The Reserve Bank of India’s rate-setting panel will increase the key policy rate by at least 35 basis points this week, said the majority of 15 economists who participated in a Moneycontrol poll.

The Monetary Policy Committee will begin its three-day meeting on August 3 and announce the outcome on August 5.

If realised, this month's increase in the repo rate would be the third consecutive one since May. The MPC raised the policy repo rate by 90 basis points in May and June to quell inflationary pressures. One basis point is one-hundredth of a percentage point. The repo rate, at which the RBI lends short-term funds to banks, currently stands at 4.9 percent.

The MPC is striving to keep a lid on soaring price pressures. India’s headline retail inflation rate, as measured by the Consumer Price Index, was largely unchanged at 7.01 percent in June from 7.04 percent in May. Retail inflation has stayed above the RBI’s medium-term target of 4 percent for 33 consecutive months and above the 2-6 percent tolerance range for six straight months.

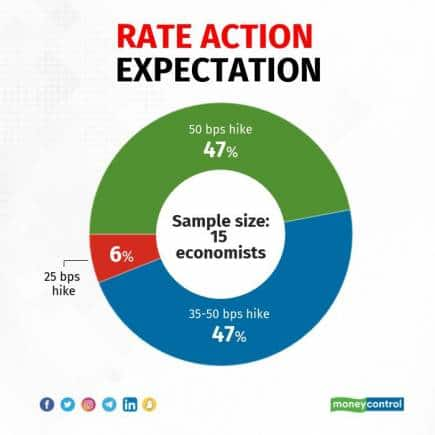

Economists polled by Moneycontrol on August 2 estimated rate increases ranging from 25 bps to 50 bps, with all but one expecting a hike of at least 35 bps. Four of the 15 participants favoured a 35 bps rate increase, while two expected a hike of 35 to 50 bps in August. Seven participants predicted a 50 bps rate hike. One participant expected the repo rate to be hiked by 40 to 50 bps, while one favoured a 25 bps increase.

“We expect the repo rate to be raised by 35 bps to 5.25 percent, after the cumulative 90 bps increase in this cycle yet far,” said Radhika Rao, senior economist at DBS Bank. “In the absence of an outright change in stance to tightening, the guidance is likely to emphasise on the preference to withdraw accommodation to anchor inflationary expectations. Focus is squarely on the inflation fight, whilst minimising hurt to growth.”

Also read: Banking Central | Another rate hike coming this week

Inflation may have peaked

Most economists polled expect the RBI to signal that price pressures in India may have peaked. The panel will most likely keep its inflation forecast unchanged in August. In the June policy, the MPC had increased the inflation projection for FY23 to 6.7 percent from the earlier estimate of 5.7 per cent as the protracted nature of the Russia-Ukraine war put pressure on commodity prices globally.

CPI inflation averaged 7.3 percent in April-June, 20 bps lower than the RBI's forecast. According to BofA Securities, there is a "high chance" inflation could undershoot the RBI's current forecast of 7.4 percent for July-September too.

Further, BofA Securities' estimated trajectory shows that inflation has peaked and the trajectory is headed lower to sub-6 percent levels by the March quarter.

Barclays’ India economist Rahul Bajoria added that while imported inflation was the dominant driver of the price spike over the past year, this factor will now cease to exert upside pressures in some segments. This, coupled with the series of supply-side measures by the government and seasonal reversal in prices of some perishable goods, is moderating the CPI trajectory, he said.

Barclays sees downside risks to the central bank’s forecast of FY23 average inflation and said the MPC may acknowledge that price pressures have peaked.

Hikes to continue

Even though India’s inflation may have peaked, it still warrants caution, especially since underlying inflation appears sticky, said economists. As per Moneycontrol calculations, core CPI inflation was 6 percent in June, slightly lower than the May print of 6.1 percent. This, coupled with aggressive monetary policy actions by the US Federal Reserve and other developed market central banks, could mean that the MPC will continue hiking rates beyond August.

Frontloading of rate hikes seems to be the theme, with most economists predicting successive rate hikes over the next two meetings.

“With end-March FY23 inflation likely under 5 percent and sliding down further ahead, FY23 could see policy rates go up by another 75 bps (including August), with the RBI showing its intent to keep real rates near the estimated natural rate,” said Madhavi Arora, lead economist at Emkay Global Financial Services.

According to Deutsche Bank, another risk is that the Fed Funds rate rises even higher to 4 percent by early next year, which may lead to further narrowing of the interest rate differential if the RBI reduces its own pace of rate hikes. The rate differential between the 10-year Indian government bond yield and the 10-year US Treasury yield now stands at 464 basis points from 454 bps on June 1.

If the Fed’s rate increases are faster than that of the MPC, it could narrow the interest rate differential between the two countries and accelerate an outflow of dollars from India’s debt and equity markets. That can have an adverse impact on the rupee, which slipped to a record low of 80.06 to the dollar last month.

“We are not suggesting for once that the RBI has to move exactly in line with the Fed, but our limited point is that it is a prudent strategy to maintain a certain minimum amount of interest differential, failing which there could be further adverse consequences for the rupee over the near to medium term,” Deutsche Bank added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.