Madhuchanda DeyMoneycontrol Research

India’s 460-million tonne cement industry — the second largest globally — has hit a rough patch.

Demand has been growing slower than GDP, and excess supply has led to utilisation rates of less than 70 percent on an average. The industry is stuck in a low single digit growth trajectory.

To add to cement makers’ woes, raw material and other input costs have risen in the last couple of quarters. Pet coke, coal and diesel have become dearer, squeezing profit margins, even as producers in some regions were able to hike cement prices.

The cost impact was higher for cement companies in the North owing to a higher proportion of pet-coke usage and the temporary ban on usage of pet-coke. The ban would have forced them to switch to higher cost alternatives. The impact on profitability would have been higher, but operating leverage gains on higher volumes, saved the day.

The demand picture remains challenging with issues such as sand mining ban in a few states and weak construction activity, especially in housing.

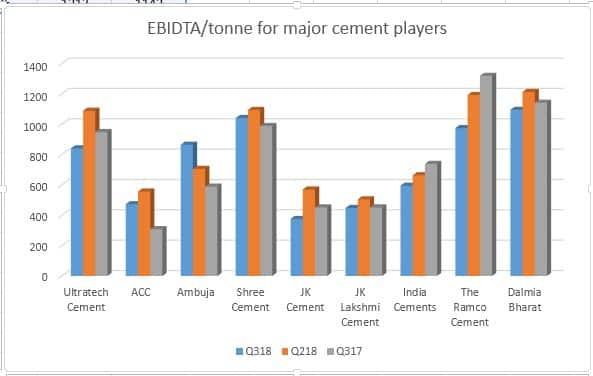

The December quarter reflected the rising cost pressure as is evident in falling profitability per tonne.

However, stronger growth in sales on account of the demonetisation in the base quarter, capacity addition for some players and inorganic growth (acquisition) for few others, softened the blow.

The cost benefit that cement companies enjoyed (power & fuel as well as freight) seems to be waning. In the absence of broad-based demand revival and valuation still reflecting optimism, investors got to place their bets wisely.

What do we like in large cap?

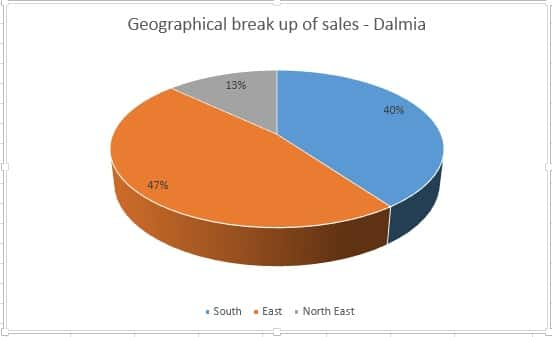

In the largecap space, we will keep an eye on Dalmia Bharat. With a capacity of 25 mt (11 plants spread across 8 states), Dalmia Bharat markets its cement in 21 states of India. It is predominantly present in south, east and north east.

Dalmia enjoys industry-leading unit Ebitda (earnings before interest depreciation & tax) as a result of its brand focus, optimisation of lead distances, blending and fuel mix, along with a turnaround of its acquired assets.

The penchant for M&A continues – it is aggressively looking at stressed cement capacities - Kalyanpur, 1.1mt in east; Murli, 3mt in the west, although recent reports suggest that they may have lost the bid to acquire Binani (domestic capacity 6.2mt in the north). While such inorganic move will increase the leverage in the books and make the business model a bit risky, the company so far has a successful track record of turning around acquired capacities.

The ongoing merger with OCL India would simplify its structure and would also be tax efficient. The company today has close to 6% market share and in future it intends to take this up to 10%.

While fiscal incentives so far enjoyed by the company would also start to come off and might result in EBITDA (operating profit) stagnating in the near future, the stabilisation of the stressed capacity should start contributing in the medium term. The stock trades 10.9X FY19P EV/EBIDTA. Should the stock correct on losing its bid to Ultratech for Binnani, it could provide a good entry opportunity.

What are we looking at in mid cap?

Sanghi Cement's 4.1 million tonnes per annum capacity plant located in Kutch, Gujarat is one of the largest single location cement plant in India.

The company is one of the lowest-cost producers among its peers. Limestone availability near its plant, installed conveyor belt, multi-fuel technology for its kiln and power plant and a 63MW thermal plant has made Sanghi Industries a low-cost producer among its peer. Further, acquisition of two ships along with the 15MW WHR (waste heat recovery) plant commissioned would lead to strong operating efficiencies.

In the quarter gone by, despite myriad cost pressure, the operating expenses reduced by 5% year on year to Rs 200crore, primarily driven by power & fuel and freight & forwarding cost. The company reported Ebidta per tonne of Rs 831 as compared to Rs 504 in Q3FY17.

The company is expanding its cement capacity by 4mn tonnes (by FY20) for which it raised Rs 800 crore in debt through term loans and Rs400 crore through a QIP.

The new capacities would aid its rationalisation of freight costs and expansion into high-growth markets. While its core Gujarat market is expected to grow in-line with industry average, the company is growing at higher pace than the industry average on account of increasing sales volume in new geography like Mumbai.

The stock trades 11.3X FY19P EV/EBIDTA and should be looked at in the ongoing correction phase of the market.

Star Cement has installed clinker capacity of 2.6mt and cement grinding capacity of 4.4mt (including lease based grinding units) spread across Assam, Meghalaya and lease-based grinding units in West Bengal.

The North East market is fairly concentrated with two major producers. Cement players from the mainland markets find it difficult to cater to the North East region due to logistics bottlenecks and non-availability of clinker units.

Star management is actively considering the next leg of capacity expansion, as the demand is expected to remain firm in its core markets. The plan to set up a grinding unit in Siliguri, West Bengal with a capacity of 1.5-2mt is under active consideration

Government gives incentives for investments in the North East region with a purpose to boost industrial activities in the region. As of now, the North East Industrial and Investment Promotion Policy, 2007 (NEIIPP 2007) is in place, which was formulated for 10 years.

Star too enjoys a host of subsidies and exemptions under NEIIPP. Although freight subsidy is expiring in Q4 FY18, faster subsidy clearance remains a tailwind.

Star Cement has been consistently delivering robust profit. In the quarter gone by, the company’s Ebidta/Pat rose by 60%/173% respectively year on year. Robust pricing, sales recovery in North East, lower sales outside North East region and stable fuel costs aided the performance. Thus, Star reported its best ever and industry’s best unitary Ebidta of Rs2280/mt.

The stock trades at 9.4X FY19P EV/EBIDTA and looks interesting.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!