Nitin Agrawal

Moneycontrol Research

Highlights:

- Leadership position in rear drive assemblies

- A strong brand with robust clientele

- Growth drivers: capacity expansion and new product launches

- Attractive valuations

--------------------------------------------------

Automotive Axles Ltd (AAL), a provider of rear drive axle assemblies to commercial vehicles (CV) catering to all major auto manufacturers, has leadership position, robust clientele, operating under favourable industry, lean balance sheet and strong financial performance. The business is also gearing itself for upcoming EV wave and trades at reasonable valuations and hence making a long-term buy.

Opportunities

In last couple of months, domestic market has been facing challenges on the back of weakening macroeconomic environment leading to muted sentiments for automobile sector including CV segment. Recent fall in crude oil prices and improvement in liquidity situation have, however, made operating environment benign for the segment. We believe demand to be sluggish in the short term but long-term growth outlook remains promising on the back of economic growth, rising income levels, lower penetration, government’s thrust on increasing rural income and focus towards infrastructure and construction.

Moreover, upcoming BS VI emission norms, to be implemented from April 2020, are expected to lead to pre-buying as BS VI compliant vehicles would be expensive than the current vehicles. Additionally, government’s scrappage policy would potentially lead to replacement of 200,000-300,000 trucks which are over 20 years old, which would bode well for the company.

Realisations to improve – strong demand for higher tonnage

The introduction of Goods and Services Tax (GST) has led to a structural change in the logistics sector and has led to consolidation of warehouses driving operational efficiencies for the players. This has led to significant rise in demand for higher tonnage vehicles. Further, government’s focus towards road infrastructure is also boosting the demand for higher tonnage vehicles. This is expected to augur well for the AAL as it drives higher realisation and margin from these products.

Strong clientele

On the back of technology prowess, product innovation and quality, AAL has been able to partner with who’s who of industry. It has clients such as Ashok Leyland, Daimler India, Man Trucks, Mahindra & Mahindra, Tata Motors, Volvo Eicher and Asia Motor Works, among others. Ashok Leyland is the largest client of AAL followed by Tata Motors.

Moreover, AAL focuses on deepening its presence in China, USA, France, Italy, and Brazil. In the last fiscal gone by, it partnered with Volvo Thailand by securing export order for solo and tandem axles and brakes. It has, recently, started production for the same and the management believes that it is a significant business that AAL is doing.

Capacity expansion to cater to rising demand

The company continues to experience strong demand from its customers and in order to meet it, the management has planned to expand its capacity. It has planned to increase the axle housing line’s capacity to 20,000 units from 16,500 units per month and brake capacity to 120,000 units from 83,000 units per month.

Dominant position

On the back of strong product quality and robust client base, AAL has a dominant position in the product segments it caters to. It is number one player in axles and number two player in brakes.

New product launches – to increase content per vehicle

AAL continues to focus on product innovation to drive growth. It has recently introduced suspension products for CVs, which is expected to increase content per vehicle by at least 25-30 percent.

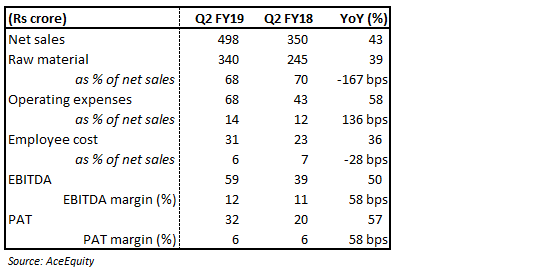

Strong Q2 FY19 performance

Riding strong on the growth coming in CV segment, AAL has posted a very strong 43 percent year-on-year (YoY) growth in its net revenues. On the back of strong operating leverage, AAL posted a YoY expansion of 58 bps in its earnings before interest, tax, depreciation and amortisation (EBITDA) margin. Expansion was lower, primarily, due to rise in operation expenses.

However, management believes that input material prices would continue to mount pressure on the operating profitability of the company.

Attractive valuationsRecent correction in the overall market has led to AAL’s stock price to fall 27 percent from 52-week high, making the valuations very attractive. AAL currently trades at 18.3x and 15.1x FY19 and FY20 projected earnings.

For more research articles, visit our Moneycontrol Research page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.