Neha DaveMoneycontrol Research

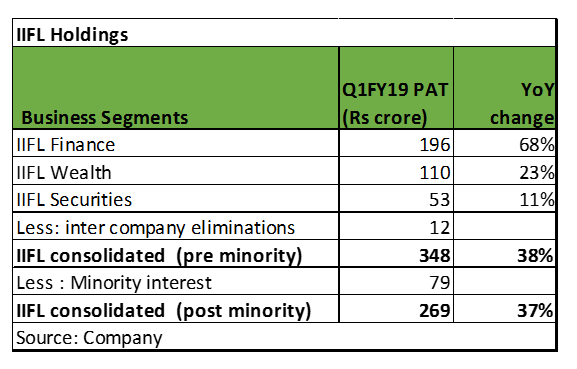

IIFL Holdings, one of the fastest growing NBFCs in the country, reported a 37 percent year-on-year growth in its consolidated net profit (after minority interest) for the June quarter to Rs 269 crore.

The NBFC has three main core businesses -- IIFL Finance (loans and mortgages), IIFL Wealth (wealth and asset management) and IIFL Securities (equities, investment banking, and commodities).

These three business segments will be listed as separate entities on completion of the proposed restructuring.

IIFL Holdings' strong performance in the first quarter of the current fiscal year was driven by robust growth in its lending business and the increased scale of its wealth management business.

The company's income from capital markets grew at a slow pace, largely due to the pressure on yields in its broking business.

While IIFL holdings has progressed well across business segments, we are most excited about its wealth management business.

The phenomenal growth in wealth management assets and alternative investment funds (AIF) have been key catalysts for the company's growth over the last two years.

The void created by the exit of a few foreign banks in the wealth space has been smartly captured by IIFL Wealth.

Going forward, we see its wealth assets steadily increasing as the under-penetrated wealth market grows in sync with India's economic growth and rising income levels.

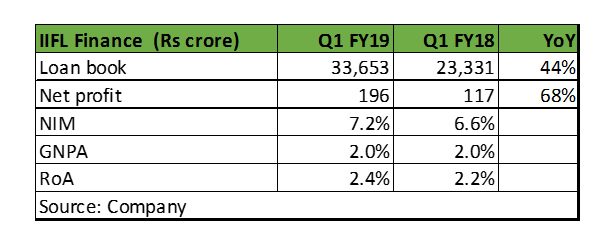

IIFL Finance Q1 – Robust loan growth continues

With a loan book size of Rs 33,653 crore, IIFL Finance is the key driver of both revenue and profit for the group, contributing 56 percent of its consolidated profit (before minority interest and excluding inter-company eliminations).

The lender posted a robust profit growth of 68 percent on year on the back of a 44 percent rise in the size of its loan book, a rise in net interest margin (NIM), and lower credit costs.

The company's higher operating expenses, which were 56 percent higher than in the same quarter last year, were offset by strong revenue growth, which led to an increase in profitability.

IIFL Finance's loan book is well diversified and predominantly retail (85 percent). The loan book largely consists of homes loans (28 percent), loan against property (17 percent), construction finance (14 percent), commercial vehicle (13 percent) and gold loans (13 percent).

Lending to micro, small and medium enterprises (MSMEs) and micro finance are the new focus areas for the company.

The increase in the size of its its loan book in the quarter under review came from across the board. Loans to MSMEs, micro finance loans and gold loans grew 139 percent, 291 percent and 60 percent on year, respectively, albeit on a smaller base.

Home loans, construction finance loans and commercial vehicle loans continued to grow at a fair click, while the growth in loans against property was muted at 4 percent.

Despite the company's average cost of funds increasing 20 basis points sequentially, its NIM expanded by 60 bps on year to 7.2 percent.

This was primarily due to the recognition of interest on Stage 3 assets (standard assets with potential stress) and an upfront gain on assignment under Ind AS.

Th lender's asset quality remained stable, with its gross NPA ratio coming in at 2 percent. As the NBFC moved to ECL (expected credit loss)-based provisioning norms, loan loss provisions declined 41 percent on year.

Though the performance of the NBFC has been resilient so far on the asset quality front, investors should be cognizant of fact that the lending book is relatively unseasoned and needs to be tested through business cycles.

Despite competition from private banks intensifying, we see IIFL Finance increasing its share in the overall credit pie. As such, we expect strong earnings driven by loan growth and a focus on high-yield retail segments.

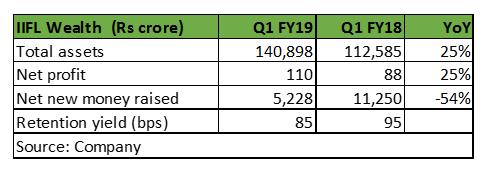

IIFL Wealth Q1: Strong fee income growth, muted fund based income.

IIFL Wealth, one of the largest wealth managers in the country, reported a rise of 25 percent year on year in its net profit for the June quarter, as the total assets it managed increased 25 percent to around Rs 1.41 lakh crore.

Around 81 percent of the company's assets were distribution assets. Its retention yield on assets was down to 85 bps at the end of Q1, compared to 95 bps last year, primarily due a to fall in its fund-based income.

IIFL Wealth now carries out the parent company's business of giving large-ticket loans to high net worth individuals. It had a loan book of Rs 5,611 crore, as at end June, 2018.

The wealth NBFC, which mainly offers loans against securities, saw its loan book grow 56 percent year on year. However, it was around 16 percent lower on a sequential basis.

The company's management preferred to go slow in the light of rising borrowing costs and guided that it will prefer the loan book to be around 5-6 percent of its total wealth AUM.

Net new money raised fell 54 percent on year in the quarter under review. The management attributed the slowdown to a fall in inflows from abroad due to the regulatory changes relating to NRI investment in AIFs.

We are not very concerned about the fall in net new money as the outlook for the wealth management sector is promising. IIFL Wealth recently raised Rs 746 crore at a valuation of Rs 14,600 crore, which is 38 times its FY18 net profit.

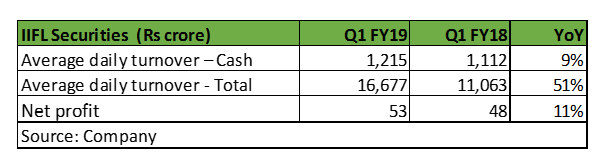

IIFL Securities Q1: muted performance as pressure on broking yields continue

IIFL Securities, a key player in both retail and institutional broking, reported earnings growth of 11 percent year on year. Despite turnover rising, the growth in broking revenue was a mere 2 percent due to a drop in commission yields.

The capital market-related business is relatively small and accounted for only 15 percent of the company's consolidated profit.

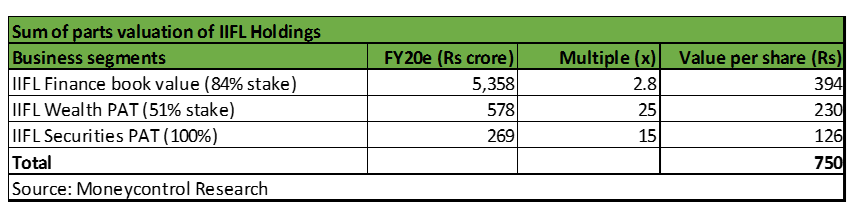

Fairly valued, buy for wealth franchise

IIFL Holdings, with diversified business segments, has many growth drivers and remains a key beneficiary of increased penetration of financials services.

We see profitability improving for the NBFC on the back of strong growth in its loan book, buoyant capital markets and growing wealth and asset management businesses.

On the consolidated level, IIFL Holdings delivered a strong performance with a return on assets of 2.4 percent and a return on equity of 20.3 percent.

However, the stock seems reasonably valued at its current level, offering little upside. Having said that, the recent capital raising exercise further enhances the NBFC's ability to expand its wealth franchise and can result in higher profitability in the future.

So investors with a long-term horizon wanting exposure to a valuable wealth franchise and a growing lending business, should consider buying into the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!