With the NSE Nifty 50 finally breaking through the 20,000 mark, investors and analysts are now looking at banking stocks to sustain the gains and push the benchmark higher, supported by a few other scrips.

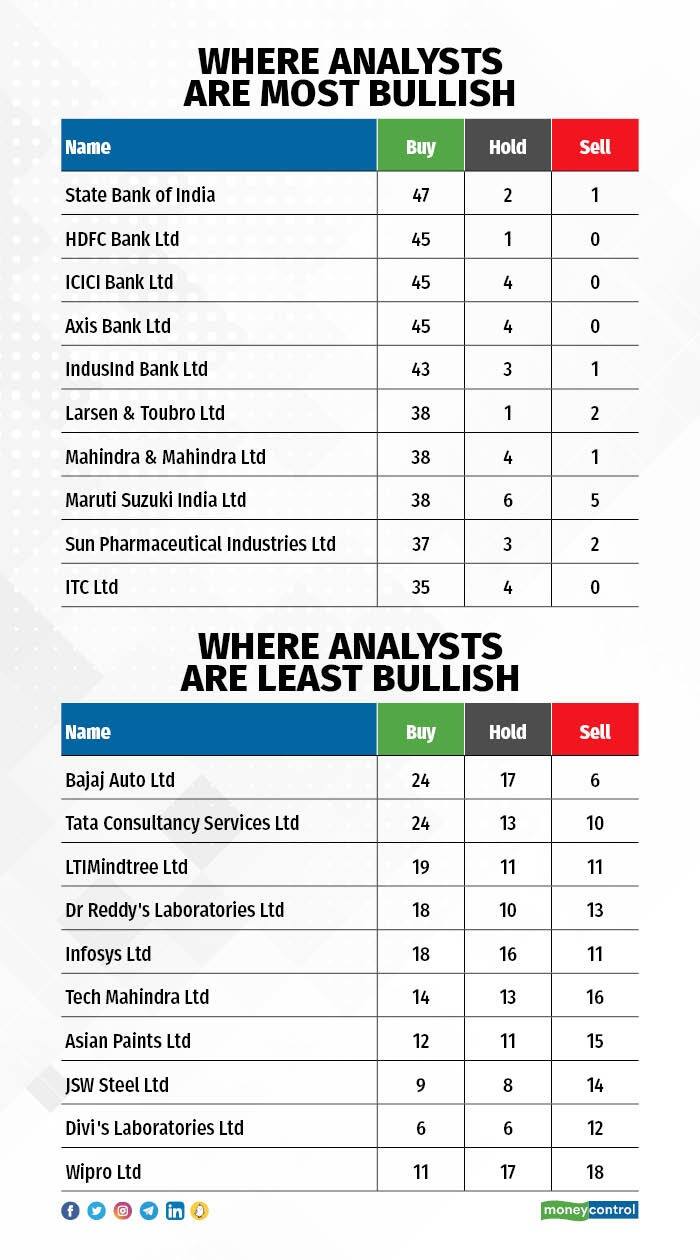

While banking sector stocks seem to have captured analysts’ attention, IT stocks have failed to please them. Banking stocks have the most number of ‘buy’ calls as of September 11 among the Nifty 50 index, while IT stocks have the most ‘sell’ calls, Bloomberg data shows.

State Bank of India (SBI) tops the list with 47 ‘buy’ calls on its stock. SBI is followed by HDFC Bank, ICICI Bank, and Axis Bank with 45 ‘buy’ recommendations each.

“While all the sectors are contributing to the move, we feel the performance of banking would play a crucial role in making a sustained up move from hereon,” said Ajit Mishra, SVP Technical Research at Religare Broking.

Banking on credit growth

The banking credit growth accelerated to 15.4 percent in FY23 from 9.7 percent in FY22, said IDBI Capital in a report dated September 11. Going ahead, credit growth will be in the range of 12-14 percent, and will be led by higher retail credit growth, coupled with revival of corporate credit, said the brokerage firm.

IDBI Capital also expects housing sector credit to witness positive traction due to the repo rate pause and a strong focus on the affordable housing scheme.

Also Read: Nifty @ 20k: 49 out of 50 stocks participated in the rally from March

IT stocks: Valuation concerns

On the contrary, analysts maintain a cautious stance on IT stocks, mainly due to rich valuations. Wipro has 18 ‘sell’ calls -- the highest number in the pack. Among other IT stocks in the Nifty 50, Wipro is followed by Tech Mahindra with 16 ‘sell’ calls and LTI Mindtree with 11 ‘sell’ calls. Tata Consultancy Services stock has 10 ‘sell’ calls.

Infosys slashed its revenue growth guidance for the current fiscal to 1 percent to 3.5 percent from 4 percent to 7 percent, citing a challenging macro-economic environment as the reason. TCS and Infosys after the Q1FY24 earnings had highlighted the lack of any visibility on-demand pick-up as clients remain cautious, and there is no uptick in discretionary IT spending.

“Our meetings suggest limited improvement in the demand environment. We thus believe that Nifty IT's 33 percent premium to Nifty looks rich given that over the past 15 years entering Nifty IT at these levels, has led to underperformance vs Nifty. We thus remain cautious on the sector,” said Jefferies in a report dated September 7.

Also Read: Nifty @ 20k: Top 10 companies estimated to show highest EPS growth in FY24-25

Other stocks that can move the needle

Apart from the banking stocks, analysts are also bullish on Larsen & Toubro, Mahindra & Mahindra, and Maruti Suzuki. All three stocks have 38 ‘buy’ recommendations each as of September 11.

On the flip side, other than the IT stocks, Asian Paints and JSW Steel have the maximum number of ‘sell’ calls. Asian Paints has 15 sell recommendations, while JSW Steel has 14.

The Nifty Auto Index is experiencing a resurgence due to increased demand and improved profit margins, coupled with a favorable product cycle for various companies. This has led to the Nifty Auto Index outperforming the broader Nifty-50 Index by a substantial 33 percent during the period from 2022 to 2023, said Jefferies in a report dated September 7. Jefferies expects auto companies earnings to register a double-digit CAGR over FY 2023-26.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.