is the second-largest manufacturer across globe with an installed capacity of 240,000 units across its 9 manufacturing units. In order to cater to rising demand, it has two upcoming plants, one each in Indore and Adityapur.

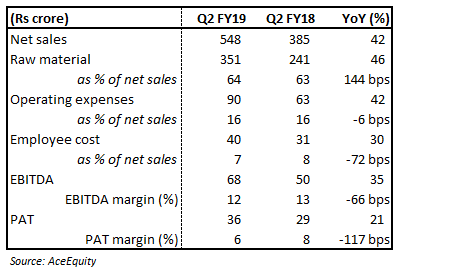

Strong Q2 FY19 performance

Net sales clocked year-on-year (YoY) growth of 42 percent on the back of strong demand coming in from M&HCV (medium and heavy commercial vehicle), which witnessed a YoY production growth of 38 percent during the same period. What continues to trouble the company is the sharp rise in RM (raw material) prices. RM prices as a percentage of net sales went up 144 bps leading to earnings before interest, tax, depreciation and amortisation (EBITDA) margin contraction of 72 bps (YoY). Fall in margin was arrested by operating leverage, lower operating and employee costs. Profit-after-tax (PAT) also witnessed a strong YoY growth of 21 percent.

Valuation – at attractive levels

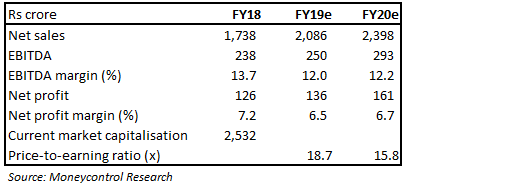

Amid market volatility, stock price has corrected 37 percent from its 52-week high making the valuations very attractive. It currently trades at valuations 18.7 and 15.8 times FY19 and FY20 projected earnings. We advise investors to buy the stock for long term.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.