Sachin Pal

Moneycontrol Research

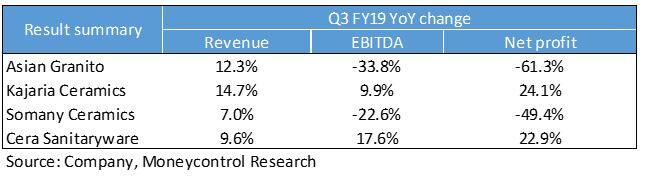

Companies in the tile and sanitaryware space had a mixed Q3 FY19. Growth in topline was primarily aided by healthy consumer demand during the festive season. Recent price hikes along with softening commodity prices and strengthening of the rupee versus the dollar lent support to operating margins on a sequential basis. Margins, however, continued to remain under pressure on a yearly basis.

Festive demand drives topline

Organised players continues to face a tough operating environment amid heightened competitive intensity from unorganised players. Growth in Q3 was aided by the timing of festive season (Diwali falling in November last year compared to October in the preceding year), which led to a shift in demand. While Kajaria Ceramics and Cera Sanitaryware delivered a healthy performance in topline as well as bottomline, Somany Ceramics as well as Asian Granito India witnessed a decline in operating profit despite a decent increase in revenue.

Asian Granito’s eight percent year-on-year (YoY) increase in volume was on account of higher share from the trading business. The same for Kajaria was much stronger than competitors and stood at 16 percent for Q3 FY19. In comparison, Somany’s strategy of rationalising its working capital continued to impact its sales volume, which came in softer at 8 percent.

For Cera, topline growth of 10 percent was driven by strong growth in its faucets segment, which increased more than 20 percent YoY. However, the increase in sanitaryware revenue was muted at five percent.

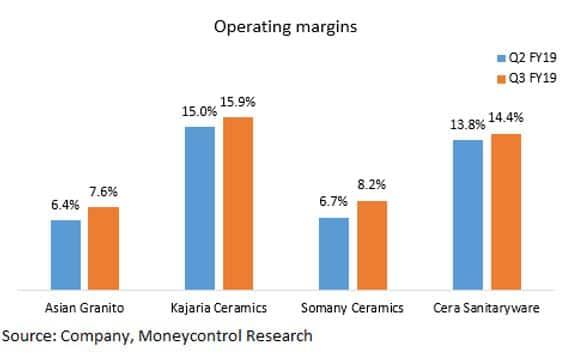

Margins improve sequentially

Rising raw materials prices have been hampering margins across the building materials industry. Operating margins for all tile and sanitaryware manufacturers have come under pressure as natural gas prices (linked to crude oil and dollar-rupee rate) have risen sharply in the past one year. Natural gas is a major constituent of tile manufacturing process. However, it forms a very small constituent in sanitaryware manufacturing.

Margins in Q3 came in better for all the players as stabilisation in power and fuel cost and price hikes aided improvement in margins. Besides, Cera also benefited from weakness in metal prices (mainly copper), which alleviated cost pressures in its faucets business (23 percent of revenue).

Real estate market remains subdued

The building materials industry has had a challenging operating environment over the past 12-18 months. The combination of high competitive intensity, subdued real estate demand and elevated input costs has had a compounding effect on profitability of the industry. However, the softening of commodity prices (oil as well as metal) and strengthening of the rupee appears positive as this paves the way for margin improvement.

The residential real estate sector witnessed a declining trend in new launches as the inventory pile-up continues to remain at elevated levels, given the lack of demand from mid- to high-end customer segments. The ongoing liquidity squeeze (emerging from the fall out of IL&FS) has further dented the fortunes of real estate developers. The sector has been lagging for the past 5-6 years and a revival seems around the corner as the government is taking various initiatives (interest subsidies and GST rate cuts) to sweeten the deal for new homebuyers.

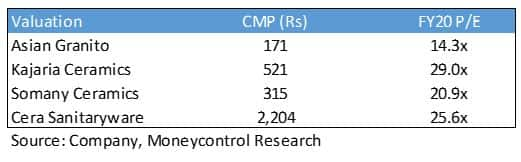

Prefer Cera and KajariaThese organised players enjoy a strong brand recall and are augmenting their distribution network to gain further scale. We remain sanguine on the long-term prospects of all four players but remain selective in terms of stock picks within the sector as the current market is witnessing a flight to quality.

Somany’s business appears to be undergoing business transition as the management continues to tighten its working capital cycle, which would take one-to-two quarters more for stabilisation. On the valuation front, Asian Granito appears cheapest among the lot but the emergence of corporate governance issues after the arrest of CEO will continue to have an overhang on the stock in a volatile market environment.

Cera’s operating performance was stronger in comparison to others but the core business (sanitaryware) had a sluggish quarter. While the sanitaryware business is anticipated to growth in mid-to-high single-digits, its future earnings will be driven by newer product segments (tiles, faucets, water heaters, wellness, etc), which continue to gain market traction.

Among the four companies in the tiles and sanitaryware segment, Kajaria’s resilience in terms of topline and bottomline has been quite noteworthy as the company has delivered higher volume growth than its competitors as well as the industry. Also, the company has been able to arrest the fall in its margin through strict cost control measures.

Kajaria as well as Cera are our preferred picks from the sector as the resilience in their operational performance indicates the management’s execution capabilities in a tough market environment. Although both the stocks seems fairly priced at current valuations (Kajaria: 29 times and Cera: 26 times estimated FY20 earnings), they would continue to command a premium to their competitors. Long-term investors should keep on accumulating them on dips.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!