Despite the ongoing correction seen in the domestic markets, Kotak Institutional Equities' Sanjeev Prasad said that the valuations for many stocks and sectors are absurd.

The run-up in the stocks is a result of the lack of fear and the focus on greed (of returns) among retail investors, that have pushed valuations to absurd levels in several cases, said the Kotak report. As a result, the recent sharp correction in the Indian market and stocks does not change the brokerage's cautious outlook on the market, as valuations remain frothy.

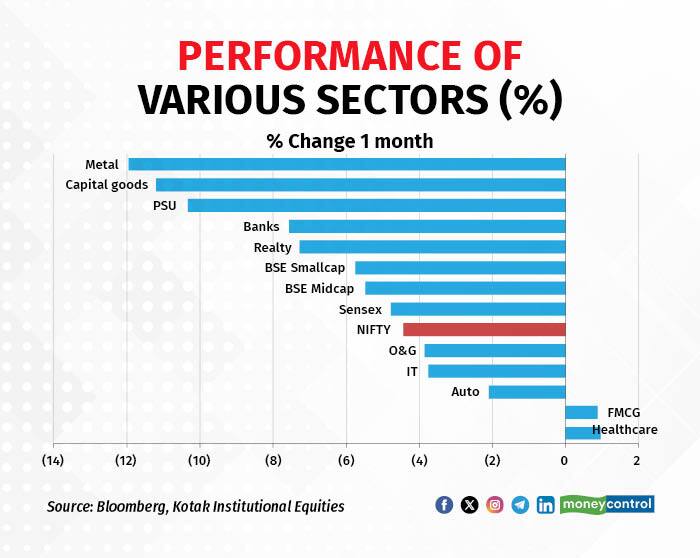

There is also a low scope for earnings upgrades, noted Prasad, as a result of fairly aggressive earnings, profitability and volume assumptions across sectors. The uncertain global macro-picture also weighs, as bond yields and interest rates are likely to remain higher-for-longer.

The sky-high valuations are primarily resultant of the price-agnostic buying from non-institutional investors and ‘forced’ buying of domestic institutional investors for the past 2-3 years.

"Investors were willing to give any multiple for stocks irrespective of the business models and fundamentals, use exotic valuation methodologies and multiples and believe any random narrative about sectors and stocks," said the Kotak report, adding, "It is possible that retail investors may show some of their usual chutzpah and buy stocks aggressively (buy on dips has been the common mantra so far), but that would be really comical."

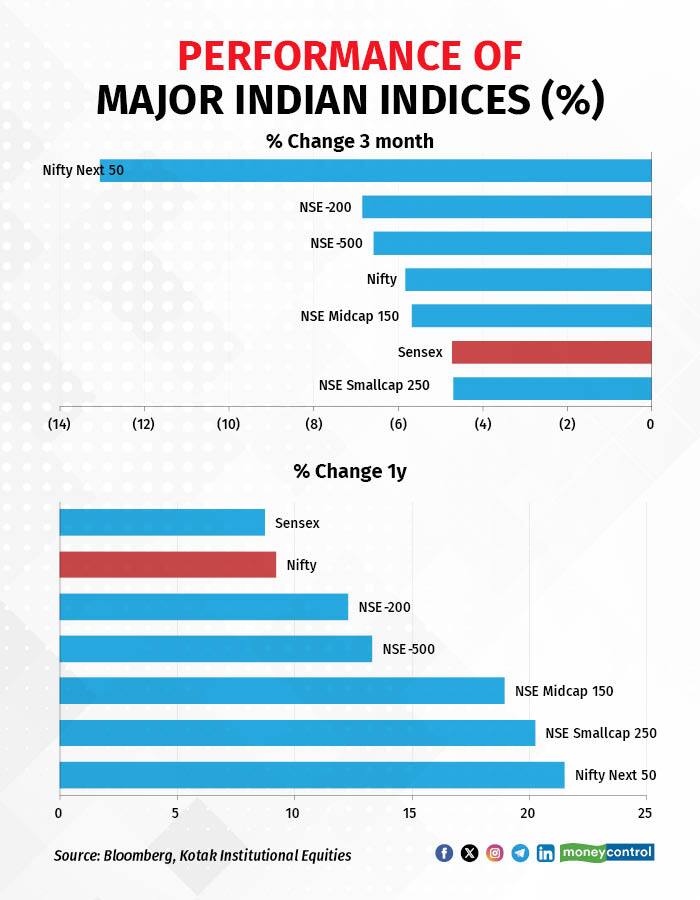

As a result of the ongoing correction, the large-cap universe might hold out better while small-, mid-caps and 'narrative stocks' bleed, seeing further correction if the alignment to fundamentals and value were to continue.

"There is no reason to expect otherwise. FPIs are unlikely to look at India favorably in a hurry (no

new money for EMs/continued redemptions, high valuations) and retail investors would increasingly contend with dwindling trailing returns," added Prasad.

Kotak further added that some narrative stocks have a further way to fall, based on their true valuations. "Many of them have corrected sharply in the past 3-6 months, but most are trading at absolutely ludicrous valuations," said the report.

The scary part of this, according to the research analysts at the brokerage, is that retail shareholders are the dominant shareholders of such companies (after the promoter) and the number of retail shareholders has increased several-fold in such companies, along with the dramatic rise in the share prices.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.