IT major Wipro announced buyback of its shares worth Rs12000 crores when it declared its earnings for the last quarter of FY 2022-23 last month. This will be Wipro’s fifth buyback in history. The buyback has been approved for a minimum price of Rs 445 a share which is roughly 16% higher than its current close of Rs 382 on 18th May. Record date, opening and closing dates are yet to be announced but are expected to be sometime in June. The size of the buyback offer is 4.91% of the total equity shares which is good enough to get a decent acceptance ratio in the retail category.

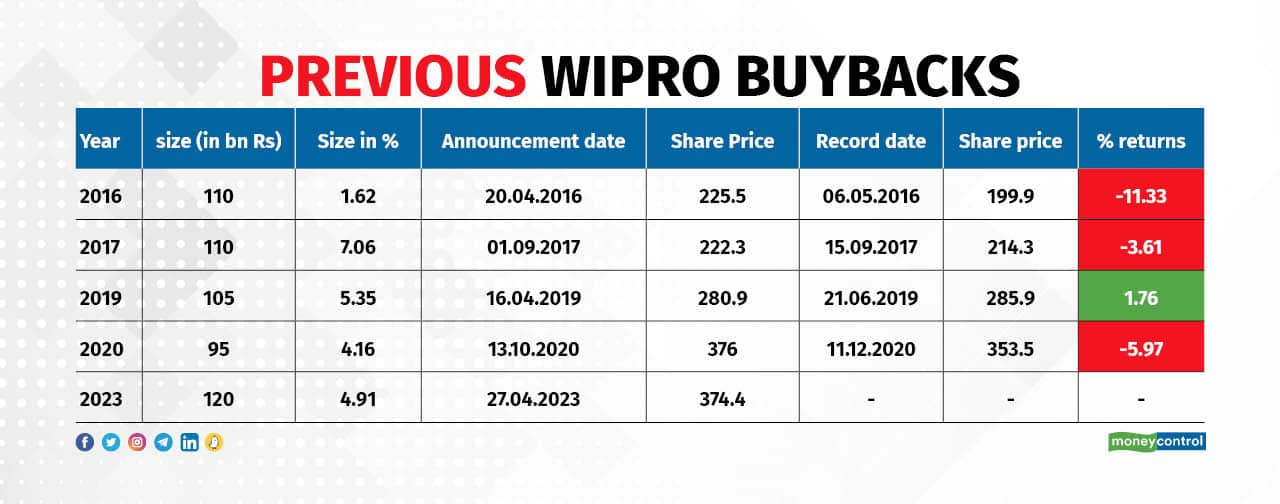

Let’s look at what happened in the previous 4 buybacks that were announced by Wipro in the year 2016, 2017, 2019, 2020. The below graphic illustrates the stock’s return from the date of announcement of buyback to the record date. It’s clearly visible that the stock corrected quite a bit on 3 of the 4 occasions and closed 1.7% higher during 2019.

Previous Wipro Buybacks

Previous Wipro Buybacks

The average loss during the period from the date of announcement of buyback to the record date is 4.8%. The buyback announcement came along with the earnings declaration for Q4 FY 2022-23. It posted a revenue decline of .6% in the constant currency terms which was below the street estimates. The company is expecting sluggishness in the near future and cut down on its growth guidance by 1-3%.

If we look at the couple of recent buybacks offered by other IT companies, two names come to my mind - TCS and Birla Soft. TCS announced its buyback when the stock was trading at 3900 and offered to buy it at 4500 which was again 15% higher from CMP at that point. But since the buyback announcement, TCS has only corrected. It made a high of a little over 4000 a piece post the buyback announcement and currently trades at 3200 which is 18% lower than its price on the buyback announcement.

Similarly, BSOFT announced its buyback on May 23rd, 2022 when the stock was trading at 378. The buyback price was set at 500 a share which was 32% higher than its CMP at that time. The stock never closed above 380 on a daily basis since that buyback announcement till date. The stock touched 250 on the downside and currently trades at 320 a piece.

Those who are holding the shares in their portfolio for a long term perspective can tender it in the buyback and based on the acceptance ratio can buy the accepted shares back. For example, if you hold 500 shares, you can tender them all and let’s say acceptance ratio comes in at 8% in which case 40 shares will be accepted at 445 a piece, and you will be left with 460 shares.

The remaining 40 shares can again be bought from the open market which is likely to be much less than the buyback price. However, should you buy now from the open market to tender it in the buyback programme, I will not advise my readers on that. I have presented some data for my readers to make an informed decision.

Disclaimer – The author is an independent trader based out of Singapore, with a decade of experience in trading equities and derivatives. Readers are expected to consult their financial advisor before making any decision.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.