RBI’s policy action sets a broader direction for interest rates, but yields are also a function of demand and supply of bonds. In that regard, the fiscal deficit and Government borrowing becomes an important variable, and the Union Budget 2024 didn’t let the bond market down. India's 10-year government bond (G-sec) yield fell to 7.06% to a near 6-month low following the budget announcement.

Government sticking to the path of fiscal consolidation in an election year is a big positive. Adhering to its glide path to attain a fiscal deficit of 4.5% by FY26, the fiscal deficit is pegged at 5.1% of GDP for FY25 much lower compared to the revised estimates 5.8% for FY24. Moreover, the Government’ gross and net borrowing is budgeted at Rs 14.13 lakh crore and Rs 11.75 lakh crore respectively for FY25.

The lower gross borrowing for FY25 compared to planned market issuances of Rs 15.4 lakh crore for FY24 is welcome news and will not crowd out private credit. Moreover, the demand for G-sec is likely to be buoyant in FY25 due to India’s inclusion in global bond index. The favorable demand -supply dynamics will continue to exert downward pressure on yields.

Fiscal prudence and easing inflation outlook to aid lower rates

RBI’s target for CPI inflation is 4% within a band of +/- 2%. India’s CPI inflation accelerated to 5.69% in December’23. However, the good part is that core CPI inflation which excludes food and fuel items from CPI inflation basket has fallen to 3.77% in December’23, much lower than 6.1% level seen in February’23.

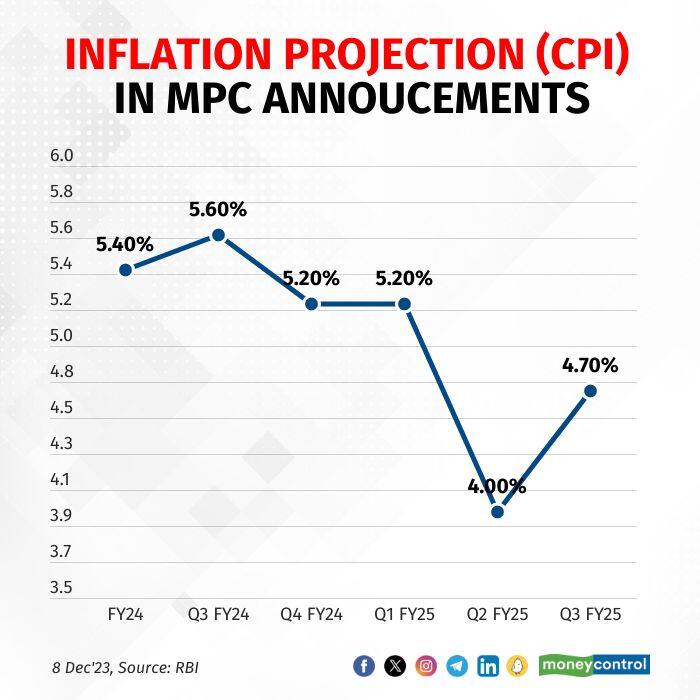

RBI’s inflation projection for FY24 is at 5.4% and is projecting average headline inflation to soften in FY25 to 4.5% despite potential risks of below normal monsoon and volatile food prices.

The MPC members have often expressed comfort around a real rate of around 1.5%. The real rate which is Repo rate (6.5%) minus one year ahead CPI inflation (4.5%) is now 2% against RBI’s comfort level of 1.5%. Hence, there is room for rate cut for 50 bps. RBI’s monetary policy will leverage on the fiscal restraint shown by the central Government and likely deliver rate cuts in second half of CY24.

Banks will be key beneficiaries

The lower G-sec yields will boost non-interest income of banks. The mark-to-market (MTM) gains on the bond portfolio (SLR securities) will support the profitability of banks at a time when margins are under pressure due to sluggishness in deposit growth. The non-interest income will be a lever to improve ROA (return on assets) especially as credit cost is at a decadal low and further improvement is unlikely.

SBI will be among the key beneficiaries of the fiscal prudence and also stands to benefit from increased capex to Rs 11.11 lakh crore which will drive credit demand. Large private banks also stand to gain especially Kotak Mahindra Bank as large chunk of its investment portfolio (around 81%) is lying in trading book (AFS+ HFT category) on which it will see MTM gains.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.