Sachin Pal

Moneycontrol Research

Highlights:

- Gujarat Ambuja had a strong Q3

- Focus on maize processing aiding margins and return ratios

- Capital allocation continues to improve- Trading at single-digit FY19 estimated earnings

-------------------------------------------------

Maize-processing company Gujarat Ambuja Exports (GAEL) continues to witness strong performance, aided by favourable supply-demand dynamics from its key end market. The company appears to be on a strong footing considering the uptick in maize prices, improving capital allocation, and available production capacity.

Q3 earnings highlights

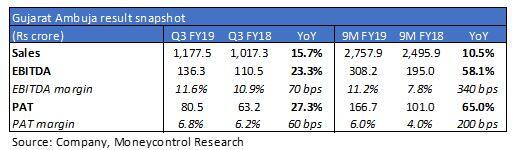

- The topline growth for Q3 was strong at 16 percent year-on-year (YoY), the operating margins further expanded 70 bps YoY on the back of higher capacity utilisation and increased contribution from manufacturing capacities. EBITDA (earnings before interest, tax, depreciation and amortization) for the quarter came in 23 percent higher in comparison to last year.

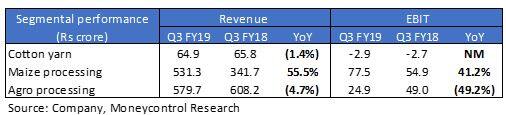

- Stellar performance from the maize processing division led the strong performance in Q3 for Gujarat Ambuja Exports. Higher capacity utilisation coupled with firm realisations drove the revenue growth of 55 percent and EBIT growth of 41 percent in the quarter gone by.

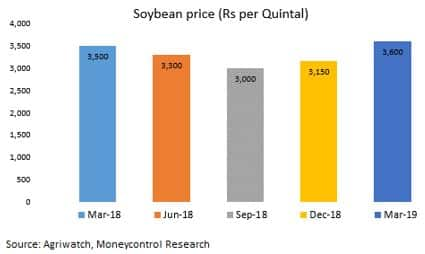

- Cotton yarn segment, which engages in the spinning, knitting and weaving of cotton, had another subdued quarter and reported a negative bottomline. The volumes as well as profits of agro processing division were hit by a combination of change in business mix and volatility in underlying commodity prices (mainly soybean).

Other Developments

- The Chalisgaon maize processing unit has seen a sharp ramp-up in capacity utilisation, which has moved higher to 80 percent within 12 months of initiation. Further, the company is planning to set up 1,000 TPD maize processing Greenfield plant at Malda in West Bengal at an estimated cost of 300 crores.

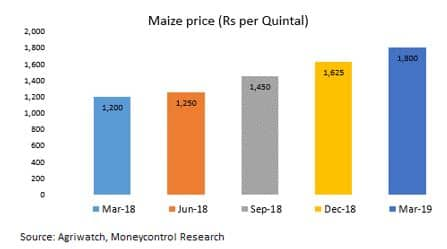

- Rainfall deficit and worm attack have impacted the production of maize in the kharif season, the supply continues to be tight and the spot prices of maize (corn) have moved higher to 17-18 Rs per kg. Amidst tighter supplies, the prices of starch (and derivatives) have also moved in line with corn. Given the constraint supply environment, prices are likely to remain firm upto Q1 FY19 until the arrival of the new crop in May-June.

- The return ratios continues to improve as the incremental capital is being directed towards maize processing division. The leverage also continues to be reasonable and the debt-equity ratio stood at 0.4x at the end of Q2 FY19 (vs 0.6x in Q4 FY18).

Outlook and Recommendation

- We remain optimistic on long-term prospects of GAEL as the business has delivered solid results in the few quarters. The near term earnings visibility remains strong on the back of strong realisations and available spare capacity. Further, the new capacity at West Bengal would enable it to pick up revenue share in Eastern region as well as tap export opportunities in as well fortify its presence in the South East Asia export market.

- Post the recent capacity expansion, GAEL (CMP: 221, Market cap: 2,535 crores) has emerged as the largest maize processor in India with total capacity of 3,000 MTPD and a market share of 21-22%. While the business has been performing well, the valuations seem equally attractive at current levels (9 times FY19 estimated earnings) considering the long headroom for growth and earnings visibility.

Read: How to identify long term winners in the consumer durables space?

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!