The S&P BSE Sensex rallied more than 300 points to hit a fresh life high of 39,288 on April 16 surpassing its previous record high of 39,270 (hit on April 3). Nifty also surpassed its previous record high of 11,761 to hit a fresh life high of 11,786.60.

Well, benchmark indices might have reclaimed their April highs but there was plenty of action among select stocks.

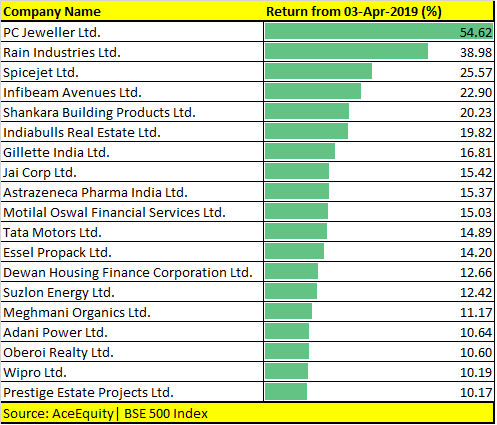

As many as 19 stocks in the S&P BSE 500 index rose 10-50 percent from April 3, which includes Wipro, Oberoi Realty, Suzlon Energy, Tata Motors, SpiceJet, Rain Industries and PC Jeweller.

In terms of Sensex stocks, Tata Motors was the outperformer, which rallied nearly 15 percent from April 3 till date, followed by Coal India, Bajaj Auto, Hero MotoCorp, Maruti Suzuki, M&M and ITC.

The momentum in the market remains strong and Nifty50 is on track to hit 12,000-13,000 in FY20, suggest experts. However, earnings will be key.

Technically, chart patterns suggest that Nifty could see a 15 percent up move going forward which should ideally take the index towards 13,000.

As we approach the crucial event of General Election 2019, the price structure of the Nifty indicates a major shift in trend direction as it recorded a “Golden cross” along with similar crossover in index constituents collectively contributing 73 percent to the index weight, ICICIdirect said in a report.

This makes the brokerage firm to reinforce its positive stance by revising its earmarked target upward at 12,800-13,000 for FY20.

In technical parlance, when a medium-term moving average (50 days) crosses a longer-term moving average (200 days) it is termed as a “Golden Cross”.

Last month, Goldman Sachs also upgraded India to overweight and placed a 12-month target of 12,500 for the Nifty.

The global investment bank raised the rating to overweight given sharp underperformance in Jan-Feb, better 3Q earnings, and a pick-up in FII positioning from lows amid rising market expectations of a potentially stable govt.

For Sensex, most of the global brokerage firms peg the target upwards of 40,000. BNP Paribas earlier in the month upgraded India to ‘overweight’ from ‘neutral’ earlier on and also raised its December-end target to 42,000 from 40,000 stability in earnings and fund flows.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!