An unusual shareholder’s name pops up in a little over 100 mid- and small-cap listed companies on the NSE and BSE: the Ministry of Corporate Affairs’ Investor Education and Protection Fund Authority. According to Trendlyne data, the IEPFA publicly held 116 stocks with a net worth of Rs 1,720 crore as of June 30.

Most of these stocks are lesser known companies such as Kriti Industries, Haryana Leather, Glance Finance, and Zodiac JRD MKJ, among others. The bigger names, wherein IEPFA’s stake is worth more than Rs 50 crore, include Caplin Point, Kirloskar Brothers, Aegis Logistics, Nesco, Bharat Rasayan and Ganesha Ecosphere.

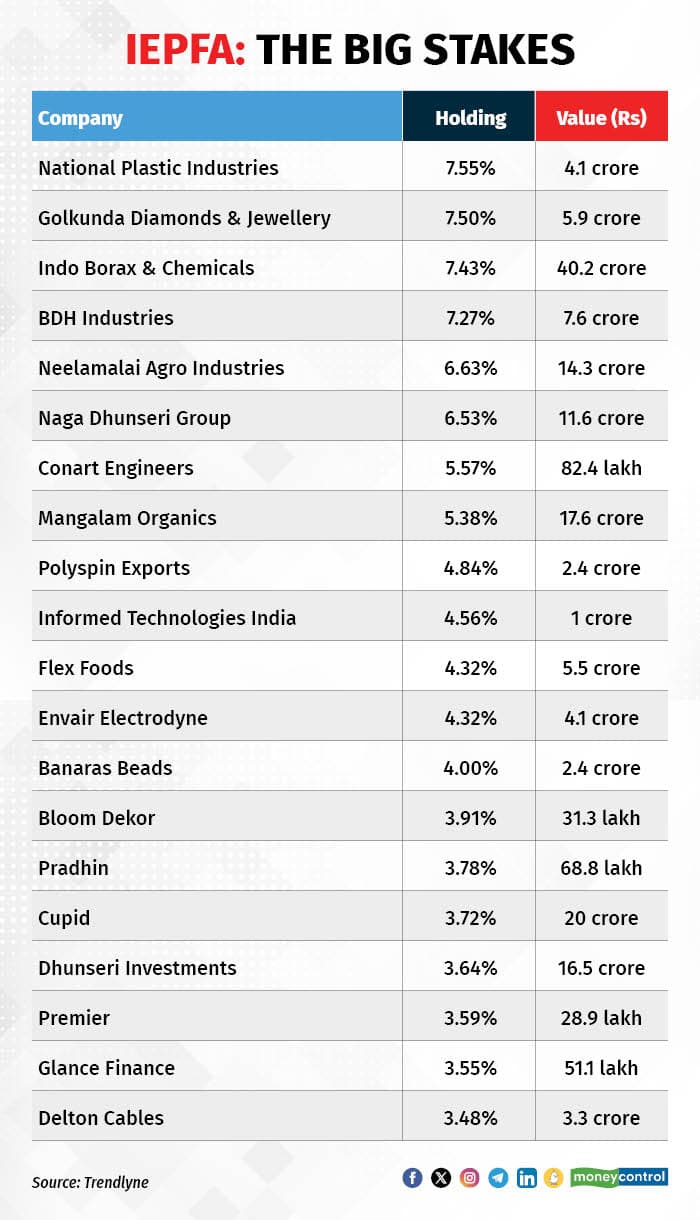

When it comes to the largest stakes, IEPFA held more than 7 percent in National Plastic Industries, Golkunda Diamonds, Indo Borax and BDH Industries as of June end.

Also Read: Diamond valued at coal price: Zodiac shareholders taken for a ride, offered 75% discount to book

Active investing or regulatory affair?

On the face of it, even the Ministry may appear to have been taken in by the midcap mania of the past few months. But, that isn’t the case. This is after all the ‘Investor Education and Protection Fund’. The fund was established by the government to ensure dividends unclaimed by shareholders are vested with the fund, so they can be utilised for investor awareness activities and the protection of their interests.

Eventually, it evolved into a repository of shares.

Speaking to Moneycontrol, Atul Pandey, Partner, Khaitan & Co, explained how. “The provisions of Section 124 of the Companies Act, 2013, mandated the transfer of all shares in respect of which dividend has not been paid or claimed for seven consecutive years or more,” he said.

This resulted in a number of companies, particularly listed companies having a large chunk of shareholders from the pre-dematerialisation regime, having to transfer such shares to the fund, he added.

To do away with paperwork, India introduced the demat account system in 1996 for trades on exchanges. While most shareholders made a smooth transition, the account details of some were not available and those physical shares were never dematerialised.

That does not mean that all of the IEPFA portfolio companies were listed in the pre-demat era. There is a possibility of a shareholder’s data with the depository becoming outdated and the shareholder becoming untraceable.

Also Read: Brokers face operational issues in client fund rules, request Sebi for relaxation

Can the shares be reclaimed?

Yes. It is the duty of IEPFA to ensure that the investors are able to claim such amounts, along with the interest due and payable thereon, as and when a shareholder makes a legitimate claim, said Rohini Nair, co-founding member and partner at ANB Legal.

As per the ministry website, claimants need to submit a printout of Form IEPF-5, along with other documents, to the nodal officer at its registered office for verification.

“IEPF equivalent structures under different legal frameworks operate in other countries such as SEC/FINRA in USA, FCA in UK, but their common goal is to protect and educate investors in their respective countries,” Nair added.

Also Read: Yatra vs MakeMyTrip vs EaseMyTrip: How do the numbers stack up?

Corporate governance issues?

With a significant stake comes significant power—the power of voting rights. However, the voting rights lying with IEPFA remain unexercised, which potentially gives rise to corporate governance challenges.

“To address this concern, the ministry has granted greater leeway to the authority to liquidate such shares,” said Pandey. IEPFA is entitled to offer the shares to any acquiring entity in case of amalgamation, share exchange, conversion of securities and also receive money on behalf of minority shareholders.

A separate ledger is maintained for such proceeds. However, there is no readily available data of instances where the MCA has liquidated its holding.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.