By DEVINA MEHRA

Everyone wants to emulate RJ...or at least his investment results.

One line that stood out for me from the recent book, 'The Big Bull of Dalal Street: How Rakesh Jhunjhunwala Made His Fortune' by Neil Borate, Aprajita Sharma and Aditya Kondawar was this: "Not every year I make money. I make money in spurts, like 1989-92, 2003-07, 2009-11. In 1994-99 I would not have made any trading income." — Rakesh Jhunjhunwala.

If you want to internalise one RJ superpower, this is it: To understand and act on the fact that stock market returns are lumpy, not even.

Also read: Rakesh Jhunjhunwala's greatest investment hits and odd misses

If you remain disciplined through downturns, or frustrating sideways moves which can go on a long time while you're living through them, you'll be way ahead of the rest of the pack.

Struck by FOMO

Instead, the way most investors behave is to get struck by FOMO (Fear of Missing Out) and jump onto a theme just when it is peaking.

Case in point: All the Nasdaq ETFs and funds in 2021 that were heavily subscribed (although I kept warning against those at the time) because the Nasdaq had been on the tear for 2-3 years.

Even in the Indian market, all thematic funds that are launched, whether for sectors like IT, pharma, etc, or some other theme like Greater China, all come near the peak of the cycle for that particular theme. The fund houses well understand that this is the easiest way to gather assets...even if it brutally drags down the investors' portfolio returns.

And this FOMO issue is predictably compounded by panic selling on the other side...

Hence suddenly the same Nasdaq that looked so attractive in 2021 appeared very risky once it was already down 40 percent in 2022!

Thus many compounded their problem of buying at the wrong price by also selling at the wrong price.

Nasdaq, which was at the bottom of the global league tables in 2022, is close to the top again this year.

Some more similar thoughts from investors: Last year, many came to us saying, 'When your India PMS is doing so well, why should we have anything in your global funds?'

Then the logic of global diversification over the long term starts to dim.

Cut to today, it is: 'Why invest in equity when I made more in fixed income last year?'

So asset allocation decisions for the long term are made based on how some asset performed in the last 3 months or 6 months...a complete recipe for disaster!

Watch the sentiment

Remember that sentiment is always a contra indicator.

When you are feeling buoyant and confident is exactly when you should be wary, as the next period returns are likely to be below average.

On the other hand, if the general feeling is of anxiety and frustration, the next period returns are likely to be above normal.

These are confirmed by a host of academic research studies across the world.

In theory, we all know that equity might give higher returns over the long term but it is with a lot more volatility than a host of other asset classes.

But in reality, we get rattled when the returns are volatile/ not there/ even negative for a period of time.

Unfortunately, if you get out of the market at scary times, you'll never be able to catch up when the upmove comes.

If you missed out on just the 10 best days of the Indian stock market in a full 40 years, you would have lost out on two-thirds of the returns.

Miss out on 30 best days over 40 long years and 90 percent of your returns disappear.

As it happens, these sharp upmoves normally come in a bear phase as markets rarely go up that rapidly in a bull phase.

For example, if you did not get back into markets by end-March 2020 after the horrifying COVID crash at the beginning of that month, you'd have missed the 30 percent move in the next 5 weeks in both India and global markets – a gap that would have been impossible to bridge, no matter how smart an investor you are.

In an ideal world, you would get out before a big crash and get back in time – something we did manage to do, both in our India PMS and global funds during the Covid crash – we called out the turning points in public in real-time.

At other times we used hedges to cushion a possible crash when things looked uncertain.

But overall, in the scheme of things, it is bigger damage to your portfolio returns if you are out of the market at the wrong time than if you remain invested and face a decline in your portfolio.

Also read: A collection of stories that capture the investment philosophy of Rakesh Jhunjhunwala

The takeaway

Therefore, what's the takeaway?

Please think carefully about your India versus global allocation.

Within India, your fixed income, gold, equity, real estate, etc allocation.

Then don't keep tampering with it on an everyday basis.

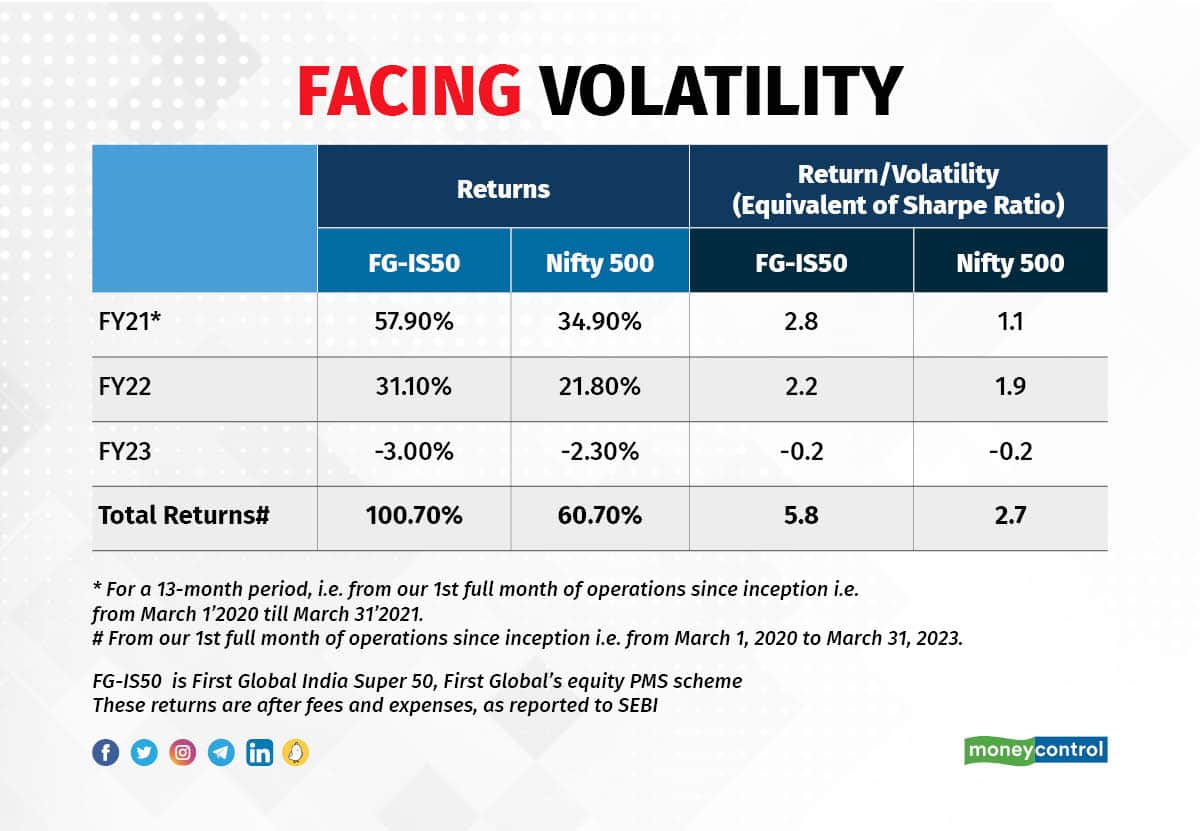

These are the returns on Indian equities (and the First Global equity PMS, India Super 50) over the last 3 years.

Yet 1.5 months of gold prices going up or fixed deposit rates increasing and investors start dissing equities.

But let the stock market go up 25-30 percent and the same people will then come running back, compounding their problems.

Equanimity, discipline and an ability to stick to your long-term plans, basically control over your mind, are keys to successful investing.

Happy investing!

(The writer is the Founder and Chairperson of First Global, a leading Indian and global investment management firm. She is a gold medalist from IIMA and has been in the investment business for over 30 years. She tweets @devinamehra and can be contacted at info@firstglobalsec.com or www.firstglobalsec.com)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.