Jitendra Kumar Gupta

Moneycontrol Research

While India is becoming the second largest steel producer in the world, JSW Steel emerged as the fasted growing company and gained the title of the largest steel producer. From a meagre 2.6 million tonne of quarterly run rate of steel production about three year back, the company is producing close to 4 million tonne of steel quarterly leaving behind its close competitors like Steel Authority of India (SAIL) and Tata Steel. During the quarter-ended December 2018, market share rose 80 basis points (100 bps=1 percentage point) to 13.7% in the domestic market.

Q3 FY19 result analysis

Key positives

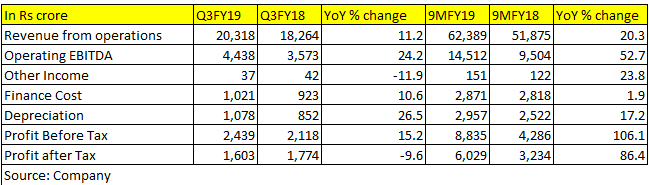

During Q3, the company reported a 3% growth in production volume. However, this did not translate into sales, considering low export demand. The company reported a 10% drop in export volumes, but part of that was compensated by a 15% YoY growth in domestic sales. Due to higher realisations, JSW Steel was able to deliver consolidated sales growth of 11.2%. Standalone realisations rose 18% to almost Rs 50,000 a tonne.

This had a positive rub off on margin. The benefits of higher production kicking in also aided margin. In Q3 , consolidated operating EBITDA grew around 17% to Rs 4,501 crore. This led to a 110 bps improvement in earnings before interest, tax, depreciation and amortisation (EBITDA) margin to 22.15%. Improving sales mix, currency depreciation and strong demand from original equipment manufacturers (OEMs) led to better pricing and thus resulted in a better margin.

Key negatives

On the operating front, the company witnessed an increase in raw material costs. Cost of blended iron ore and coking coal increased 6% and 7% YoY, respectively. While this added to the overall cost, the impact was marginal in light of the strong growth in realisations. This is also the reason why, despite the cost pressure, EBITDA per tonne rose to Rs 12,060 in Q3 FY19 from Rs 9,000 a tonne in Q3 FY18.

Key observations

While the newly acquired assets in the US and Italy are still incurring losses, the management is hopeful that with the ramp-up in production they should start making a positive contribution next year.

While the export market suffered due to various reasons, domestic demand continues to grow around 8%. During Q3, the company's domestic market share grew 80 bps to 13.7%.

OutlookSince November last year, steel prices have fallen, led by subdued demand in the international market, because of increasing supply and global trade tensions. However, the management now believes that the prices are bottoming and is hopeful of maintaining its FY19 volume guidance. While volumes growth remains reasonably strong, earnings uptick would depend on steel prices. At the current market price of Rs 279.3 per share, the stock is trading at nine times its FY20 estimated earnings and 6.2 times based on an estimated FY20 enterprise value to EBITDA, which is reasonable.

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!