Highlights

Plastiblends India: Masterbatch leader posted strong margin show

Key aspects to watch: Improved balancesheet & higher promoter stake

GTPL Hathway: Topline aided by subscription revenue & EPC contractsEmami Paper Mills: Margins lift growth, but unsustainable debt

These are early days still for the Q3 FY20 results season. But there are a few companies that have bucked the broad weak trend. We have gone behind the scenes to figure out what stood the select few in good stead.

In a sluggish growth environment, operating margin is a key parameter to look at. Here, the impact of any accounting standard change and the fine print need to be factored in, without which one fails to get the big picture. Additionally, raw material-led improvement in operating margin should be closely tracked as it may not be sustainable due to the current volatility in commodity prices.

Plastiblends India (market cap: Rs 539 crore), the biggest domestic manufacturer of colour and additive masterbatches, posted a strong set of numbers on the margins front. It belongs to the Kolsite group, which is also the parent company of plastic extrusion firm Kabra Extrusiontechnik (mcap: Rs 246 crore). Its facilities in Daman, Palsana and Roorkee command an annual capacity of 1,00,000 tonne of masterbatches.

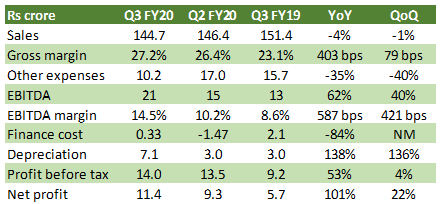

In the quarter gone by, turnover growth was broadly flat. Thanks to lower raw material cost, gross margins expanded by nearly 400 bps year on year (YoY). On account of lower other expenses, EBITDA (earnings before interest, tax, depreciation and amortization) margin rose to 14.5 percent.

This is the company’s strongest show on the margin front in the past 7 quarters and ahead of the management’s expectations of 11-12 percent for the full year. Remember, lower other expenses is also attributed to change in accounting standards (AS 116). Precisely because of this accounting standard change, other expenses fell by Rs 2.69 crore. If we don’t apply the new accounting standards, EBITDA margin for Q3 should be about 12.6 percent.

As for the bottom line, the company gained from lower taxation and interest cost partially offset by a higher depreciation cost. However, investors need to heed the following points.

The lower interest cost is a results of interest assistance under the Scheme for Assistance for Plastic Industry of the Gujarat government. During Q3 and the first nine months of FY20, Plastiblends India received a support of Rs 84 lakh and Rs 3.84 crore, respectively. Higher depreciation cost stemmed from the change in accounting standards (AS 116) leading to recognition of Rs 2.60 crore as additional depreciation expense for lease assets.

Table: Plastiblends India Q3 financials

Source: Company

Coming to balance sheet, the company saw lower debt (Rs 56 crore as of September 2019 as against Rs 105 crore in March 2018), leading to some comfort in leverage ratio (debt/equity: 0.2x). The key monitorable appears to be trade receivables, which is trending at 19 percent of trailing 12 month sales.

Notably, its promoters have been raising their stake in the company over the past few quarters. The stock has positively reacted after the results and is trading at a reasonable 12.6x FY20 estimated earnings.

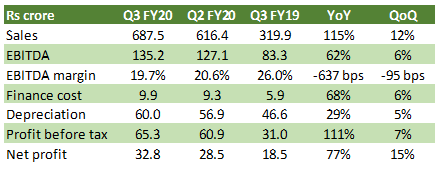

The December quarterly results of GTPL Hathway Ltd (market cap: Rs 864 crore) is another set that requires your attention. The digital cable TV and broadband service provider with a strong presence in Gujarat and West Bengal posted a healthy top line growth, mainly helped by EPC (Engineering, Procurement & Construction) contracts, which have added Rs 237.7 crore (35 percent of total sales) to the top line.

The company is a Project Implementation Agency under Gujarat Fibre Grid Network Limited for connecting villages through optic fibre cable. Excluding EPC contracts, top line growth is 41 percent YoY aided by a jump of 44 percent in subscription revenue and 46 percent in carriage sales.

Its paying subscribers (7.35 million in Q3 FY20 as against 7.45 million in Q3 FY19) have increased on a sequential basis though the number fell YoY. Broadband revenue has gone up by 17 percent YoY, chiefly led by increase in active subscribers. ARPU (average revenue per user) is stagnant at the levels of Rs 415 for the past four quarters.

In the case of EPC contracts, operating margin slightly improved to 6.9 percent from 6.8 percent in Q2 FY20. Excluding those contracts, EBITDA margin has improved by 50 bps QoQ (40 bps YoY) to 26.4 percent, driven by lower other operating expenses.

Table: GTPL Hathway Q3 financials

Source: Company

The company is utilising its cash flows for its capex plans and retiring debt. Net debt stands at Rs 186.1 crore as of December 2019 compared to Rs 217.8 crore as of September 2019, taking the debt to equity ratio to a reasonable 0.26x.

The stock is trading at 7.2x FY20 estimated earnings. The Reliance Jio owned Hathway Cable has 37 percent stake in GTPL Hathway while Jio's direct stake reads 4.5 percent.

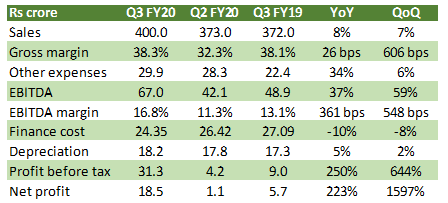

Emami group’s Emami Paper Mills (market cap: Rs 761 crore) too caught our eye. Sequentially, sales grew by 7 percent while EBITDA jumped by 59 percent, chiefly because of a drop in raw material prices (-2 percent QoQ). Bottom line was also aided by lower taxation and interest cost.

Table: Emami Paper Mills Q3 financials

Source: Company

However, we would like to qualify the results with two observations. The company made a departure from accounting standard AS-21 by not recognizing notional forex loss of Rs 12.4 crore. The justification is it presents a "true and fair" view of the financial performance and cash flow.

Emami Paper Mills is seen to enjoy a natural hedge with respect to foreign exchange losses since domestic sales price of newsprint is directly linked to the dollar price of imported newsprint. Nevertheless, if we price in forex losses, reported EBITDA margin slips to 13.7 percent slightly ahead of Q3 FY19 numbers.

Second, its debt remains elevated at Rs 1,190 crore as of September 2019. Though the figure is lower than the March 2019 level, the debt/equity ratio is at an unsustainable level of 4.8x.

Weighed down by limited financial flexibility, the company was forced to shelve its 2 lakh tonne planned greenfield project. It also faced a credit rating downgrade in 2019.

Even after the recent surge in stock prices, the stock is more than 50 percent lower than August 2018 levels. However, given the weak balance sheet, how the leverage is reduced -- at the company and the group levels -- remains to be seen.

For more research articles, visit our Moneycontrol Research page

Disclaimer: Moneycontrol Research analysts do not hold positions in the companies discussed here

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!