Sachin Pal

Moneycontrol Research

Asian Paints reported a decent set of numbers for the last quarter of FY18. The company surprised positively with low double-digit volume growth for Q4 FY18. Financial performance for the quarter gone by was largely on expected lines. Earnings before interest, tax, depreciation and amortisation (EBITDA) margin increased year-on-year (YoY) as the increase in raw material prices was offset by lower employee and other expenses. Overall, it is facing a challenging environment of slow volume growth and rising input costs.

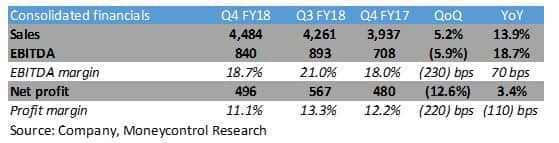

Consolidated net sales increased 13.9 percent year-on-year (YoY) to Rs 4,484 crore in Q4 FY18. EBITDA increased 18.7 percent YoY to Rs 840 crore. EBITDA margin improved YoY as richer product mix and price hikes helped the company offset the raw material price impact.

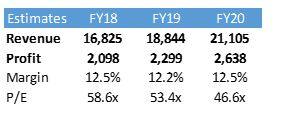

For FY18, Asian Paints reported a topline of Rs 16,825 crore and bottomline of Rs 2,097 crore. While topline grew 11.7 percent YoY, bottomline increased by just four percent YoY in an inflationary environment.

Volume growth remains key

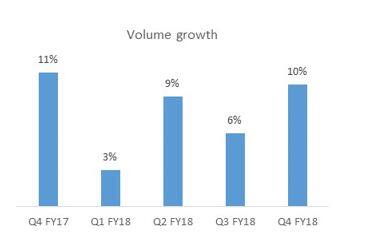

The company witnessed a low double-digit growth (about 10 percent YoY) in the decorative segment in the quarter gone by compared to a six percent YoY volume growth in the last quarter. Pent-up demand can be ascribed as one of the key reasons for the volume pick-up seen last quarter.

Volume growth in the first half was impacted by de-stocking and re-stocking related to the Goods & Service Tax. Slow volume growth during the year gone by can also be attributed to the implementation of Real Estate Regulatory Authority (RERA) which caused a temporary slowdown in the housing segment.

The sector is showing signs of a recovery as the economy is gradually recovering post-implementation of GST. The industry is witnessing a volume uptick in rural areas, while urban areas continue to remain stagnant.

Input costs continue to rise

Titanium dioxide (TiO2), the key raw material for paint companies, continues to move northwards. Kronos, a US-based producer and marketer of TiO2 pigments, reported that average selling prices were around 26 percent higher in the first quarter of 2018 as compared to the first quarter of 2017. In April, the quarterly contract prices of TiO2 have reached the highest levels in the last five years. Constrained demand-supply scenario will keep TiO2 prices at elevated levels for the next couple of quarters.

Apart from high TiO2 prices, the company is also facing cost pressures on other raw materials. Prices of monomers and crude oil derivatives, which mirrors oil price movements, have moved up both on a sequential as well as YoY basis. A large portion of these raw materials (30-35 percent) are imported. Adverse movement of the rupee against the dollar is adding to industry woes.

Asian Paints has been tackling persistent input cost pressures with gradual price hikes. After the 1.5 percent hike announced in March, it has announced another price hike of two percent effective May.

Domestic operations

The domestic business (decorative, home improvement and industrial paints) contributed around 88 percent of total revenue in FY18. Demand on a quarterly basis was impacted by a number of factors such as Diwali, marriage season and monsoon. Q4 FY18 was much better in terms of volume and Asian Paints maintained its market share in FY18 amid competitive pressures. However, the company does not see any visible signs of a demand pick-up in recent months.

Capacity expansion at Visakhapatnam and Mysuru (both having 3 million KL per annum capacity) is on track and is expected to commence production in FY19. The company has entered into the home décor segment with the launch of AP Homes stores two years back. These stores have been launched in four locations - New Delhi, Kochi, Coimbatore and Raipur - and have seen positive customer response.

International operations

Its international business accounted for 12 percent of total revenue in FY18. Business in Asia and Middle East continues to stay on course, but operations in Africa (Ethiopia and Egypt) are facing severe headwinds on account of adverse currency fluctuations.

Outlook and recommendation

Demand revival remains the single most important factor as the company is likely to face margin pressures due to firming up of key raw material prices. The negative effects of GST are tapering off and domestic operations are showing signs of moderate volume growth especially in rural areas. However, RERA implementation has hampered demand recovery on a broad basis and it would be interesting to see how quickly the market returns to normalcy.

Asian Paints is taking successive price hikes to ease off margin pressures. Despite recent price increases, the company is likely to post a steady topline growth along with 20-30 bps margin compression in FY19.

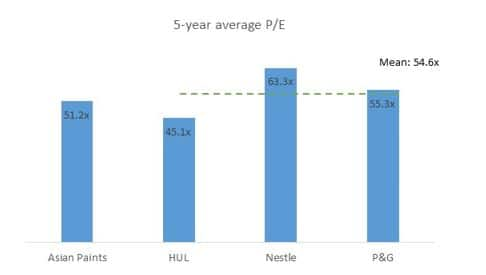

Average price-earnings multiple over the last five years stands at 51.2 times. Historically, the company has traded at a minor discount to the consumer segment average. It currently trades at price-earnings multiple of 46.6 times based on FY20e earnings. At current valuations, the stock offers limited upside.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!