Krishna Karwa

Moneycontrol Research

Highlights:

- Anup Engineering and Arvind Fashions are anticipated to trade at premium valuations in due course

- For Arvind Ltd, re-rating will be predominantly driven by earnings traction

- The demerger will help unlock value once Arvind Fashion's valuation reflects the true potential of the business --------------------------------------------------

Arvind Ltd, the textile major, first announced a plan to demerge the engineering and branded apparel divisions on November 8, 2017. After SEBI's approval, the demerger finally took place on November 28, 2018.

While Anup Engineering got listed on the exchanges on 1 March, 2019, Arvind Fashions got listed on March 8, 2019.

The core objective behind the exercise was to unlock value in each of the three verticals. Consequently, cash flows and profits from a particular segment would be utilised to fund growth strategies of the respective segment only.

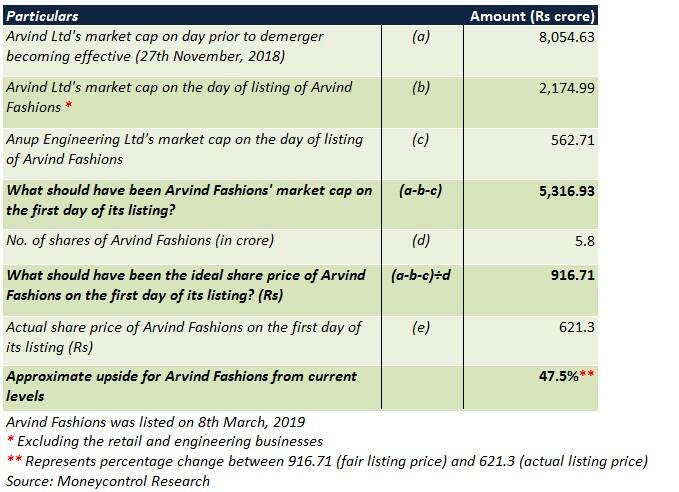

A glance at the exhibit suggests that Arvind Fashions was incorrectly quoting at the exchanges ie. at a steep discount to its fair value on the first day of its listing (March 8, 2019). Therefore, Arvind Fashions is expected to stay on an upward trajectory till its appropriate price (in our view, this will be somewhere in the range of Rs 900 – 1,000) is discovered by the Street. It remains to be seen how markets value this coveted business from Arvind Ltd's stable.

Notwithstanding the glitch, here's a glance at how the 3 businesses are shaping up:-

Arvind Ltd (excluding Anup Engineering and Arvind Fashions)

Arvind Ltd's stock price post-demerger (ie. from November 28, 2018 onwards) hasn’t had a good run. Besides market volatlity and weak Q3 numbers, here are a few concerns in the minds of investors that possibly hindered the stock's upmove:-

- High capex investments pertaining to expansion of garmenting facilities

- Steep raw material (cotton) costs that could lead to margin pressure

- Overcapacity in denim fabrics, thus resulting in lower utilisation rates

Despite the above-mentioned challenges, the possibility of the stock re-rating in the long-term cannot be ignored if there is a revival in earnings. This, in turn, would depend on the following:-

- Introduction of value-added products in advanced materials (ie. technical textiles)

- Foray into manufacturing activewear and athleisure products (fabrics and garments)

- Increased in-house captive consumption of fabrics for manufacturing apparel

Anup Engineering

Investors have been pretty bullish about the prospects of Anup Engineering because its products are pretty niche and high-margin in nature.

Besides being the third largest heavy fabrication player in India, the company caters to clients across specialised sectors such as petrochemicals, oil and gas, fertilisers and power.

Its financials are healthy too.

If Anup Engineering keeps delivering high RoCEs (return on capital employed) and generating positive free cash flows (as seen in the past) sustainably, it will command premium valuations.

Most stocks in the capital goods space have been plagued with issues such as highly leveraged balance sheets, a weak demand environment and input cost hikes, among others. So, any outperformance by Anup Engineering compared to its peers will, almost certainly, result in a big price upside.

Arvind Fashions

Arvind Fashions has shown consistent improvement in its margins since the past few quarters. This, coupled with a strong portfolio of brands and promising potential of Indian retail, caught the attention of investors. Going forward, here are the factors that will influence the company’s performance:-

- Store additions in brands and speciality retail

- Accelerated foray into leisurewear

- Operating leverage from power brands

- Economies of scale and strong private label brands in ‘Unlimited’, the affordable fashion format

Is there any value proposition in store?

For investors that held shares of Arvind Ltd pre-demerger and continue to hold them now as well (ie. after the 3 businesses are separately listed), Arvind Fashions will contribute the most in terms of value creation. In the near-term, Arvind Fashions' stock will keep rallying till it reaches its fair price.

While Anup Engineering's historical positives are already discounted in the stock's price, Arvind Ltd will have to prove its mettle convincingly.

For more research articles, visit our Moneycontrol Research page

(Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!