Highlights

Engineers India (EIL; CMP: Rs 198; Market Cap: Rs 11151 crore; Rating: Overweight) has reported a strong set of numbers for the June quarter of FY26, underscoring improved execution across its core consultancy and turnkey segments. With order inflows broadening beyond hydrocarbons and its entry into nuclear and clean energy, the company appears well-positioned to deliver sustainable growth. A healthy balance sheet and reasonable valuations add comfort to the earnings outlook.

Results analysis

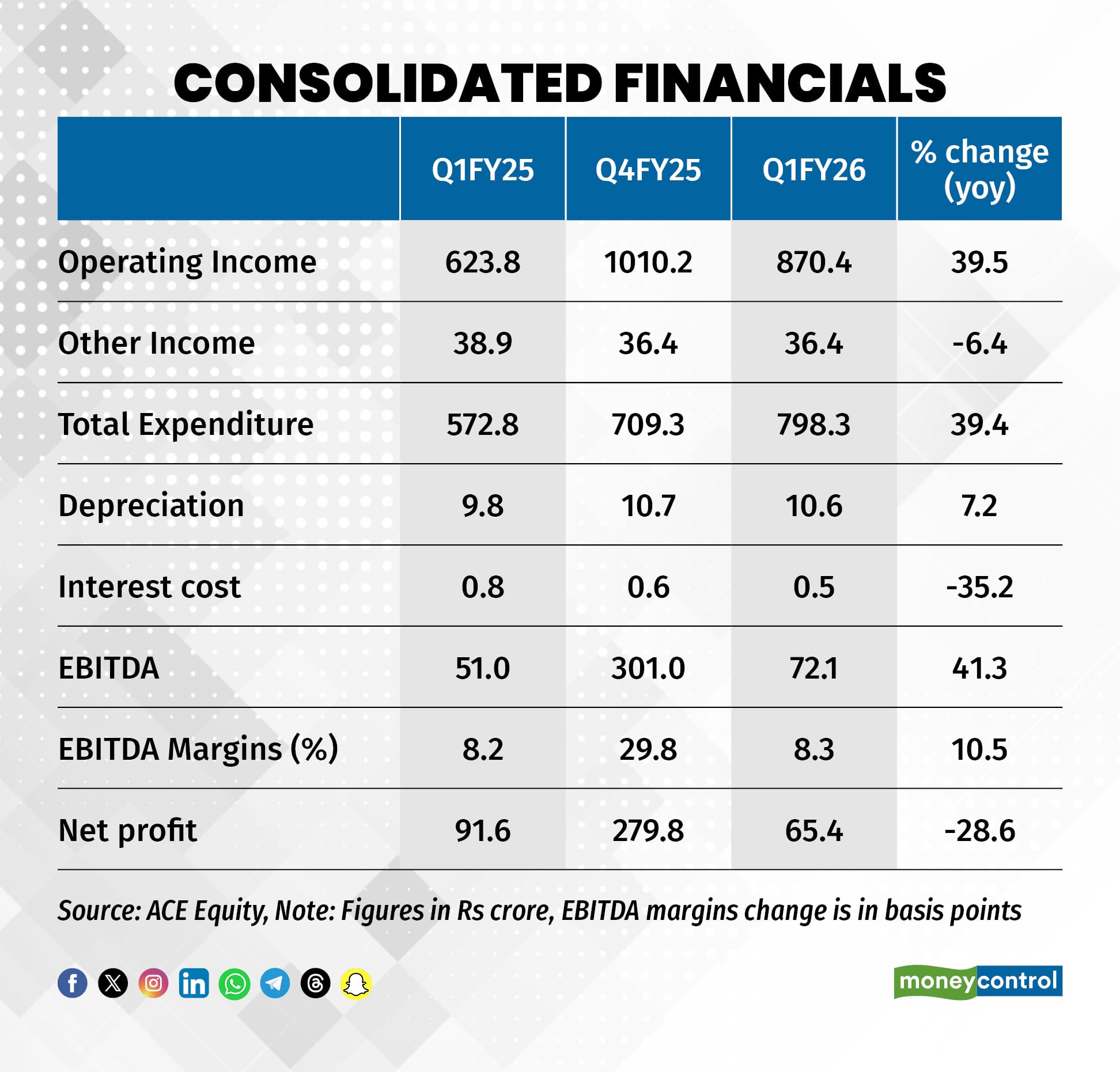

Execution picked up significantly in Q1FY26, with revenues growing by 39.5 percent year-on-year to Rs 870 crore, aided by better-than-expected order execution in turnkey projects, where revenues grew by 70 percent year on year. Profitability was equally robust, with EBITDA rising 41 percent year on year and margins at 8 percent. The consultancy business margins improved to 16.7 percent, a 160-basis points expansion compared to last year, supported by higher order inflows and pricing.

Turnkey projects, which typically carry lower margins, maintained stability at 5-7 percent, reflecting disciplined bidding and execution strategies.

Earnings Outlook

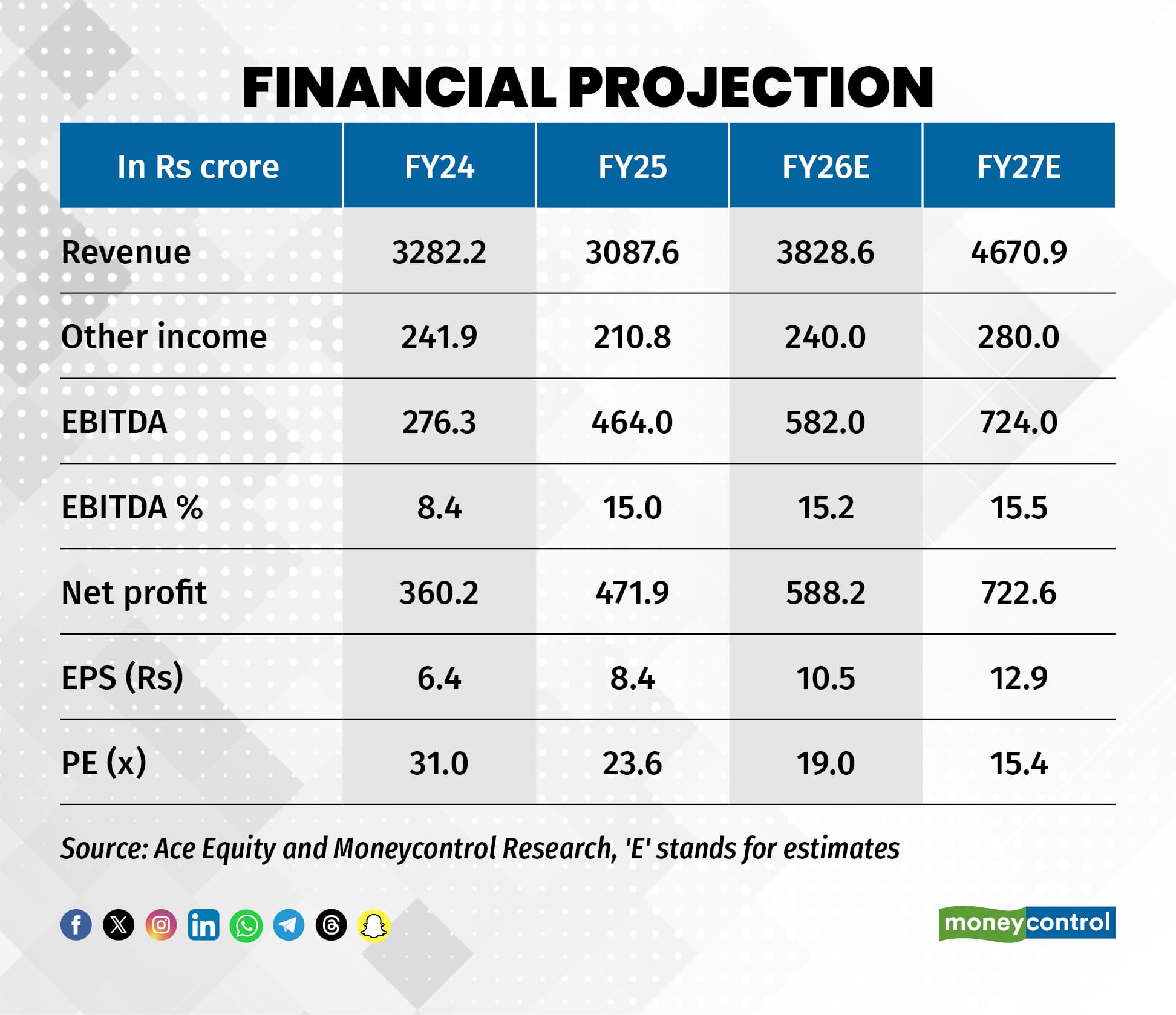

EIL has guided to a 15-20 percent revenue growth in FY26, broadly in line with FY25, with order inflows expected to remain steady. Importantly, the company’s diversification is beginning to deliver results. Nearly 40 percent of the order book now comes from non-hydrocarbon sectors, with EIL foraying into the nuclear segment through a contract awarded by NPCIL. This move not only reduces reliance on hydrocarbons but also positions the company in a strategic growth area with long-term potential.

Internationally, EIL continues to build scale, with nearly Rs 950 crore of orders booked so far this year, driven primarily by the Middle East, which remains a strong geography. Domestically, refinery and petrochemical investments remain robust, while opportunities in infrastructure and energy transition projects offer incremental upside. The management’s medium-term target of achieving Rs 5,000 crore turnover (Rs 3282 crore in FY25) by FY28 reflects its confidence about execution and strong orders in hand. The company is sitting on an order book of close to Rs 12100 crore (up 26 percent in last one year) which is 3.7 times its fiscal 2025 revenues.

Valuations

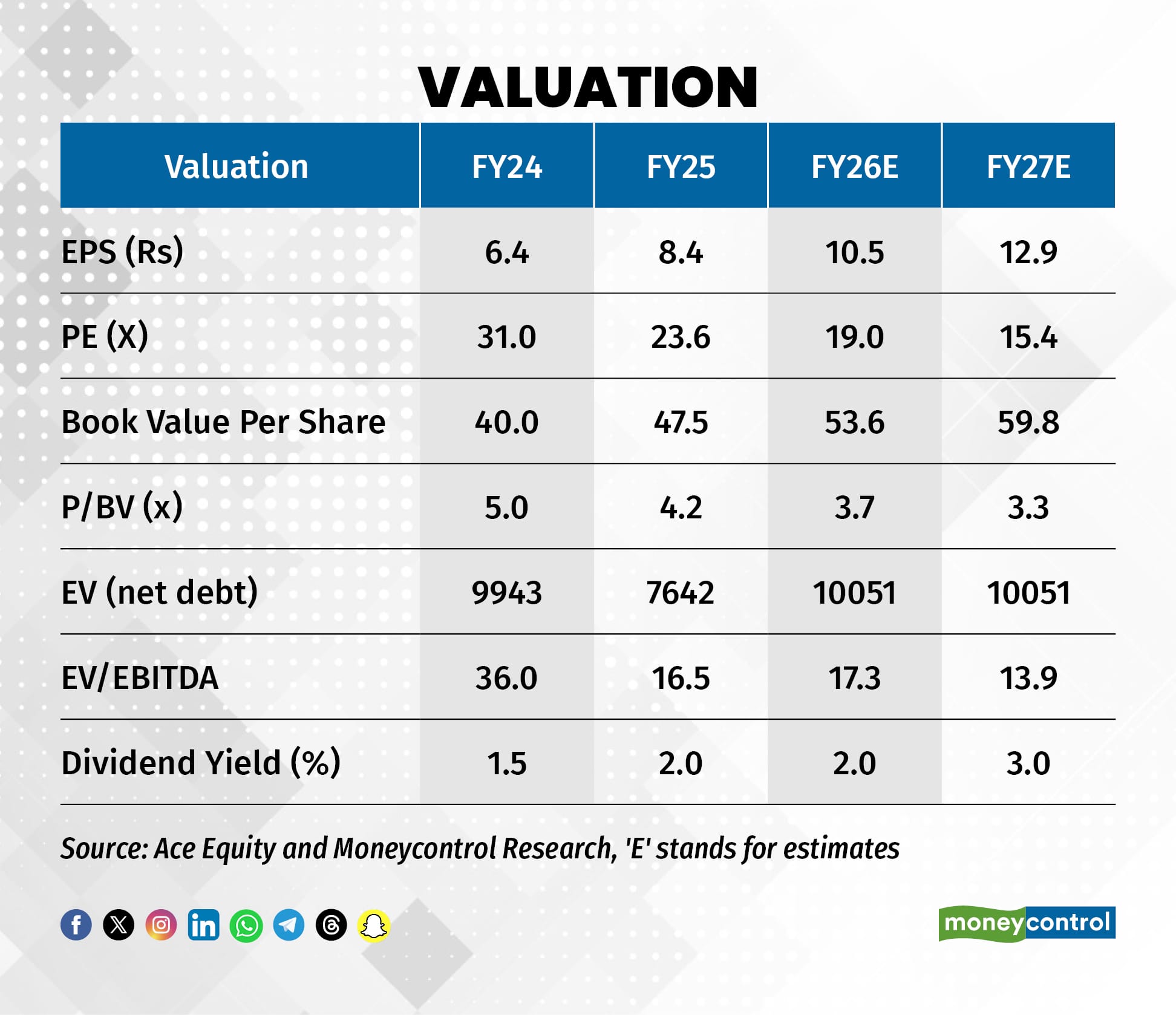

After a sharp correction, EIL now trades at around 15 times its FY27 estimated earnings, which is quite good considering the earnings visibility, sector diversification, and strong balance sheet. In the long term, the company should benefit from a robust order book in both hydrocarbon and non-hydrocarbon projects, improving consultancy business, and new opportunities in the energy transition space.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.