Krishna Karwa

Moneycontrol Research

Highlights:

- Positives discounted in the stock price

- Healthy topline traction seen across segments

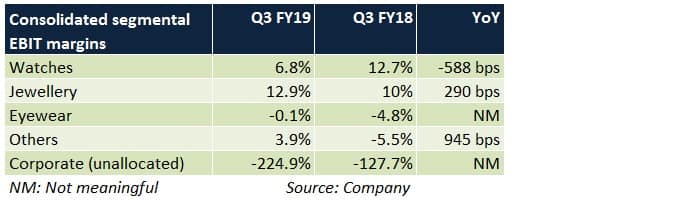

- Jewellery margins improved; watches and eyewear margins subdued

- Store additions and product launches will be key revenue drivers

- Product mix and cost rationalisation should boost margins

--------------------------------------------------

In Q3, Titan Company witnessed revenue traction across all segments: jewellery, watches and eyewear. Despite a sharp uptick in jewellery margin, overall profitability was not up to the mark because of margin contraction in watches and eyewear.

Tanishq jewellery store additions, availability of new variants across the three segments, changes in product mix and cost management initiatives will drive growth going forward. However, the stock trades at a steep valuation and is at a 52-week high. This leaves little room for a major upside in the near future.

As of Q3 FY19-end, the company’s 1,600 exclusive stores, located in 281 Indian cities and towns, cover approximately 2 million square feet of retail area.

Q3 analysis

Positives

- Strong sales growth in all the three segments

- Operating leverage seen in jewellery. This was attributable to revenue traction in new stores, higher gross margin, lower discount days, recovery of Rs 18 crore of inventory losses (from Q2 FY19) and lower promotional spends

- Corporate assets rose due to surplus cash reserves

Negatives

- Consolidated margin was flat

- Heavy advertisement spends led to a big dip in watch margins

- Eyewear segment reported a loss

Observations

Jewellery

- Around 40 new Tanishq outlets will be added each fiscal. Most of these will be opened under the franchise route to limit capex

- The contribution of high-value studded and diamond jewellery, which stood at roughly 25 percent of jewellery segment's sales in Q3 FY19, is slated to increase to nearly 40-50 percent (on a yearly basis) over the next 4-5 fiscals. Owing to higher realisations, margins should move up

- In gold jewellery, customer acquisitions under the Golden Harvest Scheme (GHS) and exchange programmes will be crucial in driving revenue growth. GHS allows buyers to purchase jewellery in instalments, whereas exchange schemes (at specified intervals during the year) enable customers to get new, refurbished ornaments by exchanging their old ones

- To refresh the product portfolio, new varieties of jewellery (under categories such as gold, wedding, diamond, silver, plain) would be introduced from time to time

Watches

- Supply-chain consolidation should reduce redundancies and save distribution costs

- Most of the new collections will be in the digital smartwatch category, one of the fastest growing areas in this segment currently

- Impetus will be laid on driving sales from large format stores and e-commerce channels in particular

Eyewear

- New products will be launched at competitive price points to gain market share. Therefore, revenue growth will be predominantly volume driven

- The company's frame manufacturing facility is likely to commence operations. Reduced dependence on external suppliers bodes well for margins

- The management aims to increase the customer base to 3.7 million by FY19-end and 10 million by FY23-end (from 2.4 million in FY18)

- Attempts are being made to normalise advertising costs (as a percentage of sales)

Others

- SKINN, a perfume brand, has been well-received in department stores and multi-brand outlets because it is well-priced versus the competition (i.e. compared to 60-70 foreign brands). It is already a Rs 100 crore brand. To enhance brand visibility, extensive marketing will be undertaken

- Taneira, a saree brand, is expected to gain scale. The company has tie-ups with more than 300 vendors to source sarees from 50 weaving clusters. The number of brick-and-mortar stores (four at present) may also increase in due course

Risks

- Reintroduction of Prevention of Money Laundering Act, 2002 (PMLA) provisions could dampen jewellery demand . Moreover, seasonality (H2 of a fiscal year is better than H1) is high in this segment on account of festivities and weddings

- The eyewear segment has been struggling to remain consistently profitable

- On account of heavy investments in promoting the luxury watches space, especially the Favre-Leuba brand, there isn’t much to look forward to on this front for the next few years

- The company still has Rs 46 crore worth of exposure to Infrastructure Leasing & Financial Services (IL&FS)

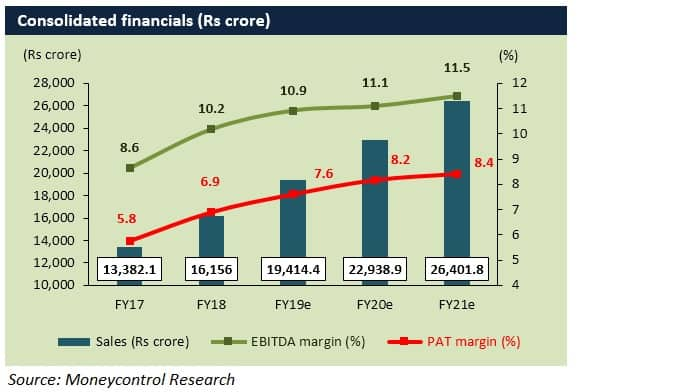

Outlook

- The stock trades at 41.6 times its FY21 estimated earnings. Thanks to a robust set of Q3 numbers, the stock is at a 52-week high

- Most of the above-mentioned investment moats are comprehensively captured in the price

- The scope for any further meaningful re-rating appears limited.- Investors should consider buying the stock only on dips

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!