Sachin PalMoneycontrol Research

ACC and Ambuja Cements, two of India's biggest cement companies controlled by global cement giant Lafarge Holcim, reported a decent set of earnings in the second quarter of 2018 on the back of healthy volume growth. The operating profit margins of both these companies improved on a quarter-on-quarter (QoQ) basis on the back of modest growth in realisations and operating efficiencies.

Result snapshot

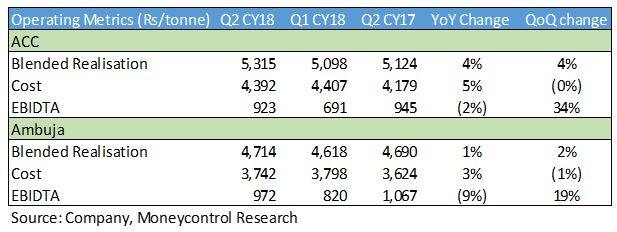

ACC reported revenues of Rs 3,848 crores for the second quarter of CY18. Revenue growth of 11 percent year-on-year (YoY) was mainly driven by an improvement in volumes as well as realisations. Adjusted earnings before interest, tax, depreciation, and amortisation or EBITDA (excluding one-time employee separation cost) for the quarter stood at Rs 668 crores compared to Rs 637 crores over the same period last year. EBITDA margins contracted by ~100 bps on a yearly basis as the cement companies are facing input cost pressures.

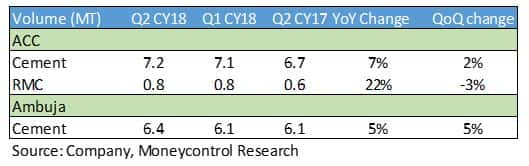

Strong demand across regions, especially eastern markets, drove up the cement volumes. The company reported an increase of 7 percent YoY in cement volume while the RMC volumes grew 22 percent YoY.

Realisations in the cement segment witnessed an improvement of around 4 percent QoQ. EBITDA per tonne also increased on a sequential basis as higher realisations offset increasing cost pressures (mainly petcoke and fuel).

On a QoQ basis, ACC benefitted from lower raw material prices and stable power and fuel costs. Cost efficiencies aided the margin improvement which moved higher from 13.6 percent in Q1 CY18 to 17.4 percent in Q2 CY18.

Ambuja Cements reported a revenue increase of 5 percent year-on-year. This was primarily driven by higher volumes as the realisation showed a minor variation on a YoY basis.

The higher volumes for the quarter resulted from healthy demand from housing and infrastructure segments. Capacity utilisation during the quarter stood at 87 percent in Q2 CY18 versus 82 percent in Q2 CY17.

Operating efficiencies along with lower employee and other expenses aided the improvement in EBITDA margins of Ambuja from 17.7 percent in Q1 CY18 to 20.6 percent in Q2 CY18.

However, EBITDA margins contracted by around 210 bps on a yearly basis as the cement companies are facing input cost pressures. EBITDA for the quarter gone by stood at Rs 622 crores compared to Rs 651 crores over the same period last year.

ACC has a premium market positioning and therefore reports a higher realisation compared to Ambuja. However, its high-cost structure results in lower EBITDA per tonne compared to Ambuja.

Key developments

In a recent development, the National Company Law Appellate Tribunal has upheld the Rs 6,700 penalty imposed by the Competition Commission of India (CCI) alleging cartelisation against Ambuja, ACC and other cement companies. Both ACC and Ambuja have not made any provisions against the earlier imposed penalties of Rs 1,150 and Rs 1,164 crore, respectively.

As a part of its business strategy, Ambuja and ACC continue to focus on premiumisation and cost rationalisation as the input prices, as well as logistic costs, continue to rise. Accordingly, the board of both these companies has decided to enter into a Master Supply Agreement (MSA) which would be synergetic to both companies. The MSA would allow these companies to procure clinker, cement, and raw materials from each other as well as use spare capacities on mutually agreed terms.

With the capacity reaching near full utilisation, Ambuja is also planning to set up a 3.1 MT clinkerisation plant at Marwar Mundwa in Rajasthan. The expansion would be executed in two phases. Phase I of 1.7 MT which entails an investment of Rs 1,391 crore and has already been approved by the Board. This plant should further help in reducing the lead time as well as costs.

To expand its market presence, ACC is planning to buy residual cement business of Jaiprakash Associates (JPA). The deal is expected to close by Q2 CY18. The ACC-JPA deal value is pegged at around Rs 5,200 crores for a cement capacity of 5.5 mtpa. This translates to an EV/ ton of 139 USD which seems on the higher side compared to the recent acquisitions in the sector.

Growth Outlook

The growth outlook for the sector and both the companies appears positive as the demand in the industry is expected to pick over the next 6-12 months as the execution of infrastructure projects gathers momentum. Besides, government focus on affordable housing and normal monsoon will further spur the demand from the rural segments.

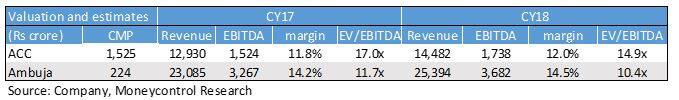

We prefer Ambuja over ACC as the latter has a higher fixed cost structure and lags much behind its peers in terms of operating margins. From a valuation standpoint as well, Ambuja is trading at a minor discount to ACC. We, therefore, advise long-term investors to accumulate the stock on any weakness.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.