Nitin Agrawal

Moneycontrol Research

Baja Auto had started to stabilise as was evident from the Q4 FY18 numbers, but hit a speed bump in Q1 FY19. While the company reported a significant increase in volume and revenue, operating margin was marred by an adverse product mix and price cut undertaken by the management in the entry level motorcycle segment. Though export markets have stabilised now and reported strong volume growth, we tread with caution as we are skeptical about challenges on the margin front as it tries to grab market share.

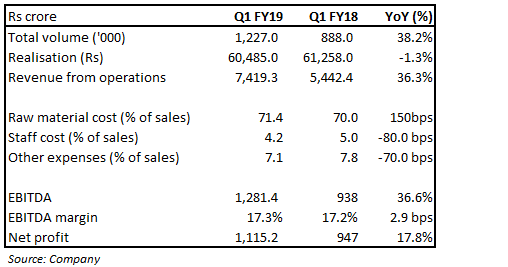

Quarter in numbers

Operating revenue witnessed a 36.3 percent year-on-year (YoY) growth on the back of strong volume growth (38.2 percent). Average realisation, however, declined 1.3 percent YoY due to adverse product mix.

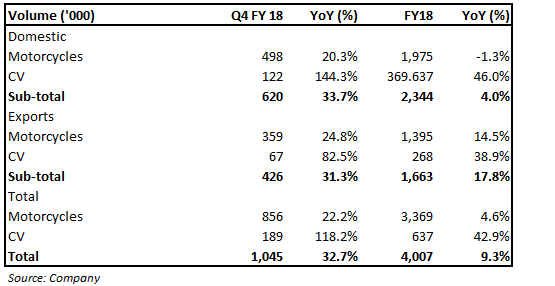

Firing on all segments In terms of quarterly performance, Bajaj Auto registered an overall volume growth of 38.2 percent YoY, aided by a 43.8 percent growth in the domestic market (39.3 percent in motorcycles and 80.4 percent in three-wheelers) and 31.4 percent growth in the export market.

In terms of quarterly performance, Bajaj Auto registered an overall volume growth of 38.2 percent YoY, aided by a 43.8 percent growth in the domestic market (39.3 percent in motorcycles and 80.4 percent in three-wheelers) and 31.4 percent growth in the export market.

Volume growth in the motorcycle segment was led by price cut taken by the management in entry variants and strong demand for mid-executive and premium bikes. 3Ws continue to do well with the end of ‘Permit Raj’.

The company achieved its highest ever quarterly volume in the export market, driven by strong demand accruing from Nigeria, a key market.

Operating performance marred by price cutsIn a quest to gain market share in the entry-level motorcycle segment, the management had undertaken price cuts. This impacted earnings before interest, tax, depreciation and amortisation (EBITDA) margin negatively, which stood at 17.3 percent, flat YoY but down 210 bps quarter-on-quarter (QoQ).

This was further impacted by a rise in raw material (RM) prices. The management said it has passed on the rise in RM prices in all segments other than the entry-level motorcycle segment. It said the price hike impact should get reflected next quarter but the entry-level segment would continue to weigh on margin.

Factors to watch out for

Domestic motorcycle segment: Focus on market share

Investors have been worried over the company’s domestic position and significant loss of market share. With the dust settling down in the automobile industry, it witnessed strong growth in the domestic segment in Q1 FY19.

Bajaj Auto outperformed industry growth (19 percent) in volume terms. This helped the company gain 230 bps market share which now stands at 16.3 percent. This was, primarily, fuelled by a 74 percent YoY volume growth in entry-level bikes, which grew on the back of its pricing strategy. The management said it would continue to focus on buying market share in this segment. It has guided to achieve 20 percent market share in the motorcycle segment by FY19 end and has a long-term target of 24 percent.

Operating margin to remain under pressure

EBITDA margin has come off from around 20 percent levels it achieved in the last few quarters owing to negative pricing actions undertaken by the management in entry-level bikes. However, it indicated that negative pricing action exist only on 14 percent of total turnover, which could be offset by margins in the premium segment.

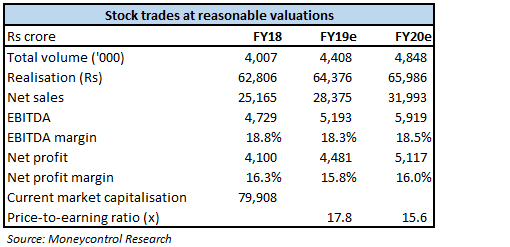

The management sees pricing action continuing for may be 2-3 years, depending on market forces. We feel this might fuel the price war within the 2W industry, hurting all players’ profitability, including Bajaj Auto. We expect the company to continue to post margin in the 16.5-17.5 percent range going forward.

Strong 3W sales to continue

The management continues to remain optimistic about the 3W segment. It believes growth from end of ‘Permit Raj’ is over and that the next leg of growth in the segment will accrue from diesel and cargo segments.

Focus on new markets

Export markets have stabilised now. The management said motorcycle exports witnessed growth on the back of strong recovery in Nigeria; focus on the sports segment in Latin America, especially Argentina; and new product launches in the Philippines and Malaysia. The commercial vehicle segment grew on the back of a recovery in Egypt and new markets. The management said it would continue to focus on export and new markets and has guided to exports of 2 million units in FY19, up from 1.6 million units sold in FY18.

Focus on 125cc and above segment

The management sees very high competition in entry bikes (100/110 cc), which is highly commoditised and offers no pricing power. In light of this, Bajaj Auto has decided to focus on the 125cc and above segment where customers are willing to pay some premium, giving it pricing power.

Efforts in the export market have started showing positive signs, with exports expected to do well going forward. Contraction in EBITDA margin and strong competition in entry-level bikes will weigh on the segment’s performance.

From a valuation perspective, the company is currently trading at a multiple of 17.5 times and 15.2 times FY19 and FY20 projected earnings, respectively.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!