Madhuchanda DeyMoneycontrol Research

The recent tariff assault initiated by the United States on Chinese imports, which sparked a prompt retaliation by China, has left global investors worried. For emerging markets, reeling under the impact of the strong dollar, rising US interest rates and an end to accommodative monetary policy globally, the news of trade wars between the titans was another nail in a coffin whose lid has taken quite a hammering.

Make no mistake: This is not transient noise that will dissipate in the short term. The recent American posturing comes from a fear of China acquiring technology at a pace that could dethrone the US decisively in the coming years.

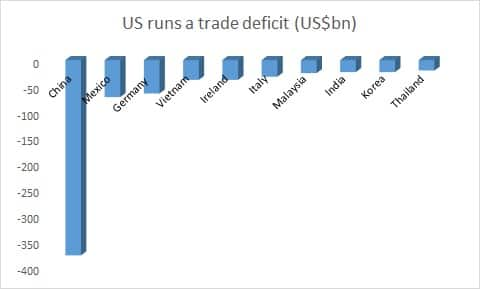

Source: US International Trade Commission

The background

In August last year, President Donald Trump formally gave the US Office of Trade the task of identifying how China was transferring US technology, “undermining US companies’ control over their technology in China”, as well as seeking to do so by acquiring US companies in the US.

The main theme of the report was that China was guilty of aggressively seeking technology transfer at the expense of US corporations, both in China and the US.

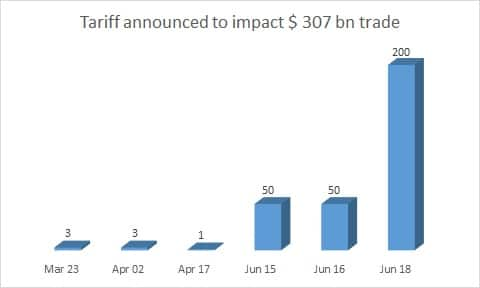

Based on the report, Trump announced plans to impose $50 billion in tariffs on 1,300 general imports from China, ranging from chemicals to jet parts, industrial equipment, machinery, communication satellites, aircraft parts, medical equipment, trucks, and even helicopters, nuclear equipment, rifles, guns and artillery. China has retaliated, resulting in a full-blown trade war.

Source: Moneycontrol Research

What is bothering USA?

The rhetoric on China is important for Trump in the run up to the November 2018 mid-term election to tout his ‘economic nationalism’ strategy. Trump’s hyperbole and bombast, designed for his domestic political base, will continue while his negotiators try to work out the China-US trade changes. It is unlikely Trump wants a China trade deal before the November polls. There’s more political traction for him in publicly bashing China on trade up to the elections.

However, China is not just about political noise. What Trump wants from US allies and trade partners are token adjustments, but with China, the issues are more strategic.

US-Trump trade objectives in its negotiations with China are threefold: first, to gain access for US multinational companies into Chinese markets, especially for US banks and shadow banks (investment banks, hedge funds, equity firms, etc.), but also for US auto companies, energy companies, and tech companies.

The second objective is to obtain some visible concessions from China that reduce that country’s goods exports to the US, without China in turn reducing US agricultural and energy related exports to China.

But the main and most strategic objective of the US is to thwart China’s current rate of technology transfer from US companies in China and from Chinese companies acquiring US companies in the US.

The key technology transfer categories are artificial intelligence software and hardware, next generation 5G wireless, and nextgen cyber-security software. The US obfuscates the categories by calling it ‘intellectual property’. But it is the latest technology in these three areas that will create industry leaders and whoever (US or China) is ‘first to market’ will dominate the industries and products for decades to come.

But the technologies further represent the key to future military dominance as well. The US is concerned that China may leapfrog into comparable military capability. China’s 2017 long-term strategy document, ‘China 2025’, clearly lays out its planning for achieving dominance in these technologies over the coming decade. So it comes as no surprise that the US has barred Qualcomm and Google from supplying chips and technology to ZTE, the Chinese device maker, for seven years.

The US defence sector wants to stop, or at least dramatically slow, China’s acquisitions of technology-related US companies. While tariffs are on paper only so far, the US has been clearly targeting China companies hunting for US acquisitions

While trade tariffs can have short-term inflationary impact on US consumers and possible diversion of some Chinese exports to other markets, blocking Chinese investments has far-reaching implications that may not get reversed.

This escalation would be damaging for the US and Chinese economies since global companies invest across the globe and any disruption can impact competitiveness.

Can the US sustain its competitiveness and spirit of innovation by erecting barriers?

This is actually the main question, and the answer is a big no. While China needs US for technology and markets, US is no less dependent on China.

The US debt to China is $1.19 trillion as of March 2018. That's 19 percent of the $6.29 trillion in Treasury bills, notes, and bonds held by foreign countries. This gives China some political leverage. If China threatens to sell part of its debt holdings, US interest rates would rise and slow economic growth.

By hurting Chinese exports, US can inflict pain on China, but the Asian giant is now working on developing a thriving domestic market and China’s share of exports to GDP at 20% is not exceptionally high and comparable to many other countries.

In fact, the strategy of protectionism might impact the US more. By undermining the World Trade Organisation, the door is now open for higher tariffs across the board and protectionism globally that could hurt US exports – the engine that Trump is trying to develop.

Inward-looking policies will be inflationary, raise interest rates and impact global growth, thereby impacting almost every country, especially the ones without a large domestic market.

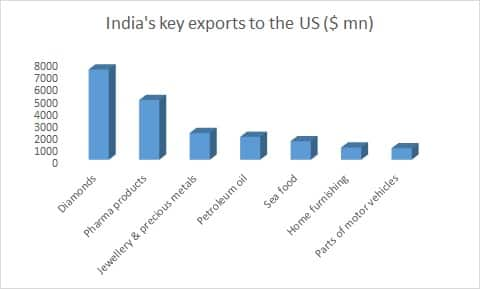

Source: Ministry of Commerce, GoI

To that extent, India too stands to lose, in addition to the immediate impact of volatile capital flows. Given that India’s exports basket to the US is vastly different from China’s, this crisis between the giants is unlikely to open near-term opportunities for India.

There is clearly a lot at stake for the two largest economies. But a trade war wouldn’t result in better protection of US technology or give American firms better access to Chinese markets. Nor would it help China to invest in America.

That said, given the slim likelihood of better sense prevailing, this is a war without a cease-fire in sight. This is a fact global markets will have to digest.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.