Neha Dave

Moneycontrol Research

Following the liquidity crunch, Bajaj Finance’s stock corrected almost 24 percent from its 52-week high and yet it is one of the best performing stock in the Nifty year to date (YTD).

While the Nifty is down by 4 percent, Bajaj Finance (BFL) is up by 32 percent YTD, creating a staggering alpha for the investors. In fact, it has been one of the greatest wealth-creating stocks, growing 68x in the last 11 years (generating 47 percent of compounded annual returns (CAGR)).

The stellar stock performance isn’t a surprise since the lender has an enviable track record of growing its asset book by 42 percent CAGR and profit by 62 percent CAGR in the past 11 years.

The performance has been good so far but the question that arises is should investors look at the stock incrementally at the time when NBFCs are staring at multiple headwinds? Yes, in our view.

While there are macro concerns in form of tightened liquidity, rising interest rates and increasing competition that can compress margins, the micro business of BFL continues to be very strong.

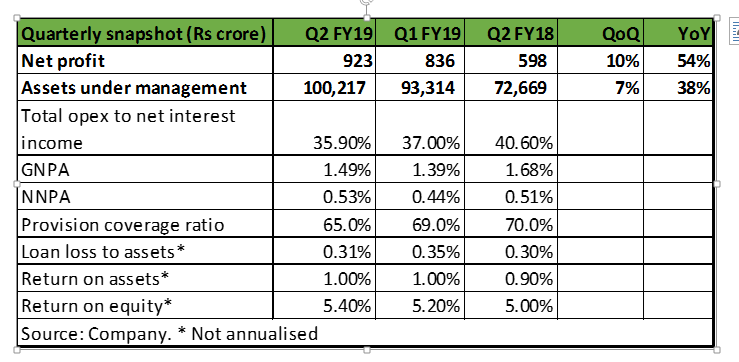

BFL, one of the largest retail asset financing NBFCs in India, posted yet another year of solid net profit growth of 54 percent year -on-year (YoY) led by robust loan book growth and controlled expenses. Its loan assets increased to Rs 100,217 crore, growth of 38 percent YoY.

We try to touch upon some of the most pertinent factors that will drive its future stock performance.

What is the impact of current liquidity crunch on BFL?

BFL is well positioned amidst tightening liquidity for the NBFC sector. The lender has diversified borrowing mix. Funding from banks, money markets and deposits stood at 34 percent, 52 percent and 14 percent of its total borrowing respectively as at end September. Commercial papers (CPs) formed only 9 percent of total borrowings while around 14-15 percent of total borrowings was raised through deposits. Management plans to increase the share of deposits to 23-25 percent over next two years. BFL has built a strong deposit base (retail plus corporate deposits) of around Rs 10,000 crore over past five years which is now third largest in NBFC space after HDFC and PNB Housing.

While borrowing from the money market has incrementally become difficult for most NBFCs, we are enthused by the fact BFL along with its housing subsidiary BHFL have collectively raised over Rs 5,395 crore in money markets in Oct.

The lender maintains an adequate liquidity buffer ranging from 4 to 6 percent of its borrowing in liquid mutual funds and G-sec. Also, we are encouraged by its conservative policy on gearing. Gearing has been maintained below 7 times over the past few years despite aggressive growth in assets. The lender has a track record of raising equity capital whenever leverage moves above 6 times.

So overall, we don’t envisage any liquidity issues for the company. We expect BFL to tide through the current liquidity crunch comfortably given its strong parentage, top-notch credit ratings and well-matched mix of short-term and long-term assets and liabilities. In fact, we see BFL as one of the key beneficiaries of liquidity shift towards strong and top quality names.

Can BFL’s loan book continue to grow at current pace?

Management does not foresee any impact on loan growth because of funding challenge. While management allayed investor’s fear of slowdown, we expect macro concerns to moderate growth in certain segments like SME, developer financing and securities lending business in near term.

Over medium to long term, we see potential for loan growth as the company has multiple products and is present in many markets. For instance, potential to cross-sell products to its existing customer franchise of 30 million can offer immense growth opportunity to BFL. Despite its high growth, Bajaj Finance’s loan book is only 1 percent of the outstanding credit and we believe, conservatively, it can grow at more than 25 percent especially when competition stands weakened.

Will high earnings growth sustain?

While funds are available to BFL, cost of funds has gone up in the recent times putting pressure on NIMs. However, BFL’s business model is resilient and should be able sustain a high-interest rate regime. As against 8.2 percent average cost of fund in FY18 and H1 FY19, BFL’s cost of funds between FY12 to FY17 ranged between 9.0 to 9.9 percent and despite that it has been able to sustainably deliver ROA of 3.3 to 4.0 percent. As per management, cost of funds is likely to stay below 9 percent for next 4-5 quarters.

Also, 45 percent of BFL’s assets are floating and could be re-priced, which would support NIMs. It has already implemented 10-15 bps of rate hike on its existing portfolio and around 20-50 bps on new loans.

So it should be ‘…should also cushion any fall in earnings.’ Also ‘despite modest NIM compression does not read right, it should be ‘due to modest NIM compression’

More importantly, BFL has levers, which should also cushion any fall in earnings due to modest NIM compression. For instance, cost to income surprised positively in current quarter, which improved to 36 percent.

So overall, we see high-interest rates as a speed breaker, not a derailment, in the BFL’s long journey upward. We see earnings growth sustainable on the back of Bajaj Finance’s vantage positioning and enough growth potential in the segment.

The big question for investors: Is the steep valuation justified, the high earnings growth notwithstanding?

Consumer durable financing business requires a deep feet-on-street and a considerably evolved risk assessment processes, stringent underwriting norms, agile monitoring and superior collection mechanisms. With the usage of technology, Bajaj Finance has succeeded in creating all of these and build a superior franchise with significant moats.

Bajaj Finance’s stock is currently trading at FY20e P/B ratio (price-to-book) of 5.6 which is a significant premium to many other NBFCs.

There is little room for a re-rating of the valuation multiple. But we feel the company can maintain high earnings growth trajectory in the near term which will lend support to the premium valuations. Having said that, steep valuation doesn’t leave much room for the lender to falter on growth or on asset quality.

While the rich valuations demand caution, the business’s unique moat makes it a must own core holding amongst Indian NBFCs. Hence, in the current volatile phase of the market, investors should look out for any price correction opportunity to buy into the stock.

Follow @nehadave01For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.