After flirting with 20,000 level once in July, the Nifty 50 finally managed to scale past the psychological mark on September 11. The benchmark Nifty 50 hit a record high of 20,008.15 with largecaps finally joining the broader markets party.

The upward momentum in markets started after March 2023, with the dawn of the new financial year. After falling to a low of 16,950-level, the Nifty 50 began its upmove, gaining close to 18 percent since then.

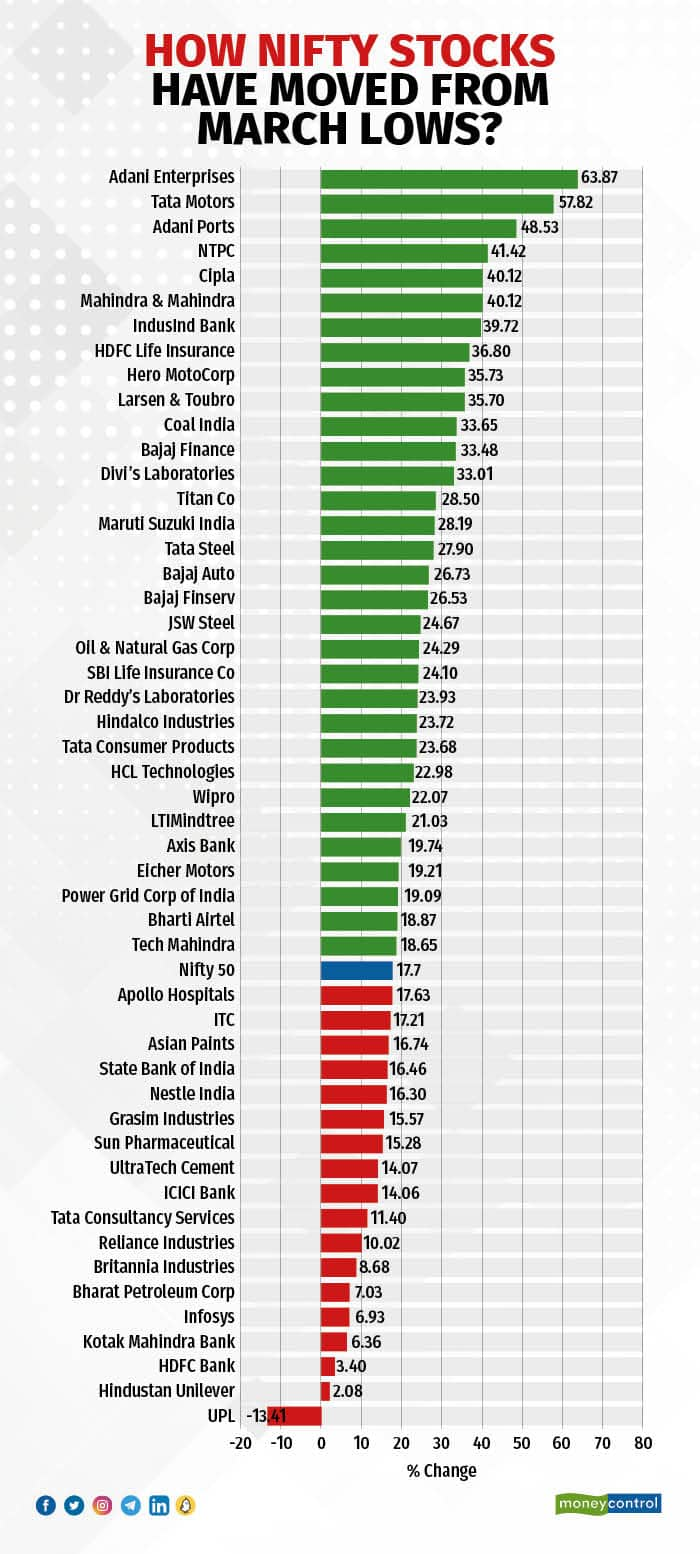

Of the 50 stocks, 49 have participated in this rally with Adani Enterprises, Tata Motors, Adani Ports, NTPC and Cipla taking the top five spots. Along with Mahindra & Mahindra, these six stocks have gained over 40 percent in the rally since March.

26 stocks, led by IndusInd Bank, HDFC Life Insurance, Hero MotoCorp, Larsen & Toubro and Coal India, gained between 18-40 percent, thus also outperforming the benchmark.

The remaining 18 stocks underperformed the Nifty 50, with UPL being the only one in the red. The agrochemical stock has lost over 13 percent in this financial year.

A closer look at the data shows that automobile stocks have led the rally, with passenger vehicle as well as two-wheeler stocks outperforming the benchmark. In fact, the Nifty Auto index has also managed to outperform the Nifty 50 by 33 percentage points in FY23.

"Improving demand and margin trajectory, along with good product cycle for several companies, is driving a fresh upturn in autos resulting in Nifty Auto index outperforming Nifty-50," as per foreign broking firm Jefferies.

Some IT stocks, despite suffering from analyst downgrades and weak demand outlook, have also managed to outperform the benchmark. Investors have taken the "buy on dips" approach in names like HCL Tech, Tech Mahindra, Wipro and LTIMindtree. Artificial intelligence is the next big trigger for the IT stocks, believes the Street.

On the other hand, analysts' darling banks — HDFC Bank, ICICI Bank and State Bank of India — have underperformed the Nifty 50, albeit the stocks are in the green.

As deposits have started getting repriced, banks are expected to face margin pressures going ahead. According to Fitch Ratings, the Indian banking sector's average NIM (net interest margin) to slightly contract by about 10 basis points (bps) in FY24 to 3.45 percent, following a 15-bps increase in FY23.

The only stock in redUPL is the only Nifty 50 stock that has declined in this rally from March lows. Analysts as well as investors have turned wary of the agrochemical stock largely because of the lack of clarity on the company's debt reduction targets. Its net debt stands at Rs 262 billion (Rs 26,200 crore) as of June.

The company has also lowered its revenue growth guidance for the current fiscal to 1-5 percent from 4-8 percent, indicating a prolonged pressure on its revenue. On the other hand, FY24 margin growth guidance was also cut to 3-7 percent from the earlier projection of 6-10 percent.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.